How Long Should You Keep Tax Papers

Managing tax-related documents is an essential aspect of financial responsibility, and understanding the optimal retention period for these papers is crucial for both individuals and businesses. The length of time you should keep tax papers varies based on several factors, including the type of tax document, the country or region you're operating in, and your specific financial situation. This comprehensive guide will delve into these factors, providing a detailed breakdown of tax document retention periods and offering practical advice to help you stay compliant and organized.

Understanding the Basics of Tax Document Retention

Tax document retention refers to the practice of keeping records and papers related to your tax obligations. These documents can include a wide range of items, such as tax returns, receipts, invoices, payroll records, bank statements, and any other records that may impact your tax liability. The primary purpose of retaining these documents is to ensure you can accurately file your taxes, substantiate any deductions or credits claimed, and address any potential audits or inquiries from tax authorities.

The Internal Revenue Service (IRS) and other tax authorities worldwide provide guidelines on how long taxpayers should retain various types of tax-related documents. These guidelines are not arbitrary; they are designed to balance the needs of taxpayers with the efficient administration of tax laws. While some documents may only need to be kept for a few years, others may require indefinite retention, especially if they relate to long-term investments, property ownership, or ongoing legal matters.

Key Factors Influencing Tax Document Retention Periods

Statute of Limitations

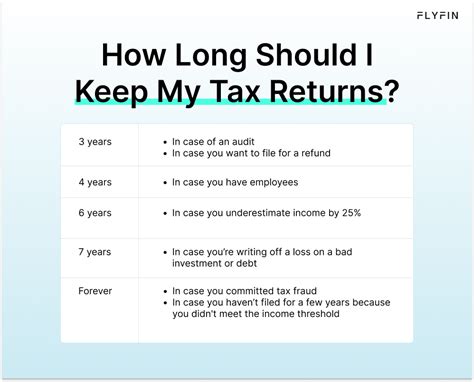

The statute of limitations is a critical factor in determining how long you should keep tax papers. This refers to the period within which the IRS or tax authorities can audit your tax returns or assess additional taxes. In the United States, the general rule is that the IRS has three years from the date you filed your return (or the due date, if earlier) to audit your taxes. However, this period can be extended to six years if you underreported your gross income by more than 25%. In cases of fraud or failure to file a tax return, there is no statute of limitations, meaning tax authorities can audit your returns at any time.

Knowing the statute of limitations is crucial because it directly impacts the retention period for your tax documents. As a general rule, it's recommended to keep your tax returns and supporting documents for at least as long as the statute of limitations period. This ensures that you have the necessary records to substantiate your tax filings should an audit occur.

Tax Return Complexity and Amendments

The complexity of your tax return can also influence the retention period for your tax papers. If you have a simple tax situation with few deductions, credits, or investments, you may not need to retain documents for as long as someone with a more complex financial situation. For instance, if you’re a sole proprietor with minimal business expenses, keeping records for three to four years might be sufficient. However, if you own a business with multiple income streams, significant investments, or complex transactions, you may need to retain documents for a longer period, such as seven years or more.

It's also important to consider the possibility of amending your tax returns. If you discover an error or omission in a previously filed return, you can file an amended return. In such cases, you should retain the original return and any supporting documents indefinitely, as these may be required to resolve any issues related to the amendment.

Type of Tax Document

Different types of tax documents have varying retention periods. For instance, the IRS recommends keeping records related to income, such as W-2 forms, 1099 forms, and pay stubs, for at least three years. However, records related to assets and their basis, such as property deeds, stock certificates, and purchase receipts, should be retained indefinitely, as they may be needed to calculate capital gains taxes or address inheritance issues.

Similarly, records related to business expenses, such as invoices, receipts, and mileage logs, should be kept for at least three years. However, if you're self-employed and your business is subject to a product or service liability claim, you may need to retain these records indefinitely to defend yourself in a potential lawsuit.

Legal and Regulatory Requirements

In addition to tax-related requirements, there may be other legal or regulatory reasons to retain certain documents. For example, employment records, including payroll documents and personnel files, must be kept for a certain period as mandated by labor laws. Similarly, if you’re in a highly regulated industry, such as healthcare or finance, you may be subject to additional record-keeping requirements to comply with industry-specific regulations.

It's essential to understand the specific legal and regulatory requirements that apply to your industry and financial situation. Consulting with a legal or financial professional can help you navigate these requirements and ensure you're not only complying with tax laws but also meeting all relevant legal obligations.

Recommended Retention Periods for Common Tax Documents

To provide a practical guide, here are recommended retention periods for some common tax-related documents:

| Type of Document | Recommended Retention Period |

|---|---|

| Income Tax Returns (Form 1040) | 3-7 years, depending on complexity and potential amendments |

| Income Records (W-2, 1099, Pay Stubs) | 3 years |

| Expenses and Receipts (Business or Personal) | 3-7 years, depending on the nature of the expense |

| Property and Asset Records (Deeds, Titles, Purchase Receipts) | Indefinitely |

| Investment Records (Stock Certificates, Brokerage Statements) | Indefinitely |

| Employee Records (Payroll, Benefits, Personnel Files) | As mandated by labor laws (typically 3-7 years) |

| Legal and Regulatory Documents (Permits, Licenses, Contracts) | As mandated by specific regulations (often 5-10 years) |

These recommendations serve as a general guide, but it's important to note that your specific situation may warrant longer retention periods. It's always better to err on the side of caution and keep documents for longer rather than risk losing important records.

Best Practices for Tax Document Management

Organize and Store Your Documents Securely

Effective tax document management starts with proper organization. Consider using a filing system that categorizes your documents by type and year. This makes it easier to retrieve specific records when needed. Additionally, ensure that your physical or digital storage is secure to protect against loss, theft, or unauthorized access.

Utilize Digital Storage and Cloud Services

In today’s digital age, many taxpayers are turning to digital storage solutions for their tax documents. Scanning and storing documents in the cloud offers several advantages, including easy access from anywhere, enhanced security, and reduced physical storage space. However, it’s essential to choose a reputable cloud service provider and ensure that your data is encrypted and backed up regularly.

Consider Third-Party Document Storage Services

For businesses or individuals with extensive tax records, third-party document storage services can be a cost-effective and secure solution. These services provide off-site storage and management of your physical documents, ensuring they are protected and accessible when needed. They often offer scanning and digital storage services as well, providing a comprehensive solution for tax document management.

Regularly Review and Dispose of Old Documents

As time passes, it’s important to review your tax documents and dispose of those that are no longer required. This not only helps to keep your records organized and up-to-date but also reduces the risk of unauthorized access to outdated information. When disposing of physical documents, ensure they are shredded to prevent identity theft or fraud.

Seek Professional Advice for Complex Situations

If you have a complex financial situation, own a business, or are dealing with inheritance or estate planning, it’s highly recommended to consult with a tax professional or accountant. They can provide tailored advice on document retention periods and help you navigate the unique challenges associated with your financial circumstances.

The Future of Tax Document Retention

As technology advances and digital transformation continues to shape the tax landscape, the way we manage and retain tax documents is evolving. The rise of e-filing and digital tax software has already made it easier for taxpayers to organize and store their records electronically. Additionally, blockchain technology and digital signatures are increasingly being explored for their potential to enhance security and streamline tax document management.

Looking ahead, it's likely that tax authorities will continue to embrace digital solutions, potentially reducing the need for physical document retention. However, until these changes become widespread and fully implemented, it's crucial to stay informed about the latest guidelines and best practices for tax document retention to ensure compliance and peace of mind.

Conclusion: A Strategic Approach to Tax Document Retention

Managing tax documents is a critical aspect of financial responsibility, and understanding the optimal retention periods for these papers is essential for both individuals and businesses. By familiarizing yourself with the factors that influence tax document retention, you can develop a strategic approach that ensures compliance, reduces the risk of audits, and provides peace of mind. Whether you choose to organize your documents manually, utilize digital storage solutions, or engage the services of a professional, the key is to stay informed, organized, and proactive in your tax document management.

What happens if I don’t keep my tax records for the recommended period?

+Failing to keep tax records for the recommended period can have serious consequences. If you’re audited and cannot produce the necessary documents to support your tax filings, you may face penalties, interest charges, or even criminal prosecution. It’s crucial to maintain proper records to avoid these risks and ensure compliance with tax laws.

Are there any tax documents I can safely dispose of early?

+While it’s generally recommended to keep most tax documents for at least three years, there are a few exceptions. For instance, you can dispose of certain types of payroll records, such as time cards and wage statements, after one year. However, it’s important to consult with a tax professional or refer to official guidelines to ensure you’re not prematurely disposing of critical documents.

Can I reduce the physical space needed for tax document storage by digitizing my records?

+Absolutely! Digitizing your tax records can significantly reduce the physical space required for storage. Scanning and storing documents in the cloud not only saves space but also enhances security and accessibility. However, it’s crucial to choose a reputable cloud service provider and ensure your data is properly encrypted and backed up.

How often should I review my tax document retention strategy?

+It’s a good practice to review your tax document retention strategy annually or whenever there are significant changes in your financial situation. This ensures that your retention periods remain aligned with your needs and that you’re not retaining documents longer than necessary. Regular reviews also help you stay updated with any changes in tax laws or guidelines.

Are there any tax-related documents I should keep indefinitely?

+Yes, there are certain tax documents that should be retained indefinitely. These include records related to significant assets, such as property deeds, stock certificates, and legal documents like wills and trusts. These documents may be needed to address inheritance issues, calculate capital gains taxes, or resolve legal disputes.