Where Is My Agi On My Tax Return

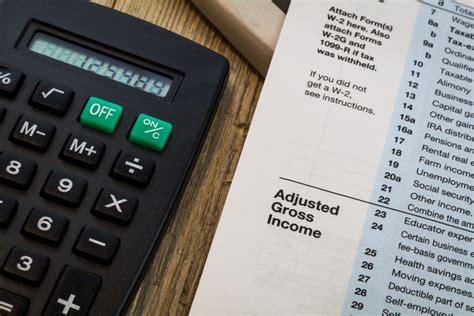

Tax season is a busy time for many individuals, and understanding the intricacies of tax returns is crucial for accurate filing. One often-discussed aspect is the Adjusted Gross Income (AGI), a key metric that can impact various tax-related decisions and benefits. In this article, we will delve into the specifics of where to locate your AGI on different types of tax returns, providing a comprehensive guide to help taxpayers navigate this important information.

Understanding Adjusted Gross Income (AGI)

Adjusted Gross Income, or AGI, is a vital calculation in the US tax system. It represents your total income adjusted for specific deductions and expenses, providing a basis for determining your taxable income. AGI is an essential factor in calculating your tax liability and can impact your eligibility for certain tax credits, deductions, and benefits. Understanding where to find your AGI on your tax return is thus crucial for making informed financial decisions.

Locating AGI on Different Tax Forms

The location of AGI on your tax return can vary depending on the type of form you’re using. Let’s explore the specifics for some common tax forms:

Form 1040: The Standard Individual Tax Return

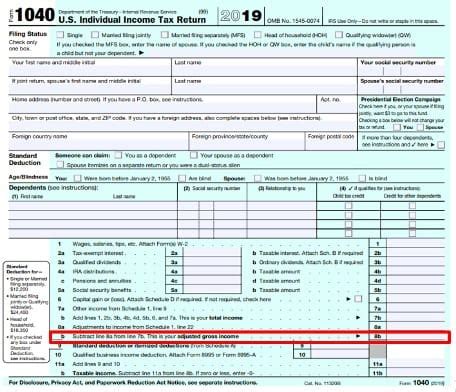

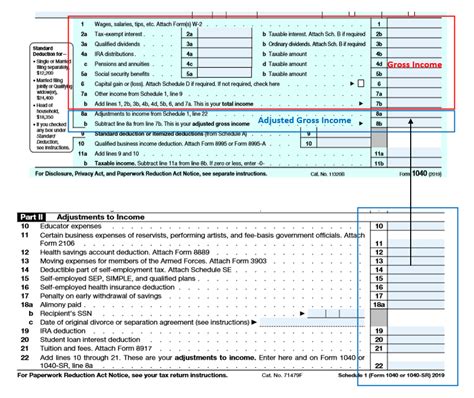

Form 1040 is the primary tax form for individual taxpayers. Here’s where you can find your AGI:

- On the front page of Form 1040, AGI is typically located in the “Income” section. It’s usually the last line of the section, labeled as “Adjusted Gross Income.”

- If you’re using the simplified version of Form 1040, AGI is located in the “Your Income” section. Look for the line that says “Adjusted Gross Income.”

- For the detailed Form 1040, AGI is on the last page, often in the “Income” section. The line for AGI is typically labeled clearly.

Form 1040-SR: The Senior Tax Return

Form 1040-SR is designed for taxpayers aged 65 and older. Finding AGI on this form is similar to Form 1040:

- On the first page of Form 1040-SR, AGI is usually in the “Income” section. It’s labeled as “Adjusted Gross Income.”

- If you’re using the simpler version of Form 1040-SR, AGI is in the “Your Income” section. Look for the line “Adjusted Gross Income.”

Form 1040-NR: The Non-Resident Alien Tax Return

For non-resident aliens, Form 1040-NR is used. Here’s how to locate AGI:

- On the front page of Form 1040-NR, AGI is in the “Income” section. It’s labeled as “Adjusted Gross Income.”

- AGI is also present on Schedule ANC, which is part of Form 1040-NR. It’s located in the “Adjustments to Income” section.

Form 1040-X: The Amended US Individual Income Tax Return

If you need to amend your tax return, you’ll use Form 1040-X. AGI on this form is:

- On the first page of Form 1040-X, AGI is in the “Income” section. It’s labeled as “Adjusted Gross Income.”

Schedule C: Profit or Loss from Business

If you’re self-employed or have business income, you might use Schedule C. AGI on this schedule is:

- On Schedule C, AGI is in the “Income” section. It’s the last line of the section, labeled as “Net profit (or loss).” This net profit or loss is then used to calculate your AGI on your main tax return.

Schedule E: Supplemental Income and Loss

For rental property income or passive investments, you’ll use Schedule E. AGI on this schedule is:

- On Schedule E, AGI is in the “Income” section. It’s the last line of the section, labeled as “Total income or loss.” This total income or loss is then used to calculate your AGI on your main tax return.

Calculating Adjusted Gross Income (AGI)

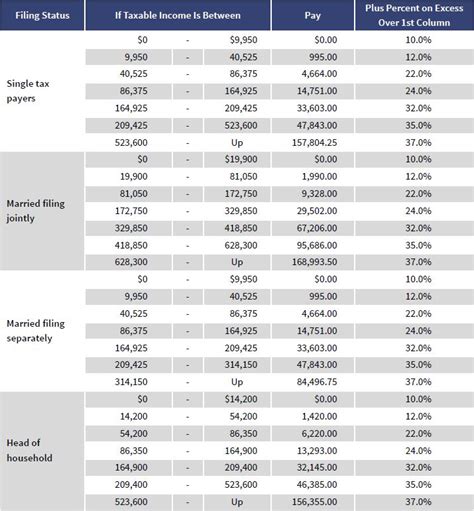

AGI is calculated by subtracting certain deductions and expenses from your total income. The specific deductions and adjustments vary based on your tax situation and the type of income you have. Here’s a general breakdown of how AGI is calculated:

| Income Type | Adjustments/Deductions |

|---|---|

| Wages, Salaries, and Tips |

|

| Business Income (Schedule C) |

|

| Rental Property Income (Schedule E) |

|

| Other Income (gifts, prizes, gambling) |

|

The Impact of AGI on Tax Planning

AGI plays a crucial role in tax planning and strategy. It determines your eligibility for various tax benefits, including:

- Standard Deduction or Itemized Deductions: AGI is a key factor in deciding whether you should claim the standard deduction or itemize your deductions.

- Tax Credits: Many tax credits, such as the Child Tax Credit or Education Credits, have AGI limits. Understanding your AGI can help you determine if you’re eligible for these credits.

- Retirement Savings Contributions: AGI affects your ability to make deductible contributions to retirement accounts like IRAs or 401(k)s.

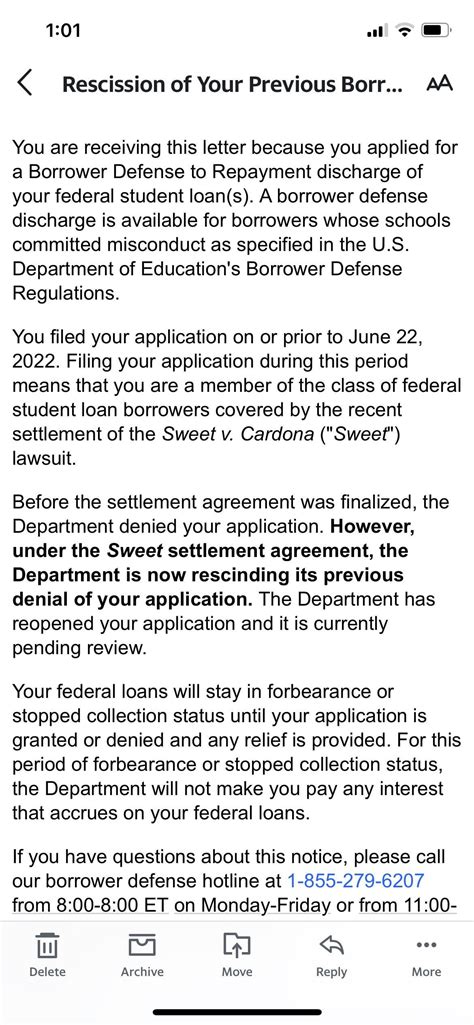

- Student Loan Interest Deduction: The deduction for student loan interest is often limited based on AGI.

AGI and Tax Filing Software

If you’re using tax filing software, the process of locating and calculating AGI is typically automated. The software will guide you through the process of entering your income and deductions, and it will calculate AGI for you. It’s important to ensure that you input accurate information to ensure an accurate AGI calculation.

Conclusion

Understanding where to find your Adjusted Gross Income (AGI) on your tax return is an essential part of tax planning and financial management. AGI is a critical metric that influences your tax liability and eligibility for various tax benefits. By knowing where to locate AGI on different tax forms and understanding how it’s calculated, you can make informed decisions about your tax strategy and maximize your financial outcomes.

What is the significance of AGI in tax planning?

+AGI is a critical metric that determines your eligibility for various tax credits, deductions, and benefits. It’s an essential step in calculating your taxable income and can impact your overall tax liability.

How does AGI differ from taxable income?

+AGI is your total income adjusted for specific deductions and expenses. Taxable income is calculated after subtracting additional deductions and exemptions from AGI. In other words, taxable income is a subset of AGI.

Can AGI be negative?

+Yes, AGI can be negative if your deductions and adjustments exceed your total income. However, this is uncommon and often indicates a need to review your tax situation with a professional.