Sales Tax Ma

Sales tax is an essential component of the revenue system in many states and plays a crucial role in funding public services and infrastructure. In the state of Massachusetts, sales tax regulations are designed to ensure fair taxation and provide a stable source of income for the state's operations. This article aims to provide an in-depth exploration of the sales tax system in Massachusetts, shedding light on its intricacies, rates, exemptions, and implications for businesses and consumers alike.

Understanding Sales Tax in Massachusetts

Massachusetts, like many other states, imposes a sales and use tax on the sale of tangible personal property and certain services. The primary purpose of this tax is to generate revenue for the state, which is then utilized for various public purposes such as education, healthcare, transportation, and public safety.

The Massachusetts Department of Revenue is the governmental body responsible for administering and enforcing sales tax laws within the state. They provide guidelines, resources, and support to help businesses and consumers understand their sales tax obligations and rights.

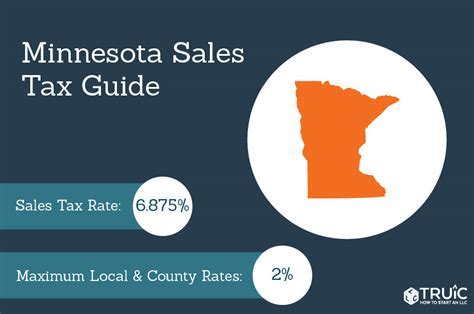

Sales Tax Rates in Massachusetts

As of my last update in January 2023, the statewide sales tax rate in Massachusetts is 6.25%. This rate applies to most retail sales of tangible personal property and certain designated services. However, it’s important to note that there may be additional local option taxes imposed by cities and towns, which can increase the overall sales tax rate in certain areas.

| Sales Tax Type | Rate |

|---|---|

| Statewide Sales Tax | 6.25% |

| Local Option Taxes | Varies by city/town (up to 2.75%) |

For example, in the city of Boston, the combined sales tax rate is 6.65%, with an additional local option tax of 0.4%. It's crucial for businesses and consumers to be aware of these local variations to ensure accurate tax collection and compliance.

Sales Tax Exemptions in Massachusetts

While the sales tax in Massachusetts applies to a wide range of goods and services, there are certain categories that are exempt from taxation. These exemptions are designed to support specific industries, promote social welfare, or alleviate financial burdens on certain segments of the population.

Some notable sales tax exemptions in Massachusetts include:

- Groceries and Food Products: Many staple food items, including milk, bread, and produce, are exempt from sales tax.

- Prescription Drugs: Medications and pharmaceutical products prescribed by licensed medical professionals are tax-exempt.

- Clothing and Footwear: Sales of clothing and footwear items priced under $175 per item are exempt from sales tax.

- Certain Services: Services such as legal, accounting, and architectural services are not subject to sales tax.

- Educational Materials: Books, periodicals, and other educational materials are generally exempt from sales tax.

It's important to note that while these are some of the more common exemptions, there may be additional exemptions applicable to specific industries or circumstances. Businesses should consult the official guidelines provided by the Massachusetts Department of Revenue to ensure they are aware of all relevant exemptions.

Sales Tax Implications for Businesses

Sales tax compliance is a critical aspect of running a business in Massachusetts. Businesses are responsible for collecting, reporting, and remitting sales tax to the state on a regular basis. Failure to comply with sales tax regulations can result in penalties, interest charges, and even legal consequences.

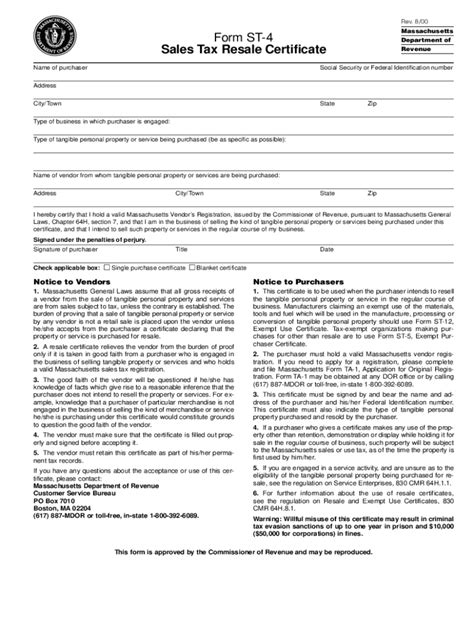

Registering for a Sales Tax Permit

Any business engaged in the sale of taxable goods or services in Massachusetts must obtain a Sales and Use Tax Permit from the Department of Revenue. This permit authorizes the business to collect and remit sales tax on behalf of the state.

The registration process involves providing detailed information about the business, including its legal name, physical address, and the nature of its operations. Once registered, the business will receive a unique permit number, which must be displayed at all places of business and used on all sales tax documents.

Collecting and Remitting Sales Tax

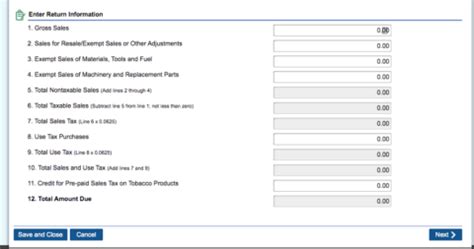

Businesses are required to collect sales tax from customers at the point of sale, based on the applicable tax rate for their location. The collected sales tax must be remitted to the Department of Revenue on a regular basis, typically monthly or quarterly, depending on the business’s sales volume.

The sales tax remittance process involves completing sales tax returns, which require detailed reporting of taxable sales, exemptions, and any applicable credits or deductions. Businesses must maintain accurate records of all sales transactions to ensure compliance with these reporting requirements.

Sales Tax Software and Tools

To simplify the sales tax compliance process, many businesses in Massachusetts utilize sales tax software and tools. These solutions automate various aspects of sales tax management, including rate calculations, exemption tracking, and sales tax filing. By investing in these tools, businesses can reduce the risk of errors, streamline their operations, and ensure timely compliance with sales tax regulations.

Sales Tax for Consumers

For consumers in Massachusetts, understanding sales tax is crucial for making informed purchasing decisions and ensuring they are not overcharged. While the sales tax rate is relatively straightforward, it’s important for consumers to be aware of the specific rates in their area, as well as any applicable exemptions, to ensure they are paying the correct amount of tax.

Calculating Sales Tax

To calculate the sales tax on a purchase, consumers can use the following formula:

Sales Tax = (Sales Price x Sales Tax Rate) / 100

For example, if a consumer purchases an item priced at 100 in an area with a 6.25% sales tax rate, the sales tax on that purchase would be calculated as follows:</p> <p><strong>Sales Tax = (100 x 0.0625) = 6.25</strong></p> <p>So, the total price of the item, including sales tax, would be 106.25.

Sales Tax Receipts and Refunds

When making a purchase, consumers should always request a sales tax receipt. This receipt serves as proof of payment and can be useful for various purposes, such as claiming refunds or resolving disputes.

In cases where a consumer believes they have been overcharged sales tax, they can request a refund from the retailer. The retailer will then process the refund and, if necessary, seek reimbursement from the Department of Revenue.

Sales Tax in the Digital Age

With the rise of e-commerce and online sales, the collection and enforcement of sales tax have become increasingly complex. Massachusetts, like many other states, has adapted its sales tax regulations to address these challenges.

Remote Sellers and Sales Tax Nexus

Remote sellers, or businesses that sell goods or services remotely to consumers in Massachusetts, are required to collect and remit sales tax if they have a sufficient presence or nexus in the state. This presence can be established through various factors, such as having employees, affiliates, or warehouses located in Massachusetts.

The concept of economic nexus has also been introduced, which means that even if a remote seller lacks a physical presence in the state, they may still be required to collect sales tax if their sales exceed a certain threshold. This threshold varies by state and is designed to ensure that online sellers contribute fairly to the state's revenue system.

Marketplace Facilitator Rules

Massachusetts has implemented marketplace facilitator rules, which hold online marketplaces responsible for collecting and remitting sales tax on behalf of their third-party sellers. This rule applies to marketplaces that facilitate the sale of tangible personal property or certain designated services.

By shifting the responsibility to the marketplace facilitators, the state aims to simplify the sales tax collection process for both businesses and consumers, ensuring a more equitable and efficient system.

Future Implications and Considerations

As the sales tax landscape continues to evolve, both businesses and consumers in Massachusetts can expect to see further changes and developments. Here are some key considerations for the future:

Sales Tax Rate Changes

Sales tax rates are subject to change based on various factors, including economic conditions, budgetary needs, and legislative decisions. While the current statewide rate of 6.25% is relatively stable, there is always the potential for adjustments in the future.

Businesses and consumers should stay informed about any proposed or implemented rate changes to ensure they are aware of their sales tax obligations and can plan their financial strategies accordingly.

Expanding Sales Tax Base

As the digital economy continues to grow, there is an ongoing discussion about expanding the sales tax base to include more online transactions. This could potentially impact a wider range of businesses and consumers, altering the way sales tax is collected and remitted.

Simplification and Modernization

Efforts to simplify and modernize the sales tax system are ongoing. This includes the development of more user-friendly tax software, improved online filing systems, and enhanced educational resources for businesses and consumers.

By embracing technological advancements and streamlining processes, the Massachusetts Department of Revenue aims to make sales tax compliance more accessible and efficient for all stakeholders.

Conclusion

Sales tax in Massachusetts is a complex yet crucial component of the state’s revenue system. By understanding the rates, exemptions, and implications of sales tax, businesses and consumers can ensure compliance, make informed decisions, and contribute to the state’s financial stability.

Staying informed about sales tax regulations, utilizing available resources, and embracing technological solutions can help navigate the challenges and opportunities presented by this essential tax.

What is the sales tax rate in Massachusetts for 2023?

+

As of my knowledge cutoff in January 2023, the statewide sales tax rate in Massachusetts is 6.25%. However, it’s important to note that local option taxes can increase the rate in certain cities and towns.

Are there any sales tax exemptions in Massachusetts?

+

Yes, Massachusetts has several sales tax exemptions. Common exemptions include groceries, prescription drugs, clothing and footwear under $175, certain services, and educational materials.

How often do businesses need to remit sales tax in Massachusetts?

+

The frequency of sales tax remittance depends on the business’s sales volume. Typically, businesses with higher sales volumes remit sales tax monthly, while those with lower sales volumes remit quarterly. However, the exact schedule can vary, so it’s best to consult the Massachusetts Department of Revenue for specific guidelines.

Can consumers get refunds for overpaid sales tax in Massachusetts?

+

Yes, consumers can request refunds for overpaid sales tax from the retailer. The retailer will process the refund and, if necessary, seek reimbursement from the Department of Revenue. It’s important to keep sales tax receipts as proof of payment for potential refund claims.