American Vat Tax

Understanding American VAT tax, or Value Added Tax, is crucial for businesses operating within the complex landscape of the US tax system. This indirect tax is applied to most goods and services at each stage of production and distribution, making it a critical consideration for companies across various industries. While the US federal government does not impose a national VAT, some states and local jurisdictions have their own versions, creating a patchwork of VAT regulations that can be challenging to navigate.

The American VAT Landscape

The absence of a federal Value Added Tax in the US is a unique feature of the American tax system when compared to many other developed nations. Instead, the country relies on a combination of other taxes, such as sales tax and excise taxes, to generate revenue. However, this does not mean that VAT is entirely absent from the American economic landscape.

State and Local VATs

While no state in the US imposes a general VAT, some states have adopted specific types of value-added taxes for certain sectors or services. For instance, Washington state has a B&O (Business & Occupation) tax that operates like a VAT, with a 0.471% tax rate on various services. Similarly, some local jurisdictions within states like New York have their own unique VAT-like taxes, further complicating the tax landscape for businesses.

| State | VAT-like Tax |

|---|---|

| Washington | Business & Occupation (B&O) Tax |

| New York | Local Sales and Use Tax |

International Considerations

The lack of a federal VAT in the US has implications for international trade. When exporting goods to countries with a VAT system, American businesses may need to navigate the foreign VAT systems, including registering for a VAT number, invoicing with VAT, and managing VAT refunds. Conversely, when importing goods into the US, businesses must understand the impact of foreign VATs on their supply chain and pricing strategies.

Impact on Businesses

The varying VAT regulations across states and localities present a significant challenge for businesses operating nationally or even locally in multiple jurisdictions. They must ensure compliance with each area’s specific VAT rules, which can be complex and time-consuming. Moreover, the administrative burden of managing VAT obligations can be a significant cost for businesses, especially small and medium-sized enterprises (SMEs) that may lack the resources of larger corporations.

Tax Compliance and Administration

VAT compliance requires businesses to maintain detailed records of all transactions, including purchases and sales, to accurately calculate the VAT due. This process can be particularly intricate for businesses involved in manufacturing or multi-stage supply chains, where VAT is added at each stage of production. Additionally, businesses must stay abreast of changing VAT regulations, which can vary not just across states but also within a state over time.

Pricing and Profitability

The presence of VAT can significantly impact a business’s pricing strategy and overall profitability. Businesses must factor in the applicable VAT rates when setting prices for their goods or services, ensuring that the VAT component is adequately covered without making the product or service uncompetitive in the market. This balance can be especially challenging for businesses operating in highly competitive industries or those facing thin profit margins.

Future Perspectives

The question of whether the US will ever adopt a federal Value Added Tax is a topic of ongoing debate among economists, policymakers, and businesses. Proponents argue that a federal VAT could provide a stable and significant source of revenue for the government, helping to fund critical social programs and infrastructure projects. It could also simplify the tax system, making it more efficient and reducing the administrative burden on businesses.

Potential Benefits and Challenges

A federal VAT could level the playing field for businesses across the country, eliminating the complexities of varying state and local VAT regulations. It could also make the US tax system more comparable to those of its major trading partners, facilitating international trade. However, introducing a federal VAT would likely face significant political resistance, given the historical opposition to broad-based consumption taxes in the US.

Preparing for a Potential VAT

While the prospect of a federal VAT remains uncertain, businesses can benefit from preparing for such a scenario. This includes developing robust tax planning strategies that consider the potential impact of a VAT on their operations, supply chains, and pricing models. By staying informed and adaptable, businesses can be better positioned to navigate any future changes to the American tax landscape.

Conclusion

In conclusion, while the American VAT tax landscape is complex and varies across states and localities, understanding and navigating these regulations is essential for businesses operating in the US. The potential for a federal VAT, though uncertain, underscores the importance of tax planning and adaptability in the dynamic world of American business and finance.

What is the primary difference between VAT and sales tax in the US context?

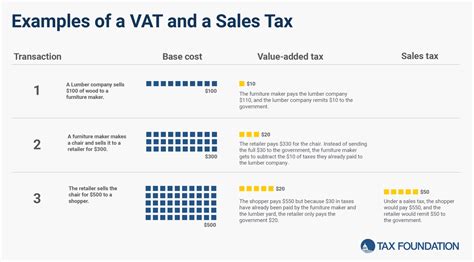

+

VAT is an indirect tax applied at each stage of production and distribution, whereas sales tax is typically charged only at the final point of sale to the consumer. VAT is generally considered a more efficient tax system as it captures value added at each stage, whereas sales tax can be avoided by businesses purchasing goods for resale.

How do businesses register for and manage VAT obligations in states that have VAT-like taxes?

+

Businesses typically need to register with the relevant state or local tax authority and obtain a tax registration number. They must then collect and remit the VAT on applicable transactions. The specific registration and filing processes can vary widely, so it’s essential to consult with a tax professional or the relevant tax authority for accurate guidance.

What are some common challenges faced by businesses when dealing with American VAT systems?

+

Businesses often face challenges in keeping up with varying VAT rates and regulations across different states and localities. Additionally, managing the administrative burden of VAT compliance, including record-keeping and filing requirements, can be complex and time-consuming. Finally, pricing goods and services to account for VAT while remaining competitive in the market can be a significant challenge.