Automobile Sales Tax In Illinois

Welcome to a comprehensive guide on the automobile sales tax in the state of Illinois. Understanding the tax landscape when purchasing a vehicle is crucial for both consumers and businesses. In this article, we will delve into the intricacies of the sales tax structure in Illinois, providing you with valuable insights and expert analysis. By the end, you'll have a clear understanding of how sales tax works for automobile purchases in this state, along with real-world examples and practical tips.

Illinois Sales Tax Overview

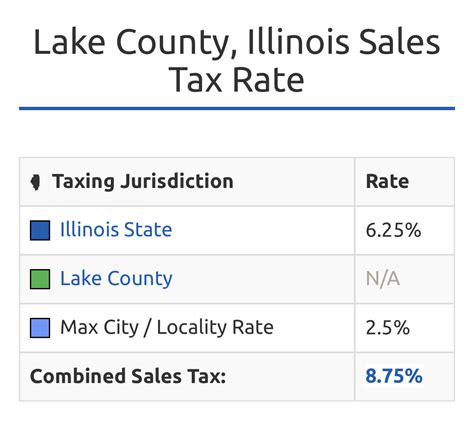

Illinois, like many other states, imposes a sales tax on various goods and services, including the purchase of automobiles. This tax contributes to the state’s revenue and helps fund essential public services. The sales tax rate in Illinois consists of both a state-level tax and local taxes, which can vary depending on the county and municipality.

As of [date], the state sales tax rate in Illinois stands at 6.25%, which is applied uniformly across the state. However, it's important to note that local taxes can significantly impact the overall sales tax rate. These local taxes are typically added to the state rate, resulting in a higher combined rate for specific areas within the state.

Local Sales Tax Variations

Illinois allows counties and municipalities to impose their own sales taxes, leading to diverse rates across the state. These local taxes are often referred to as home rule taxes and are designed to address local infrastructure and service needs.

| County | Local Sales Tax Rate | Combined Rate |

|---|---|---|

| Cook County | 1.25% | 7.50% |

| DuPage County | 1.75% | 8.00% |

| Lake County | 1.25% | 7.50% |

As you can see, the combined sales tax rates can vary significantly depending on where you are purchasing your vehicle in Illinois. It's essential to be aware of these local variations to accurately estimate the total sales tax you'll incur.

Calculating Sales Tax for Automobiles

When purchasing an automobile in Illinois, the sales tax is calculated based on the purchase price of the vehicle, including any additional fees and charges. This means that the sales tax amount can vary depending on the cost of the car you’re buying.

Let's consider an example to illustrate how sales tax is calculated for an automobile purchase in Illinois. Suppose you're purchasing a new car priced at $30,000 in Cook County, which has a combined sales tax rate of 7.50%.

The sales tax calculation would be as follows:

Sales Tax Amount = Purchase Price x Sales Tax Rate

Sales Tax Amount = $30,000 x 0.075 = $2,250

So, in this case, you would pay a sales tax of $2,250 on top of the $30,000 purchase price, resulting in a total cost of $32,250 for the vehicle.

Sales Tax Exemptions and Special Considerations

While most automobile purchases in Illinois are subject to sales tax, there are certain exemptions and special considerations to be aware of.

Trade-Ins and Used Vehicles

When trading in your old vehicle as part of a new purchase, the trade-in value is typically deducted from the purchase price of the new vehicle. This means that the sales tax is calculated based on the net purchase price, which is the price of the new vehicle minus the trade-in value.

For example, if you're trading in a vehicle valued at $5,000 towards the purchase of a new car priced at $30,000, the net purchase price would be $25,000. The sales tax would then be calculated based on this reduced price.

Sales Tax for Out-of-State Purchases

If you purchase a vehicle from another state and bring it into Illinois, you may be subject to use tax, which serves a similar purpose to sales tax. The use tax is designed to ensure that vehicles purchased out of state are taxed appropriately when they are registered and used within Illinois.

The use tax rate is the same as the sales tax rate in the county where the vehicle is registered. So, if you register your out-of-state vehicle in Cook County, you would pay a use tax of 7.50% on the purchase price.

Vehicle Lease and Rental Tax

Illinois also imposes a tax on the rental or lease of vehicles. This tax is calculated as a percentage of the total lease or rental amount and is typically included in the overall cost of renting or leasing a vehicle.

Tips for Minimizing Sales Tax Impact

While sales tax is an inevitable part of purchasing a vehicle in Illinois, there are a few strategies you can employ to minimize its impact on your overall cost.

Compare Rates Across Counties

As we’ve seen, sales tax rates can vary significantly between counties in Illinois. If you have the flexibility, consider comparing rates and purchasing your vehicle in a county with a lower combined sales tax rate. This can save you a considerable amount, especially on more expensive vehicles.

Research Tax Incentives

Stay informed about any tax incentives or rebates offered by the state or local governments. As mentioned earlier, Illinois provides incentives for the purchase of electric vehicles. These incentives can significantly reduce the upfront cost and make eco-friendly options more affordable.

Negotiate and Trade-In Strategically

When negotiating the price of a new vehicle, remember that the sales tax is calculated based on the final purchase price. By negotiating a lower price or maximizing the trade-in value of your old vehicle, you can reduce the overall sales tax amount you’ll need to pay.

Future Implications and Trends

Understanding the current sales tax landscape is essential, but it’s also beneficial to consider future trends and potential changes. While sales tax rates in Illinois are relatively stable, there are ongoing discussions and proposals that could impact automobile sales tax in the future.

Proposed Changes and Legislative Actions

From time to time, there are proposals and legislative actions aimed at modifying the sales tax structure in Illinois. These proposals may include changes to the state sales tax rate, adjustments to local tax rates, or the introduction of new tax incentives for specific types of vehicles.

It's crucial to stay informed about any proposed changes, as they can significantly impact the overall cost of purchasing a vehicle. Keep an eye on local news and government websites for updates on sales tax-related legislation.

The Rise of Electric Vehicles and Tax Policies

As the world moves towards more sustainable transportation options, the adoption of electric vehicles is on the rise. Illinois, like many other states, recognizes the importance of encouraging the transition to EVs. As a result, we can expect to see continued tax incentives and rebates to make EV ownership more affordable and attractive.

Impact of Online Sales and E-Commerce

The rise of e-commerce and online vehicle sales presents unique challenges and opportunities for sales tax collection. Illinois, along with other states, is exploring ways to ensure that sales tax is accurately collected and remitted for online vehicle purchases. This includes implementing measures to track and tax online transactions effectively.

Conclusion

Navigating the automobile sales tax landscape in Illinois requires a thorough understanding of the state and local tax rates, as well as the various exemptions and considerations. By staying informed and utilizing strategic purchasing approaches, consumers can minimize the impact of sales tax on their vehicle purchases.

Remember to research and compare rates, explore tax incentives, and negotiate effectively to get the best deal. Stay updated on any proposed changes to sales tax policies, as they can significantly influence your purchasing decisions.

What is the current state sales tax rate in Illinois for automobile purchases?

+

As of [date], the state sales tax rate in Illinois is 6.25%.

Are there any special considerations for purchasing a used car in Illinois?

+

Yes, when trading in a vehicle as part of a new purchase, the sales tax is calculated based on the net purchase price, which is the price of the new car minus the trade-in value.

What happens if I purchase a car from another state and bring it to Illinois?

+

You may be subject to use tax, which is calculated based on the purchase price of the vehicle. The use tax rate is the same as the sales tax rate in the county where you register the vehicle.

Are there any tax incentives for purchasing electric vehicles in Illinois?

+

Yes, Illinois offers tax incentives and rebates for the purchase of electric vehicles to promote sustainable transportation options.

How often do sales tax rates change in Illinois?

+

Sales tax rates in Illinois are relatively stable, but there can be occasional proposals and legislative actions to modify them. It’s essential to stay updated on any changes.