Sales Tax Az

Sales tax is an essential component of the tax system in Arizona, impacting both residents and businesses. This comprehensive guide delves into the intricacies of sales tax in the Grand Canyon State, covering its structure, rates, exemptions, and the latest developments to ensure you stay informed and compliant.

Understanding Sales Tax in Arizona

Sales tax in Arizona is a consumption tax imposed on the sale of tangible personal property and certain services. It is a critical revenue source for the state, with funds collected used to support essential public services and infrastructure.

The state of Arizona imposes a base sales tax rate of 5.6%, which is applied uniformly across the state. However, this base rate is just the starting point, as local jurisdictions have the authority to levy additional taxes, resulting in varying total sales tax rates across the state.

Local Sales Tax Rates

In addition to the state’s base sales tax rate, local governments in Arizona, including counties, cities, and special taxing districts, are authorized to impose their own sales taxes. These local taxes are added to the state rate, creating a combined sales tax that can vary significantly from one area to another.

For instance, the city of Phoenix, Arizona's largest city, levies an additional 2.3% sales tax, resulting in a total sales tax rate of 7.9% within city limits. In contrast, the city of Tucson has a lower local sales tax rate of 1.7%, bringing its total sales tax to 7.3%.

| Location | State Tax Rate | Local Tax Rate | Total Tax Rate |

|---|---|---|---|

| Phoenix | 5.6% | 2.3% | 7.9% |

| Tucson | 5.6% | 1.7% | 7.3% |

| Scottsdale | 5.6% | 2.1% | 7.7% |

| Mesa | 5.6% | 2.0% | 7.6% |

These variations in local sales tax rates can have a significant impact on businesses and consumers, particularly when operating or shopping across multiple jurisdictions. It's crucial for businesses to understand these rates to ensure accurate tax collection and for consumers to be aware of the taxes they are paying.

Sales Tax Exemptions

While sales tax is broadly applicable, certain goods and services are exempt from taxation in Arizona. These exemptions can be based on the type of product, the use of the product, or the characteristics of the purchaser.

For example, many types of food are exempt from sales tax in Arizona, as are prescription medications and medical devices. Additionally, purchases made by certain entities, such as non-profit organizations and government agencies, are often exempt from sales tax.

It's important to note that while these exemptions exist, they can be complex and subject to specific conditions and limitations. Businesses should consult with tax professionals to ensure they are correctly applying exemptions and avoiding potential penalties.

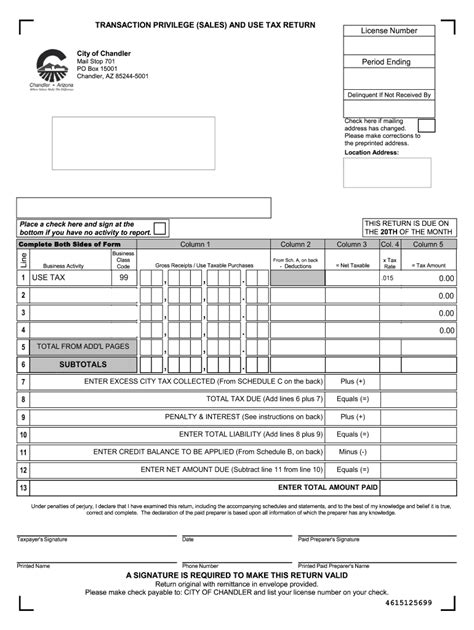

Compliance and Registration

Compliance with sales tax regulations is a critical aspect of doing business in Arizona. Businesses that make taxable sales within the state are generally required to register with the Arizona Department of Revenue and collect sales tax from customers at the appropriate rate.

The registration process involves providing detailed information about your business, including its legal structure, location(s) of operation, and the types of goods and services you offer. Once registered, you will receive a unique tax identification number and be responsible for filing regular sales tax returns and remitting the collected taxes to the state.

Failing to comply with sales tax regulations can result in significant penalties and interest charges. It's therefore crucial for businesses to understand their obligations and ensure they have the necessary systems in place to collect and remit sales tax accurately and timely.

Online Sales and Nexus

With the rise of e-commerce, the concept of nexus has become increasingly important for businesses operating online. Nexus refers to the connection or presence that triggers a business’s obligation to collect and remit sales tax in a particular state.

In Arizona, a business may have nexus and be required to collect sales tax if it has a physical presence in the state, such as a store, warehouse, or even a remote employee working from home. Additionally, economic nexus rules apply, which means that out-of-state sellers may be required to collect Arizona sales tax if they meet certain sales thresholds in the state.

Understanding your nexus obligations is crucial for online businesses to ensure compliance and avoid potential audits and penalties. It's recommended to consult with tax professionals to determine your specific nexus situation and sales tax obligations.

Sales Tax Rates and Changes

Sales tax rates in Arizona can change periodically due to various factors, including legislative decisions and local initiatives. It’s important for businesses and consumers to stay informed about these changes to ensure accurate tax collection and payment.

For instance, in recent years, several Arizona cities have voted to increase their local sales tax rates to fund specific projects or support public services. These changes can have a significant impact on the total sales tax rate and should be monitored closely by those operating in or serving these areas.

The Arizona Department of Revenue provides regular updates and resources to help businesses and individuals understand and comply with the latest sales tax regulations and rates. It's advisable to regularly check these resources or subscribe to updates to stay informed.

Sales Tax Holidays

Arizona, like many other states, occasionally observes sales tax holidays. These are designated periods when certain types of purchases are exempt from sales tax, offering consumers a tax-free shopping opportunity.

Sales tax holidays in Arizona typically focus on back-to-school supplies, clothing, and other essential items. These holidays can provide significant savings for consumers and are a great way to stimulate local economies. It's important for businesses to be aware of these holidays and ensure they are correctly applying the tax exemptions during these periods.

The Impact of Sales Tax on Businesses and Consumers

Sales tax has a significant impact on both businesses and consumers in Arizona. For businesses, the collection and remittance of sales tax is a critical aspect of their financial operations, affecting cash flow and requiring accurate record-keeping.

From a consumer perspective, sales tax can influence purchasing decisions and the overall cost of living. Higher sales tax rates can make certain goods and services less affordable, particularly for those on fixed incomes. On the other hand, sales tax can also generate revenue for essential public services, benefiting the community as a whole.

Understanding the impact of sales tax is crucial for both businesses and consumers to make informed decisions and plan their financial strategies effectively.

Conclusion

Sales tax in Arizona is a complex yet critical component of the state’s tax system, impacting businesses and consumers alike. By understanding the rates, exemptions, and compliance requirements, individuals and businesses can navigate the system effectively and contribute to the state’s economic growth.

FAQ

What is the current sales tax rate in Phoenix, Arizona?

+The current sales tax rate in Phoenix is 7.9%, which includes the state base rate of 5.6% and a local tax rate of 2.3%.

Are there any sales tax exemptions for food in Arizona?

+Yes, many types of food are exempt from sales tax in Arizona. This includes unprepared food items, such as produce, bread, and dairy products. However, certain prepared foods and beverages, like restaurant meals and coffee, are taxable.

How often do sales tax rates change in Arizona?

+Sales tax rates in Arizona can change periodically due to legislative decisions and local initiatives. While there is no set schedule for these changes, it’s important to stay informed and regularly check for updates.

Do online businesses need to collect sales tax in Arizona?

+Yes, online businesses may have a sales tax collection obligation in Arizona if they have nexus in the state. This can be due to physical presence or economic nexus, which applies when a business meets certain sales thresholds in Arizona.