Cobb County Tax Commissioner

The Cobb County Tax Commissioner's Office is a crucial entity within the Georgia tax system, playing a vital role in property tax assessments, collections, and the overall administration of tax-related matters. This office is responsible for ensuring that the county's residents and businesses comply with state tax laws, providing essential services to the community, and contributing significantly to the county's revenue generation.

The Role and Responsibilities of the Cobb County Tax Commissioner

The Cobb County Tax Commissioner, an elected official, oversees a range of critical functions, including the assessment and collection of ad valorem taxes on real and personal property within the county. This role is integral to the local government’s financial stability and planning, as property taxes are a major source of revenue for the county’s operations.

The tax commissioner's office also manages the registration of motor vehicles and watercraft, offering services such as title transfers, vehicle registration renewals, and the issuance of specialized license plates. This aspect of their work provides a convenient one-stop shop for residents to handle their vehicle-related needs, enhancing efficiency and accessibility.

Tax Assessment and Collection

At the heart of the tax commissioner’s responsibilities is the annual assessment of property values. This process involves appraising each property within the county to determine its fair market value, which forms the basis for calculating the ad valorem taxes. The office uses sophisticated assessment techniques, including physical inspections, market analysis, and data modeling, to ensure accurate and equitable valuations.

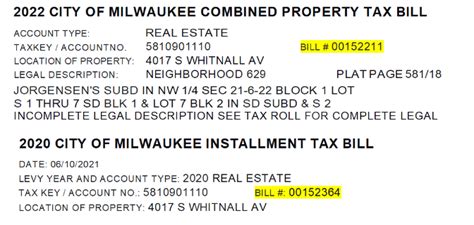

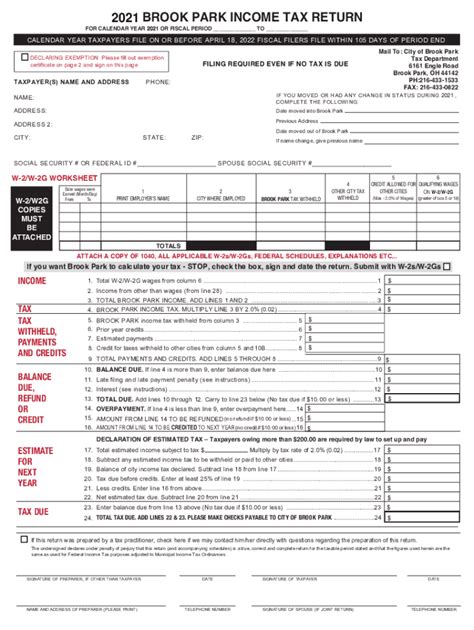

Once the assessments are complete, the tax commissioner's office sends out tax bills to all property owners. These bills detail the assessed value of the property, the applicable tax rate, and the total amount due. Property owners are typically given a grace period to pay their taxes before penalties are applied, encouraging timely payments and compliance.

The office also works closely with the Cobb County Sheriff's Office to enforce tax collection. This collaboration ensures that delinquent taxpayers are reminded of their obligations and, if necessary, that legal action is taken to recover outstanding taxes.

Vehicle Registration and Licensing

In addition to property tax administration, the Cobb County Tax Commissioner’s Office is responsible for registering vehicles and issuing vehicle licenses. This includes registering new vehicles, renewing existing registrations, and handling title transfers when vehicles change ownership.

| Service | Description |

|---|---|

| Vehicle Registration | New and renewal registrations for cars, trucks, motorcycles, and other vehicles. |

| Title Transfers | Handling the legal transfer of vehicle ownership, including lien holder information. |

| Specialty Plates | Issuing custom license plates for various organizations, causes, and interests. |

The office also facilitates the issuance of specialty license plates, which not only provide a personalized touch to vehicles but also support various causes and organizations. For instance, plates with themes like "Support Our Troops" or "Breast Cancer Awareness" not only serve as a unique expression of an individual's interests but also contribute to important causes.

The Impact and Importance of the Cobb County Tax Commissioner’s Office

The Cobb County Tax Commissioner’s Office has a profound impact on the county’s financial health and community well-being. By effectively managing tax assessments and collections, the office ensures that the county receives the revenue necessary to fund vital public services, infrastructure development, and community initiatives.

The office's vehicle registration services provide a critical link between vehicle owners and the state's transportation and safety regulations. By ensuring that all vehicles are properly registered and licensed, the office contributes to road safety, traffic management, and the efficient operation of law enforcement and emergency services.

Furthermore, the tax commissioner's role in enforcing tax compliance helps to maintain a level playing field for all property owners and businesses. This ensures that everyone contributes fairly to the county's finances, supporting the community as a whole. The office's services are also designed to be user-friendly, with online resources and in-person assistance, making it easier for residents to meet their tax obligations.

Efficient Tax Administration

The Cobb County Tax Commissioner’s Office employs cutting-edge technology and innovative strategies to streamline its operations. This includes online platforms for taxpayers to view their assessments, pay their taxes, and manage their vehicle registrations. The office also utilizes data analytics to improve the accuracy and efficiency of its tax assessments, ensuring that the tax burden is distributed fairly among the county’s residents.

For instance, the office's use of Geographic Information Systems (GIS) technology allows for detailed analysis of property values based on location, zoning, and other factors. This ensures that property assessments are accurate and reflect the true market value of each property, contributing to a more equitable tax system.

Community Engagement and Outreach

The tax commissioner’s office actively engages with the community to ensure that residents understand their tax obligations and have access to the services they need. This includes hosting public meetings, attending community events, and providing educational resources on tax-related matters. By fostering a culture of transparency and accessibility, the office builds trust and encourages voluntary tax compliance.

For instance, the office might host workshops on tax planning, offer guidance on property tax appeals, or provide resources for low-income residents to access tax relief programs. These initiatives not only assist residents but also demonstrate the office's commitment to serving the community beyond its core tax administration responsibilities.

Conclusion: A Vital Pillar of Cobb County’s Governance

The Cobb County Tax Commissioner’s Office stands as a critical pillar of the county’s governance, playing a pivotal role in maintaining financial stability and ensuring the smooth delivery of public services. Through its comprehensive range of services, the office not only upholds the integrity of the tax system but also actively contributes to the well-being and prosperity of the community.

From accurate tax assessments and efficient collections to streamlined vehicle registration processes, the office's work is integral to the county's day-to-day operations and long-term financial planning. By continuously adapting to technological advancements and community needs, the Cobb County Tax Commissioner's Office exemplifies effective public service, earning the trust and support of the residents it serves.

How often are property taxes assessed in Cobb County?

+Property taxes are typically assessed annually in Cobb County, ensuring that the tax burden is aligned with the current market value of each property.

What is the role of the Cobb County Tax Commissioner in vehicle registration?

+The Cobb County Tax Commissioner’s Office is responsible for registering vehicles, issuing licenses, and handling title transfers. They also facilitate the issuance of specialty license plates, providing a convenient one-stop shop for vehicle-related needs.

How does the office ensure accurate tax assessments?

+The office utilizes advanced assessment techniques, including GIS technology, market analysis, and data modeling, to ensure that property values are assessed accurately and equitably.