Pa State Tax Payment

Making timely tax payments is a crucial aspect of managing one's financial obligations, and for residents of Pennsylvania, understanding the state tax payment process is essential. This comprehensive guide will delve into the specifics of making Pennsylvania state tax payments, covering the various methods available, the deadlines to keep in mind, and the potential penalties for non-compliance. We will also explore some helpful tips to ensure a smooth and efficient tax payment journey.

Understanding the Pennsylvania State Tax Payment Process

The Commonwealth of Pennsylvania imposes income taxes on individuals, businesses, and trusts, with the revenue generated used to fund essential state services. The Department of Revenue is responsible for administering and collecting these taxes, and individuals and businesses must comply with the state’s tax laws to avoid penalties and legal consequences.

Pennsylvania employs a progressive income tax system, meaning that higher incomes are taxed at higher rates. For the tax year 2023, the state has set five tax brackets with rates ranging from 3.07% to 3.70%. The tax brackets are adjusted annually to account for inflation, ensuring that taxpayers are not inadvertently pushed into higher tax brackets due to rising costs of living.

Who Needs to Pay Pennsylvania State Taxes

All Pennsylvania residents with taxable income exceeding the standard deduction must file a state income tax return and pay any taxes due. Non-residents who earned income within the state, such as through employment or business activities, are also required to file and pay taxes on that income. Pennsylvania’s tax laws define a resident as someone who maintains a permanent home in the state, even if they are temporarily absent, or someone who is domiciled in Pennsylvania but maintains a temporary home elsewhere.

Businesses, including corporations, partnerships, and limited liability companies (LLCs), must also pay state taxes. The specific tax obligations and rates depend on the type of business entity and its income sources. For instance, corporations are subject to a flat corporate net income tax rate, while pass-through entities like partnerships and LLCs pay taxes on their profits through the personal income tax system.

Pennsylvania State Tax Payment Methods

Pennsylvania offers several convenient methods for taxpayers to remit their state taxes. These methods include electronic payments, traditional mail-in payments, and in-person payments at authorized locations.

- Electronic Payments: The most popular and efficient method, electronic payments can be made through the Department of Revenue's website using a credit or debit card, or through electronic funds transfer (EFT) from a bank account. The website provides a secure portal where taxpayers can enter their payment details and confirm the transaction. Electronic payments are typically processed within one business day and provide a faster and more secure alternative to traditional checks.

- Mail-in Payments: For those who prefer a more traditional approach, payments can be mailed to the Department of Revenue. Taxpayers can download and print official payment vouchers from the Department's website, complete them with their payment information, and send them along with a check or money order to the address provided. It's essential to ensure that the payment reaches the Department before the due date to avoid late payment penalties.

- In-Person Payments: In certain circumstances, taxpayers may prefer to make their payments in person. The Department of Revenue has authorized several payment locations across the state, including banks and credit unions. Taxpayers can visit these locations and make their payments by cash, check, or money order. However, it's important to note that not all locations accept cash payments, so it's advisable to check in advance.

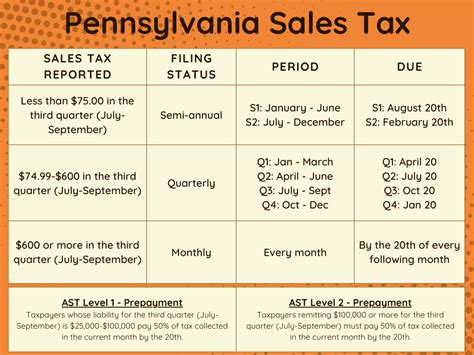

Pennsylvania State Tax Payment Deadlines

Pennsylvania operates on a calendar year tax system, which means that tax payments are due annually, corresponding with the federal tax year. The key tax deadlines to remember are as follows:

| Tax Payment Type | Due Date |

|---|---|

| Individual Income Tax Returns | April 15th (or the next business day if the 15th falls on a weekend or holiday) |

| Corporate Income Tax Returns | 15th day of the 4th month following the close of the tax year |

| Estimated Tax Payments | Four equal installments due on April 15th, June 15th, September 15th, and January 15th |

It's crucial to note that while the Department of Revenue does not charge penalties for late payments received within 60 days of the due date, interest will accrue from the original due date. After 60 days, both penalties and interest will be applied to the outstanding balance.

Pennsylvania State Tax Penalties

The Commonwealth of Pennsylvania takes a serious approach to tax compliance, and penalties for late payments or non-compliance can be significant. Here’s an overview of the potential penalties:

- Late Payment Penalty: For payments received after the 60-day grace period, a 6% penalty is applied to the outstanding balance. This penalty is calculated on a daily basis, so the longer the payment is delayed, the higher the penalty.

- Failure to File Penalty: Taxpayers who fail to file their state income tax returns by the due date are subject to a penalty of $300 or 5% of the unpaid tax, whichever is greater. This penalty is applied even if there is no tax due, emphasizing the importance of filing returns on time.

- Interest on Unpaid Taxes: In addition to penalties, interest accrues on unpaid taxes from the original due date. The interest rate is determined by the Department of Revenue and is subject to change. Currently, the interest rate is set at 6% per year, compounded daily.

It's worth noting that the Department of Revenue offers a variety of payment plans and settlement options for taxpayers who are unable to pay their taxes in full by the due date. These options include installment agreements, offers in compromise, and temporary extensions. Taxpayers should contact the Department directly to discuss their specific circumstances and explore these potential solutions.

Tips for a Smooth Pennsylvania State Tax Payment Journey

Navigating the world of state taxes can be complex, but with some preparation and awareness, taxpayers can ensure a smoother and more efficient tax payment journey. Here are some tips to keep in mind:

- Stay Informed: Keep up-to-date with the latest tax laws and regulations in Pennsylvania. The Department of Revenue's website is an excellent resource, offering detailed information on tax rates, deadlines, and payment methods. Subscribing to their newsletter or following their social media accounts can ensure you receive timely updates and notifications.

- Use Tax Preparation Software: Tax preparation software can simplify the process of filing state income tax returns. These tools guide you through the filing process, ensuring that you claim all applicable deductions and credits, and they often offer direct payment options, streamlining the entire journey.

- Explore Tax Credits and Deductions: Pennsylvania offers various tax credits and deductions that can reduce your tax liability. These may include credits for education expenses, property taxes, and dependent care. Researching and understanding these opportunities can help you optimize your tax payments and potentially reduce the overall amount due.

- Set Reminders: Tax deadlines can be easy to forget, especially with the busyness of everyday life. Set reminders for key tax deadlines, such as the filing and payment due dates, to ensure you stay on track. Many tax preparation software and mobile apps offer reminder features, making it convenient to stay organized.

- Seek Professional Assistance: If you find the tax payment process complex or have unique circumstances, consider seeking the assistance of a tax professional. Certified Public Accountants (CPAs) and enrolled agents are licensed to represent taxpayers before the IRS and state tax authorities. They can provide valuable advice and ensure your compliance with the law.

Conclusion

Making Pennsylvania state tax payments is an essential part of being a responsible citizen and business owner. By understanding the tax payment process, staying informed about deadlines and penalties, and utilizing the various payment methods available, taxpayers can ensure they meet their financial obligations efficiently and effectively. With a little preparation and awareness, the state tax payment journey can be a straightforward and stress-free experience.

Can I make Pennsylvania state tax payments online?

+Yes, the Department of Revenue offers an online payment portal where taxpayers can make payments using a credit or debit card or through electronic funds transfer (EFT) from a bank account.

What happens if I miss the tax payment deadline?

+Missing the tax payment deadline can result in penalties and interest charges. The Department of Revenue does not charge penalties for late payments received within 60 days of the due date, but interest will accrue from the original due date. After 60 days, both penalties and interest will be applied to the outstanding balance.

Are there any payment plans available for taxpayers who cannot pay their taxes in full by the due date?

+Yes, the Department of Revenue offers various payment plans and settlement options for taxpayers who are unable to pay their taxes in full by the due date. These options include installment agreements, offers in compromise, and temporary extensions. Taxpayers should contact the Department directly to discuss their specific circumstances and explore these potential solutions.