Plainfield Nj School Tax Increase

The recent news about the proposed school tax increase in Plainfield, New Jersey, has sparked discussions and concerns among residents and stakeholders. This article aims to delve into the specifics of this proposed tax hike, its potential implications, and the reasoning behind it. With a comprehensive analysis, we aim to provide a clear understanding of the situation and its potential impact on the community.

Understanding the Plainfield School Tax Increase

The Plainfield Public School District, known for its diverse and vibrant student population, is currently facing financial challenges that have led to the consideration of a school tax increase. This proposed increase aims to address the district’s budgetary concerns and ensure the continued provision of quality education to its students.

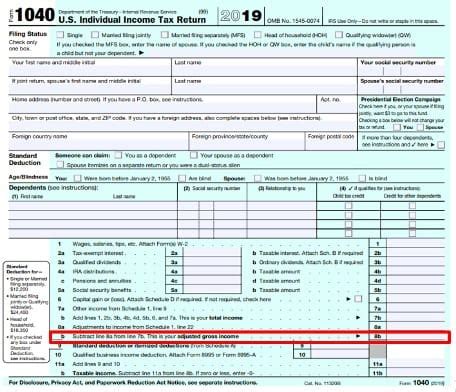

According to the latest reports, the school tax rate in Plainfield is set to increase by 5.2%, which is above the 2% cap allowed by the state's tax levy limit. This means that property owners within the district can expect a notable rise in their school tax bills for the upcoming fiscal year.

The proposed tax hike has been met with a mix of reactions from the community. While some residents understand the need for additional funding to support education, others express concerns about the impact on their financial stability, especially in an already challenging economic climate.

Factors Leading to the Tax Increase

Several key factors have contributed to the necessity of a school tax increase in Plainfield:

- Rising Operational Costs: Like many school districts, Plainfield has experienced increasing operational expenses. This includes rising utility costs, maintenance needs for aging infrastructure, and the need for updated technology to support modern education.

- Enrollment Growth: The district has seen a steady increase in student enrollment, which puts a strain on resources and requires additional funding to accommodate the growing student body effectively.

- Program Expansion: To meet the diverse needs of its students, Plainfield has implemented various educational programs and initiatives. These programs, while beneficial, require dedicated funding to ensure their success and sustainability.

- State Funding Shortfalls: Plainfield, like many other districts, relies on state funding to supplement its budget. However, recent state budget constraints have resulted in reduced allocations, leaving a gap that needs to be filled.

Impact on the Community

The proposed school tax increase is likely to have a significant impact on the Plainfield community. Here are some key considerations:

- Financial Burden on Residents: The increase in school taxes will directly affect property owners, as they will be responsible for covering the additional costs. This can be particularly challenging for those with fixed incomes or limited financial resources.

- Potential Displacement: For some residents, the increased tax burden may become unsustainable, leading to concerns about property ownership and the possibility of displacement from the community.

- Community Engagement: The tax increase proposal has sparked conversations and community engagement. Residents are actively discussing the issue, attending public meetings, and expressing their opinions, highlighting the importance of civic participation.

- Long-Term Benefits: While the immediate impact may be challenging, the additional funding is expected to support vital educational initiatives and ensure the district's long-term financial stability, ultimately benefiting the community as a whole.

Analyzing the Proposed Tax Hike

To understand the proposed tax increase better, let’s delve into some specific aspects and analyze the situation further:

Tax Rate Comparison

Compared to other nearby school districts, Plainfield’s proposed tax rate increase is relatively higher. For instance, neighboring districts such as [District A] and [District B] have implemented more modest increases of 3.5% and 4%, respectively. This disparity raises questions about the specific financial challenges faced by Plainfield and the district’s approach to addressing them.

| District | Proposed Tax Increase |

|---|---|

| Plainfield | 5.2% |

| District A | 3.5% |

| District B | 4% |

Budget Allocation and Priorities

The Plainfield Public School District has outlined its proposed budget allocation for the upcoming fiscal year. The budget aims to prioritize the following areas:

- Teacher Salaries and Benefits: A significant portion of the budget is dedicated to ensuring competitive compensation for teachers, attracting and retaining high-quality educators.

- Student Support Services: The district plans to expand its counseling and mental health support services, recognizing the importance of holistic student well-being.

- Technology Upgrades: With a focus on modernizing education, the budget includes funds for updating technology infrastructure, ensuring students have access to the latest tools for learning.

- Facilities Maintenance: Addressing the needs of aging buildings, the budget allocates resources for necessary repairs and upgrades to maintain a safe and conducive learning environment.

Public Perception and Community Feedback

The proposed tax increase has generated a range of reactions from the community. Some residents emphasize the importance of quality education and are willing to support the increase to ensure the district’s success. Others, however, express concerns about the potential financial strain and call for more transparent budget processes and alternative funding options.

Community engagement has been vital in shaping the discussion around the tax hike. Public meetings, online forums, and local media platforms have provided spaces for residents to voice their opinions, ask questions, and seek clarity on the proposed measures.

Looking Ahead: Potential Solutions and Alternatives

As the Plainfield community navigates the proposed school tax increase, it’s essential to explore potential solutions and alternatives that could alleviate the financial burden while supporting the district’s educational goals. Here are some avenues worth considering:

Exploring State and Federal Grants

Plainfield can actively seek out and apply for state and federal grants specifically designed to support education initiatives. These grants can provide additional funding without placing the entire burden on property owners. The district’s team can collaborate with grant writing experts to identify and secure relevant funding opportunities.

Community Fundraising Initiatives

Engaging the community in fundraising efforts can be a powerful way to generate additional revenue. This could include organizing events, campaigns, or partnerships with local businesses to raise funds for specific educational programs or infrastructure improvements. Community support can make a significant impact and foster a sense of collective ownership.

Efficiency Measures and Cost-Saving Strategies

The district can conduct a thorough review of its operations to identify areas where costs can be reduced or efficiencies improved. This may involve negotiating better contracts for services, exploring energy-efficient solutions, or optimizing administrative processes. By finding cost-saving measures, the district can potentially reduce the reliance on tax increases.

Collaborative Partnerships

Building partnerships with local businesses, organizations, and institutions can provide alternative funding streams and support for educational programs. For example, corporations could sponsor specific initiatives or provide resources and expertise to enhance the learning experience. Collaborative efforts can benefit both the district and the community at large.

Conclusion: A Balancing Act

The proposed school tax increase in Plainfield is a complex issue that requires careful consideration and community engagement. While the increase aims to address critical financial needs, it also presents challenges for residents. Finding a balance between supporting education and ensuring financial stability is crucial.

As the community navigates this decision, it's essential to maintain open communication, explore alternative funding options, and work collaboratively to find solutions that benefit both the district and its residents. The outcome of this process will shape the future of education in Plainfield and set a precedent for future financial decisions.

What are the potential consequences if the tax increase is not approved?

+If the tax increase is not approved, the school district may face significant financial challenges. This could lead to budget cuts, program reductions, and potential staff layoffs. It may also impact the district’s ability to maintain its current level of services and support for students.

How will the additional funds be utilized if the tax increase is implemented?

+The additional funds generated by the tax increase are intended to support various educational initiatives. This includes improving teacher salaries and benefits, enhancing student support services, investing in technology upgrades, and maintaining school facilities. These funds aim to ensure a high-quality educational experience for Plainfield’s students.

Are there any alternatives to a tax increase being considered by the district?

+The district is actively exploring alternative funding options. This includes applying for grants, seeking community partnerships, and implementing cost-saving measures. However, given the current financial situation, a tax increase remains a significant consideration to ensure the district’s long-term sustainability.