Jccal Property Tax

Welcome to this in-depth exploration of the Jccal Property Tax, a topic that delves into the intricacies of property taxation in a specific jurisdiction. This article aims to provide a comprehensive understanding of the tax system, its implications, and its relevance to both residents and investors. By examining the unique characteristics of the Jccal region, we can gain valuable insights into the impact of property taxes on the local economy and community.

Understanding the Jccal Property Tax Landscape

The Jccal Property Tax, often referred to as the Jurisdiction’s Comprehensive Assessment and Levy, is a critical component of the region’s revenue generation strategy. It is a form of ad valorem tax, which means it is levied based on the assessed value of a property. This assessment takes into account various factors such as location, size, improvements, and market trends.

The Jccal region has a diverse real estate market, ranging from residential neighborhoods to commercial districts and industrial zones. This diversity poses a unique challenge for tax assessors, as they must accurately evaluate each property's worth to ensure fairness and transparency.

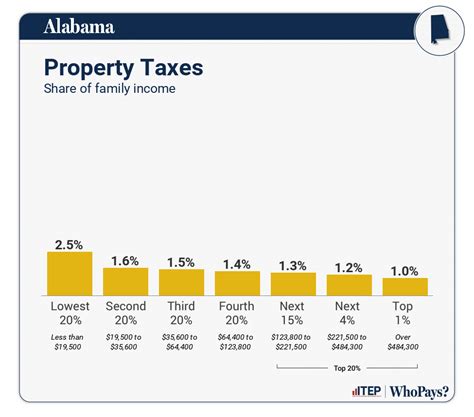

One notable aspect of the Jccal Property Tax is its progressive nature. The tax rates are designed to be higher for properties with higher assessed values, aiming to promote equity and discourage speculative investments. This approach has garnered both support and criticism, with proponents arguing for a more balanced distribution of tax burdens and detractors citing potential deterrence for high-value property owners.

Tax Assessment Process

The tax assessment process in Jccal involves a comprehensive evaluation of each property. Assessors consider historical data, recent sales in the area, and market trends to determine a property’s current market value. This process is typically conducted every few years, with reassessments aimed at keeping the tax system up-to-date and accurate.

To ensure transparency, the Jccal government provides property owners with detailed information about their assessments. This includes access to assessment records, comparison data with similar properties, and an appeals process for those who believe their property has been overvalued.

Tax Rates and Exemptions

The Jccal Property Tax is calculated by applying the assessed value of a property to the applicable tax rate. These rates are determined by the local government and can vary based on the type of property and its location within the region. For instance, residential properties might have different tax rates than commercial or agricultural properties.

In addition to progressive tax rates, Jccal offers various exemptions and incentives to promote specific economic activities. For example, senior citizens may be eligible for reduced tax rates or exemptions based on their age and income. Similarly, certain industrial sectors might receive tax breaks to encourage economic development and job creation.

| Property Type | Average Tax Rate (%) |

|---|---|

| Residential | 2.5 |

| Commercial | 3.2 |

| Industrial | 2.8 |

| Agricultural | 1.8 |

Revenue Allocation

The revenue generated from the Jccal Property Tax is allocated to various public services and infrastructure projects. This includes funding for education, healthcare, public safety, and maintenance of roads and utilities. The tax system plays a vital role in sustaining the region’s social and economic well-being.

A portion of the property tax revenue is also dedicated to community development initiatives, such as affordable housing programs, local business grants, and environmental sustainability projects. These investments aim to improve the quality of life for residents and foster a vibrant, sustainable community.

Impact on Real Estate Market and Investment

The Jccal Property Tax has a significant influence on the local real estate market and investment landscape. For potential buyers and investors, understanding the tax implications is crucial when making informed decisions.

Property Values and Tax Burden

The progressive nature of the Jccal Property Tax means that higher-value properties bear a greater tax burden. This can affect the overall profitability of investments, particularly for long-term holdings. Investors must carefully consider the potential tax implications when evaluating the financial viability of a property.

On the other hand, the tax system's focus on equity may attract investors who prioritize social responsibility and sustainable practices. By implementing progressive rates, Jccal aims to discourage speculative investments and promote a more stable real estate market.

Investment Strategies and Opportunities

Investors in the Jccal region often employ various strategies to optimize their tax obligations while maximizing returns. This may include purchasing properties with lower assessed values or exploring tax-advantaged investment opportunities, such as those in designated growth areas or sectors with tax incentives.

Additionally, the region's focus on community development and sustainability creates unique investment opportunities. Investors can contribute to local initiatives while enjoying the potential benefits of tax exemptions or reduced rates associated with these projects.

Market Dynamics and Investor Confidence

The transparency and fairness of the Jccal Property Tax system contribute to a stable and predictable real estate market. Investors appreciate the clarity provided by the assessment process and the availability of appeals, which helps maintain investor confidence and market liquidity.

Furthermore, the region's commitment to infrastructure development and community projects can enhance property values over time. This creates a positive feedback loop, where increased property values lead to higher tax revenues, which, in turn, are reinvested into the community, further boosting property values.

Community Engagement and Tax Awareness

The Jccal Property Tax system is not solely a matter of revenue generation; it also plays a vital role in fostering community engagement and awareness.

Educational Initiatives

The Jccal government actively promotes tax awareness through educational campaigns and workshops. These initiatives aim to inform residents about their property tax obligations, assessment processes, and available exemptions. By empowering residents with knowledge, the government encourages participation and reduces potential disputes.

Community Feedback and Appeals

Jccal has established an efficient appeals process for property owners who wish to challenge their tax assessments. This process allows for open dialogue between residents and tax authorities, ensuring that assessments are fair and accurate. The government values community feedback and strives to address concerns promptly.

Public Meetings and Town Halls

Regular public meetings and town hall events provide a platform for residents to voice their opinions and concerns about the property tax system. These gatherings facilitate open communication, allowing the government to gather valuable insights and adjust policies accordingly. By involving the community, Jccal aims to create a tax system that reflects the values and needs of its residents.

Future Implications and Policy Considerations

As the Jccal region continues to evolve, the Property Tax system must adapt to changing economic and demographic trends. Here are some key considerations for the future of Jccal’s property taxation:

Technological Advancements

Implementing advanced technologies, such as artificial intelligence and data analytics, can enhance the accuracy and efficiency of property assessments. These tools can assist in identifying market trends, detecting anomalies, and ensuring fair tax valuations.

Economic Growth and Development

As the Jccal region experiences economic growth, the property tax system should be flexible enough to adapt to changing market conditions. This may involve adjusting tax rates or introducing new incentives to encourage investment in specific sectors or regions.

Social Equity and Fairness

Maintaining a progressive tax system is essential to promote social equity. The government should continue to evaluate and refine tax rates to ensure that the burden is distributed fairly across different income levels and property types. This approach can help prevent income inequality and support a thriving, inclusive community.

Community Engagement and Feedback

Sustaining a dialogue with residents and stakeholders is crucial for the long-term success of the property tax system. The government should continue to prioritize community engagement, listening to feedback, and incorporating resident perspectives into policy decisions.

By actively involving the community, Jccal can create a tax system that aligns with the region's unique needs and aspirations, fostering a sense of ownership and pride among residents.

Conclusion

The Jccal Property Tax is a multifaceted system that plays a pivotal role in the region’s economy and community. From its progressive nature to its impact on real estate investments, the tax system is a key driver of social and economic development.

By understanding the intricacies of the Jccal Property Tax, residents, investors, and policymakers can make informed decisions that contribute to the region's prosperity. This comprehensive guide aims to provide valuable insights into this unique tax system, fostering a deeper appreciation for its role in shaping the Jccal community.

How often are property assessments conducted in Jccal?

+

Property assessments in Jccal are typically conducted every three years to ensure the tax system remains up-to-date and accurate. However, certain circumstances, such as significant property improvements or changes in market conditions, may trigger reassessments.

Can I appeal my property assessment if I disagree with it?

+

Absolutely! Jccal has a well-established appeals process that allows property owners to challenge their assessments. You can submit an appeal by providing supporting evidence and reasons for your disagreement. The appeals board will review your case and make a decision based on the available information.

Are there any tax incentives for green or sustainable properties in Jccal?

+

Yes, Jccal encourages sustainable practices by offering tax incentives for properties that meet certain environmental standards. These incentives can include reduced tax rates or exemptions for properties with energy-efficient features, solar panels, or other eco-friendly upgrades.

How does the Jccal Property Tax affect first-time homebuyers?

+

The Jccal Property Tax system aims to support first-time homebuyers by offering tax relief programs. These programs may include reduced tax rates or exemptions for a certain period after purchasing a home. Additionally, the progressive nature of the tax system can make homeownership more affordable for lower-income individuals.