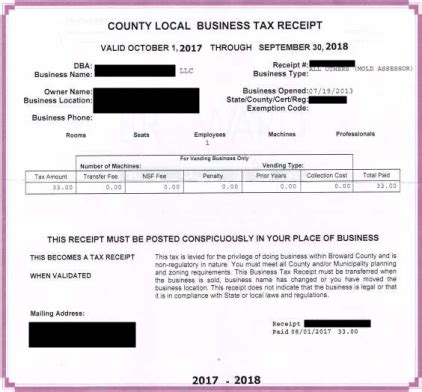

Business Tax Receipt

The Business Tax Receipt (BTR) is a vital component of the regulatory framework that governs commercial activities in various regions. This document is often an essential requirement for any business operating within a specific jurisdiction, ensuring compliance with local laws and contributing to the efficient management of economic activities. In this comprehensive guide, we will delve into the intricacies of Business Tax Receipts, exploring their purpose, benefits, and the process of obtaining them. We will also provide insights into the impact of BTRs on businesses and the wider economy, offering a holistic understanding of this essential administrative process.

Understanding the Business Tax Receipt

A Business Tax Receipt is a license or permit issued by local governments or municipalities to businesses operating within their jurisdiction. It serves as an official recognition that a business has met the necessary legal and regulatory requirements to conduct its operations. BTRs are a form of business registration, enabling authorities to track and manage commercial activities effectively. The specific regulations and requirements for obtaining a BTR can vary significantly depending on the location and the nature of the business.

The primary purpose of a Business Tax Receipt is to facilitate the collection of taxes and fees from businesses. It ensures that businesses contribute to the local economy and infrastructure through the payment of taxes, which are essential for the development and maintenance of public services and facilities. Additionally, BTRs help prevent illegal or unregulated business activities, promoting fair competition and protecting consumers.

Key Features and Benefits

- Legal Compliance: A BTR ensures that a business operates within the bounds of the law, meeting all necessary regulatory standards.

- Tax Collection: It facilitates the collection of business taxes, contributing to local revenue and economic development.

- Business Identification: BTRs provide a unique identification number for each business, aiding in record-keeping and administration.

- Consumer Protection: By regulating businesses, BTRs protect consumers from potential fraudulent or unsafe practices.

- Economic Growth: The tax revenue collected through BTRs contributes to the growth and development of the local economy, supporting public projects and services.

| Location | Annual Tax Rate | Renewal Frequency |

|---|---|---|

| Miami, FL | 0.5% of gross receipts | Annual |

| Los Angeles, CA | $100 base fee + $0.12 per $1,000 of annual gross receipts | Biennial |

| New York City, NY | $100 - $2,000 based on business type and size | Annual |

The Process of Obtaining a Business Tax Receipt

The process of acquiring a Business Tax Receipt involves several steps, each of which is critical to the successful operation of a business. Understanding and navigating these steps is essential for any entrepreneur or business owner.

Step 1: Research and Preparation

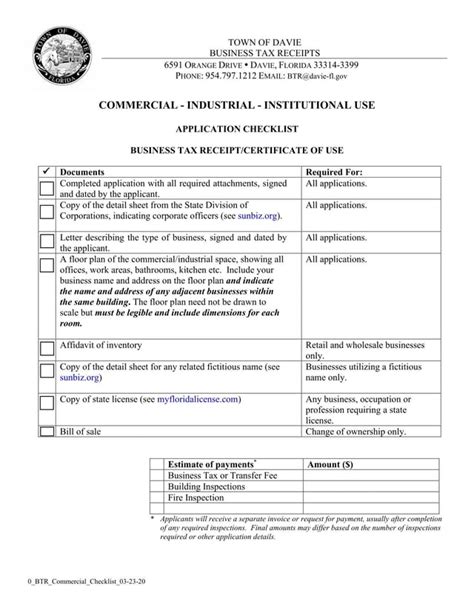

Before applying for a BTR, it is imperative to conduct thorough research on the local regulations and requirements. This includes understanding the specific taxes and fees applicable to your business, the necessary documentation, and any additional criteria for obtaining the BTR. Many local government websites provide detailed guidelines and application forms for business licenses and tax receipts.

Step 2: Application Submission

Once you have gathered all the required information and documentation, the next step is to submit your application. This typically involves filling out an official form, providing detailed information about your business, and paying the associated fees. The application process may be done online or in person, depending on the jurisdiction’s preferences and technological capabilities.

Step 3: Review and Processing

After submitting your application, it undergoes a review process by the local authorities. This review ensures that your business meets all the necessary criteria and regulations. The processing time can vary depending on the complexity of your business and the volume of applications the local government receives.

Step 4: Issuance of the BTR

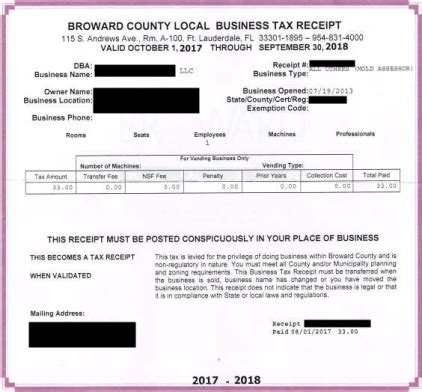

If your application is approved, you will receive your Business Tax Receipt, which typically includes a unique identification number for your business. This receipt should be prominently displayed at your place of business, as it serves as proof of your compliance with local regulations.

Step 5: Renewal and Updates

Business Tax Receipts are not permanent and usually require renewal on an annual or biennial basis. The renewal process is similar to the initial application, but it often involves a simpler procedure with updated information about your business. It is crucial to stay informed about the renewal deadlines to avoid any lapses in your compliance status.

Impact of Business Tax Receipts on Businesses

The implementation and enforcement of Business Tax Receipts have a significant impact on businesses, influencing their operations, financial strategies, and overall success. Understanding these impacts is essential for business owners to navigate the regulatory landscape effectively.

Financial Considerations

The most immediate impact of BTRs is the financial obligation they impose on businesses. The taxes and fees associated with BTRs can vary widely depending on the location and type of business. While these costs are an essential part of doing business, they can also present a challenge, particularly for small businesses with limited resources.

Operational Requirements

BTRs also come with certain operational requirements. Businesses must ensure they are compliant with all the regulations outlined in their BTR, which can include health and safety standards, environmental regulations, and labor laws. Failure to meet these requirements can result in fines, penalties, or even the revocation of the BTR, which can have severe consequences for a business’s operations.

Strategic Planning

The process of obtaining and maintaining a BTR requires strategic planning. Businesses must budget for the associated costs, plan their operations to meet regulatory standards, and stay informed about any changes in the regulatory landscape. This strategic approach ensures that businesses can operate efficiently and avoid unnecessary disruptions.

Competitive Advantage

Compliance with BTR regulations can provide businesses with a competitive advantage. By demonstrating their commitment to legal and ethical operations, businesses can build trust with consumers, investors, and partners. This trust can lead to increased customer loyalty, better access to capital, and stronger relationships with stakeholders.

Future Implications and Innovations

The landscape of business taxation and regulation is continually evolving, and the future of Business Tax Receipts is likely to be shaped by several key factors and innovations.

Digitalization and Automation

The increasing digitalization of government services is likely to streamline the process of obtaining and managing BTRs. Online applications, digital signatures, and automated renewal processes can reduce administrative burdens and increase efficiency for both businesses and government agencies.

Data-Driven Insights

Advanced analytics and data-driven insights can help governments optimize their tax structures and regulations. By analyzing economic trends, business performance, and tax revenue, authorities can make informed decisions about tax rates, incentives, and regulatory frameworks, fostering a more supportive business environment.

Sustainability and Social Impact

There is a growing trend towards integrating sustainability and social impact considerations into business taxation. This could involve incentives for environmentally friendly practices, support for social enterprises, or penalties for businesses with negative social or environmental impacts. Such measures could drive positive change while promoting responsible business practices.

Blockchain and Smart Contracts

Blockchain technology and smart contracts have the potential to revolutionize the way BTRs are managed. These technologies can enhance security, transparency, and efficiency in the issuance, tracking, and renewal of BTRs, reducing the risk of fraud and ensuring compliance.

Conclusion

Business Tax Receipts are a critical component of the regulatory framework that governs commercial activities. They serve multiple purposes, from ensuring legal compliance to facilitating tax collection and promoting economic growth. While BTRs come with certain challenges and financial obligations, they also provide businesses with a competitive edge and contribute to the development of the local economy.

As we look to the future, the landscape of BTRs is set to evolve with advancements in technology and a growing emphasis on sustainability and social impact. By staying informed about these developments and adapting to changing regulations, businesses can continue to thrive while contributing to the greater good of their communities.

How often do I need to renew my Business Tax Receipt?

+The renewal frequency for BTRs can vary depending on your location and the type of business. Some jurisdictions require annual renewals, while others may have biennial or triennial renewal periods. It’s crucial to stay informed about the renewal deadlines to maintain compliance.

Are there any exemptions or waivers for Business Tax Receipt fees?

+In certain cases, businesses may be eligible for exemptions or waivers from BTR fees. These exemptions often apply to specific business types, such as non-profit organizations or small businesses meeting certain criteria. It’s advisable to check with your local government or tax authority for more information on potential exemptions.

What happens if I operate my business without a valid Business Tax Receipt?

+Operating a business without a valid BTR can result in significant penalties, including fines, legal repercussions, and even the closure of your business. It’s essential to obtain and maintain a valid BTR to avoid these consequences and ensure your business operates within the bounds of the law.