Tax Id Finder

The process of obtaining a Tax Identification Number (TIN) can be crucial for businesses, individuals, and organizations to navigate the complex world of taxation and financial compliance. A TIN is a unique identifier assigned by tax authorities to individuals and entities, enabling them to accurately report their financial activities and meet their tax obligations. In this comprehensive guide, we will explore the ins and outs of the Tax ID Finder, a tool that simplifies the process of locating and understanding these critical identification numbers.

Understanding the Tax Identification Number (TIN)

A Tax Identification Number, often referred to as a TIN, is a unique code assigned by a government tax authority to identify taxpayers and track their tax-related activities. This number is essential for various financial transactions, including filing tax returns, opening bank accounts, and engaging in business operations. The TIN system ensures that each taxpayer is uniquely identified, allowing tax authorities to monitor and manage tax obligations effectively.

The format and structure of TINs can vary between countries and even within different jurisdictions of the same country. For instance, in the United States, the Social Security Number (SSN) serves as the TIN for individuals, while the Employer Identification Number (EIN) is used for businesses and other entities. In contrast, countries like the United Kingdom use a unique Taxpayer Reference (UTR) number, and in Australia, the Tax File Number (TFN) plays a similar role.

Key Features of TINs

- Uniqueness: Each TIN is unique to an individual or entity, ensuring that tax-related information is accurately linked to the right taxpayer.

- Compliance: TINs are essential for complying with tax laws and regulations, as they enable taxpayers to report income, deductions, and other financial data accurately.

- Privacy: TINs are designed to protect the privacy of taxpayers by ensuring that their personal and financial information is handled securely and confidentially.

- Flexibility: Different types of TINs cater to various taxpayer needs, from individuals to businesses and special entities like trusts and estates.

The Role of the Tax ID Finder

The Tax ID Finder is an innovative tool designed to assist individuals, businesses, and tax professionals in locating and verifying Tax Identification Numbers. This tool plays a crucial role in streamlining tax-related processes and ensuring compliance with applicable laws and regulations.

Key Functions of the Tax ID Finder

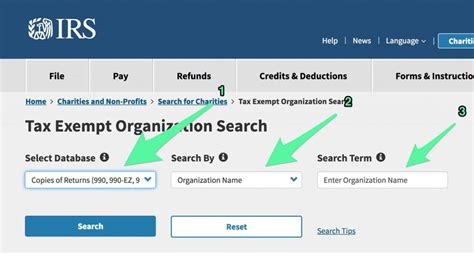

- Search and Verification: The primary function of the Tax ID Finder is to provide a platform for users to search for and verify TINs. This feature is particularly useful when dealing with a large number of taxpayers or when accuracy is critical, such as in financial transactions or tax audits.

- Data Security: The Tax ID Finder prioritizes data security, ensuring that sensitive tax information remains protected. Advanced encryption technologies are employed to safeguard user data and prevent unauthorized access.

- User-Friendly Interface: The tool is designed with a user-friendly interface, making it accessible and easy to navigate for individuals with varying levels of technical expertise. This ensures that users can quickly locate the information they need without unnecessary complexity.

- Real-Time Updates: The Tax ID Finder is continuously updated with the latest tax-related information, ensuring that users have access to accurate and up-to-date TIN data. This real-time aspect is crucial for staying compliant with ever-evolving tax laws and regulations.

Benefits for Different User Types

The Tax ID Finder offers benefits to a wide range of users, including:

- Individuals: For individuals, the Tax ID Finder provides a convenient way to locate and verify their own TIN. This is especially useful when filling out tax forms or when verifying personal tax-related information.

- Businesses: Businesses can use the Tax ID Finder to verify the TINs of their customers, vendors, and partners. This helps ensure compliance with tax regulations and can also assist in fraud detection and prevention.

- Tax Professionals: Tax accountants, lawyers, and consultants can leverage the Tax ID Finder to streamline their workflow. The tool can help them quickly gather tax-related information, verify client details, and ensure accurate tax filings.

- Government Agencies: Tax authorities and government agencies can utilize the Tax ID Finder to efficiently manage taxpayer data. The tool can aid in tax audits, data analysis, and the identification of potential tax evasion or fraud.

How the Tax ID Finder Works

The Tax ID Finder operates through a sophisticated yet user-friendly system, providing an efficient and secure way to access TIN information.

Step-by-Step Process

- User Registration: To access the Tax ID Finder, users typically need to register an account. This process involves providing basic personal or business information and creating a secure login.

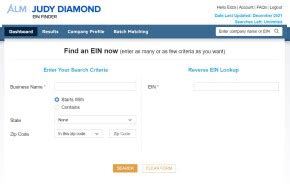

- Search Parameters: Once registered, users can input search parameters such as name, address, or other identifying details. The system then uses these parameters to locate and retrieve relevant TIN information.

- Data Retrieval: The Tax ID Finder accesses its extensive database to match the provided search parameters with existing TIN records. It then presents the user with the most relevant and accurate TIN information.

- Verification and Validation: The retrieved TIN information is verified and validated by the system to ensure its accuracy and authenticity. This step is crucial for maintaining data integrity and preventing fraud.

- User Access: Authorized users can then access the verified TIN information. This data can be downloaded, printed, or integrated into other systems for further analysis or compliance purposes.

Security Measures

The Tax ID Finder implements robust security measures to protect sensitive tax information. These measures include:

- Encryption: All data transmitted between users and the Tax ID Finder platform is encrypted using secure protocols, ensuring that information remains confidential during transit.

- User Authentication: Users must authenticate their identity before accessing TIN information. This can be done through secure login procedures, multi-factor authentication, or other advanced security methods.

- Data Storage: The Tax ID Finder stores TIN data in highly secure servers, employing advanced access controls and encryption technologies to prevent unauthorized access.

- Regular Audits: The platform undergoes regular security audits and penetration testing to identify and address potential vulnerabilities. This proactive approach ensures that the system remains resilient against emerging threats.

The Impact of the Tax ID Finder on Tax Compliance

The introduction of the Tax ID Finder has had a significant impact on tax compliance, offering several advantages that streamline the tax filing process and enhance overall efficiency.

Enhanced Accuracy

The Tax ID Finder significantly improves the accuracy of tax-related information. By providing a centralized platform for TIN verification, the tool reduces the risk of errors that can occur when manually entering or verifying TINs. This accuracy is crucial for ensuring that tax returns are filed correctly and that taxpayers are not penalized for mistakes beyond their control.

Improved Efficiency

The Tax ID Finder streamlines the tax compliance process by eliminating the need for manual TIN verification. Taxpayers and professionals can quickly access and verify TINs, saving valuable time and resources. This efficiency is particularly beneficial for businesses and tax professionals who handle large volumes of tax-related data.

Reduced Fraud and Errors

The Tax ID Finder plays a critical role in fraud prevention and error reduction. By providing a secure and verified platform for TIN access, the tool helps identify and mitigate potential fraud attempts. Additionally, the real-time updates and accurate data provided by the Tax ID Finder minimize the risk of errors, ensuring that taxpayers and tax professionals have access to the most current and reliable information.

Enhanced Taxpayer Experience

The user-friendly nature of the Tax ID Finder enhances the overall taxpayer experience. Individuals and businesses can easily locate and verify their TINs, reducing the stress and complexity often associated with tax-related tasks. This improved experience can lead to increased taxpayer satisfaction and a more positive perception of tax compliance.

Future Developments and Innovations

As technology continues to evolve, the Tax ID Finder is poised to undergo further developments and innovations to enhance its functionality and user experience.

AI Integration

The integration of artificial intelligence (AI) is expected to play a significant role in the future of the Tax ID Finder. AI algorithms can analyze vast amounts of data to identify patterns and anomalies, enhancing the accuracy and speed of TIN verification. Additionally, AI can assist in fraud detection, further strengthening the security and integrity of the system.

Blockchain Technology

Blockchain technology offers the potential for secure and transparent TIN management. By utilizing blockchain, the Tax ID Finder can create an immutable ledger of TIN transactions, enhancing data integrity and reducing the risk of fraud. This technology can also improve interoperability between different tax authorities and jurisdictions.

Mobile Accessibility

The future of the Tax ID Finder may involve increased mobile accessibility. Developing a mobile app could provide users with on-the-go access to TIN information, making the tool more convenient and accessible for taxpayers and professionals alike. Mobile accessibility would also contribute to a more inclusive tax compliance environment.

Interoperability and Data Sharing

Enhancing interoperability between different tax systems and jurisdictions is another area of focus for future developments. By enabling seamless data sharing and integration, the Tax ID Finder can facilitate cross-border tax compliance and reduce the administrative burden for taxpayers operating in multiple jurisdictions.

Conclusion

The Tax ID Finder represents a significant advancement in tax compliance and management. By providing a secure, efficient, and user-friendly platform for TIN verification, the tool has revolutionized the way taxpayers and professionals approach tax-related tasks. As technology continues to evolve, the future of the Tax ID Finder holds exciting possibilities, from AI integration to blockchain adoption, ensuring that tax compliance remains accessible, accurate, and secure.

How often is the Tax ID Finder database updated?

+The Tax ID Finder database is updated on a real-time basis, ensuring that users have access to the most current and accurate TIN information. This real-time updating is crucial for maintaining compliance with ever-changing tax laws and regulations.

Is the Tax ID Finder accessible to international users?

+Yes, the Tax ID Finder is designed to be accessible to users around the world. While the specific TIN formats and requirements may vary between countries, the tool is capable of accommodating these differences, making it a valuable resource for international taxpayers and professionals.

Can the Tax ID Finder assist in identifying potential tax evasion or fraud?

+Absolutely. The Tax ID Finder’s ability to verify and validate TINs can aid in identifying potential tax evasion or fraud. By cross-referencing TIN information with other tax-related data, the tool can help flag suspicious activities or inconsistencies, enabling users to take appropriate action.