Nj Estate Tax

Welcome to an in-depth exploration of the New Jersey Estate Tax, a critical component of the state's revenue system and a topic of interest for many residents and businesses. The estate tax, often referred to as the inheritance tax, is a levy imposed on the transfer of property upon an individual's death. It's a complex area of taxation, and understanding its intricacies is crucial for effective estate planning and management.

If the estate is valued below the 2 million threshold, it is not subject to the NJ estate tax. However, it is still important to consider other taxes, such as the federal estate tax or potential inheritance taxes in other states, depending on the residence of the beneficiaries.">What happens if the estate is valued below the taxable threshold of 2 million? +

Unraveling the Complexity of NJ Estate Tax

New Jersey’s estate tax landscape is unique and can be challenging to navigate. Unlike some other states that have eliminated their estate taxes, New Jersey continues to levy this tax, making it an important consideration for residents and those with ties to the state.

Understanding the Basics

The NJ estate tax is a tax on the transfer of property at the time of an individual’s death. It is distinct from the federal estate tax, as it is levied by the state and operates independently. The tax is imposed on the transfer of property, which can include real estate, personal belongings, cash, stocks, and other assets.

The tax is not a one-size-fits-all affair. The rate and applicability of the estate tax depend on various factors, including the value of the estate, the relationship of the beneficiaries to the deceased, and the residence of the deceased at the time of their death. This complexity often necessitates the expertise of tax professionals and estate planners.

Key Characteristics of NJ Estate Tax

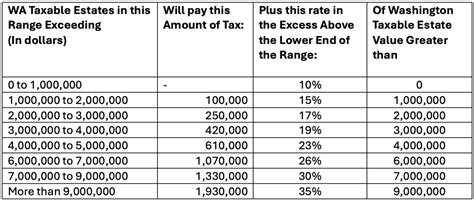

- Taxable Estate Threshold: Currently, the state of New Jersey imposes an estate tax on estates valued at 2 million or more. This threshold is significant, as it exempts a large portion of estates from the tax.</li> <li><strong>Tax Rates</strong>: The NJ estate tax operates on a graduated rate system. The tax rate increases as the value of the estate increases. For example, estates valued between 2 million and 3 million are taxed at a rate of 11%, while those valued over 10 million face a tax rate of 16%.

- Relationship of Beneficiaries: The tax treatment can vary based on the relationship of the beneficiaries to the deceased. Spouses and charitable organizations are generally exempt from the estate tax, while other beneficiaries may face varying tax rates.

- Residence of the Deceased: The tax is imposed on the transfer of property, which means that the residence of the deceased at the time of their death is a critical factor. If the deceased was a resident of New Jersey, their estate may be subject to the state’s estate tax, regardless of where the property is located.

Exemptions and Credits

New Jersey offers certain exemptions and credits to reduce the tax burden on estates. These include:

- Unlimited Marital Deduction: Transfers to a surviving spouse are exempt from the estate tax, allowing couples to effectively pass on their wealth to the surviving spouse tax-free.

- Charitable Contributions: Gifts made to qualified charitable organizations are exempt from the estate tax, encouraging philanthropy and reducing the tax liability of the estate.

- Portability: New Jersey allows for the portability of the deceased spouse’s unused estate tax exemption to the surviving spouse. This can significantly reduce the tax burden on the surviving spouse’s estate.

| Estate Value | Tax Rate |

|---|---|

| $2,000,000 - $3,000,000 | 11% |

| $3,000,000 - $5,000,000 | 12% |

| $5,000,000 - $7,000,000 | 14% |

| $7,000,000 - $10,000,000 | 15% |

| $10,000,000 and above | 16% |

Strategies for Estate Planning

Given the complexity of the NJ estate tax, effective estate planning is crucial to minimize the tax burden and ensure the smooth transfer of assets. Here are some strategies to consider:

Gifting Strategies

Making gifts during one’s lifetime can be an effective strategy to reduce the value of the estate and potentially lower the estate tax liability. Gifts to family members or charitable organizations can be exempt from the estate tax, and New Jersey allows for a certain amount of annual exclusion gifts without incurring gift tax.

Trusts and Estate Vehicles

Utilizing trusts and other estate planning vehicles can provide flexibility and control over the distribution of assets. For example, a revocable living trust can allow the grantor to manage their assets during their lifetime and avoid probate, while also providing for the smooth transfer of assets upon their death.

Insurance and Investment Strategies

Incorporating life insurance and investment strategies into estate planning can provide liquidity and help cover potential estate tax liabilities. Life insurance proceeds can be used to pay estate taxes, and certain investment strategies can be employed to maximize after-tax returns.

Charitable Giving

As mentioned earlier, charitable giving is an effective strategy to reduce estate tax liability. Gifts to qualified charitable organizations are exempt from the estate tax, and they can also provide a sense of legacy and contribute to the community.

The Future of NJ Estate Tax

The landscape of estate taxation is constantly evolving, and New Jersey is no exception. While the state currently maintains its estate tax, there are ongoing discussions and legislative efforts to reform or eliminate the tax. The future of the NJ estate tax will depend on various factors, including economic conditions, political ideologies, and the state’s revenue needs.

In the meantime, it is essential for individuals and businesses to stay informed about the latest developments and to work closely with tax professionals and estate planners to ensure compliance and minimize tax burdens.

Key Considerations for the Future

- Federal Estate Tax Reform: Changes at the federal level can have a significant impact on state estate taxes. The future of the federal estate tax, including potential changes to thresholds and rates, will influence the landscape of state estate taxes.

- Economic Factors: Economic conditions, such as inflation and the overall financial health of the state, can influence the need for revenue and, consequently, the future of the estate tax.

- Political Landscape: The political climate and the priorities of elected officials can drive changes to the estate tax system. It is important to stay engaged and informed about the political discourse surrounding tax policy.

FAQs

Is the NJ estate tax the same as the federal estate tax?

+No, the NJ estate tax is distinct from the federal estate tax. The federal estate tax is a levy on the transfer of property at the federal level, while the NJ estate tax is imposed by the state. The rates, thresholds, and exemptions can vary significantly between the two.

Who is exempt from the NJ estate tax?

+Transfers to a surviving spouse and charitable organizations are generally exempt from the NJ estate tax. Additionally, certain other beneficiaries may be exempt depending on their relationship to the deceased and the value of the inheritance.

What happens if the estate is valued below the taxable threshold of 2 million?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>If the estate is valued below the 2 million threshold, it is not subject to the NJ estate tax. However, it is still important to consider other taxes, such as the federal estate tax or potential inheritance taxes in other states, depending on the residence of the beneficiaries.

How often are the NJ estate tax rates and thresholds reviewed and updated?

+The NJ estate tax rates and thresholds are typically reviewed and updated periodically, often in response to economic conditions, legislative changes, and the state’s revenue needs. It is important to stay informed about any updates to ensure compliance.