State Of Ohio Tax Return

Filing your state tax return in Ohio is an essential process for residents and businesses to ensure compliance with state regulations and manage their financial obligations effectively. The state of Ohio, like many others, imposes income taxes on individuals and businesses, and understanding the intricacies of the tax system is crucial for accurate filing and potential tax savings.

Understanding Ohio’s Tax System

Ohio operates a progressive income tax system, which means that the tax rate you pay increases as your income rises. This system aims to provide a fair and equitable approach to taxation, ensuring that those with higher incomes contribute a larger proportion of their earnings to the state. The tax rates are applied to various income brackets, with the highest rates typically reserved for the highest earners.

For the 2023 tax year, Ohio's income tax rates range from 0.479% to 4.799%, depending on the taxpayer's income level. These rates are applied to the federal adjusted gross income (AGI) of individuals and businesses, with certain deductions and exemptions available to reduce the taxable amount.

Key Features of Ohio’s Tax System

-

Taxable Income Brackets: Ohio has multiple tax brackets, and the rate you pay depends on your income level. For example, income between 0 and 10,700 is taxed at 0.479%, while income over $233,000 is taxed at the highest rate of 4.799%. This progressive structure ensures that higher earners contribute a larger share.

-

Personal Exemptions and Deductions: Ohio allows for personal exemptions and deductions to reduce your taxable income. Personal exemptions are available for yourself, your spouse, and any dependents you claim. Additionally, you can deduct certain expenses, such as medical costs, charitable contributions, and state and local taxes.

-

Tax Credits: Ohio offers various tax credits to eligible individuals and businesses. These credits can offset your tax liability and include credits for retirement income, research and development, and even film production. Understanding the availability of these credits can significantly impact your overall tax burden.

Filing Your Ohio State Tax Return

Filing your Ohio state tax return involves a series of steps to ensure accuracy and compliance. Whether you’re an individual or a business, the process typically includes gathering necessary documents, calculating your taxable income, and completing the appropriate forms.

Step-by-Step Guide

-

Gather Documents: Collect all relevant financial documents, including W-2 forms, 1099 forms, bank statements, and any other income-related records. If you’re self-employed, ensure you have detailed records of your business income and expenses.

-

Calculate Taxable Income: Determine your Ohio taxable income by subtracting any applicable deductions and exemptions from your federal adjusted gross income (AGI). This calculation will help you identify the correct tax bracket and applicable tax rate.

-

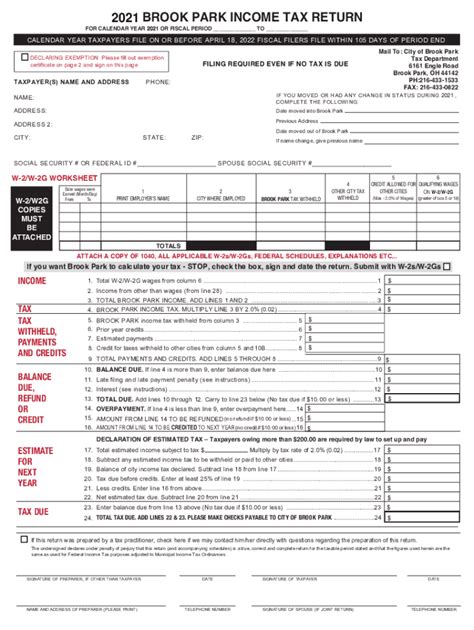

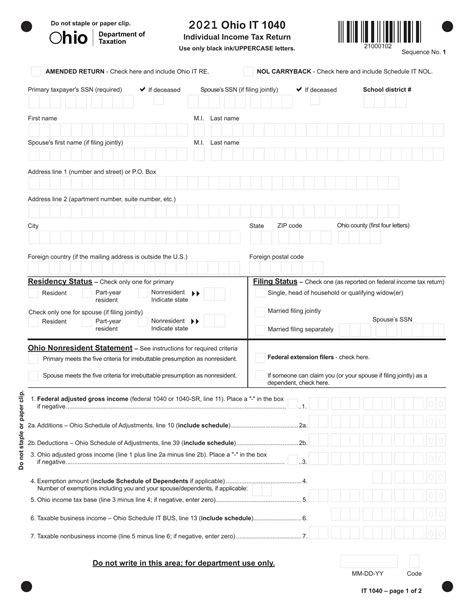

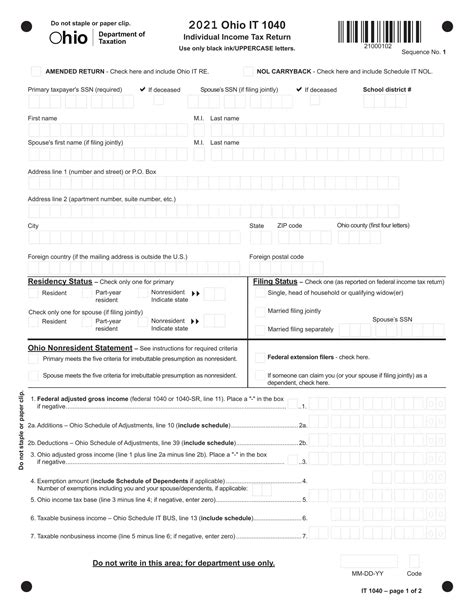

Complete Form IT 1040: The primary form for individual taxpayers in Ohio is the IT 1040. This form requires you to report your taxable income, deductions, and credits. Ensure you have all the necessary information and documentation to complete it accurately.

-

Consider Additional Schedules: Depending on your specific circumstances, you may need to complete additional schedules or forms. For instance, if you have self-employment income, you’ll need to complete Schedule C. Check the Ohio Department of Taxation’s website for guidance on which schedules apply to your situation.

-

Estimate Tax Liability: Use the tax tables provided by the state to estimate your tax liability. This step helps you understand the amount you owe or the refund you can expect. The tables consider your taxable income, filing status, and any applicable credits or deductions.

-

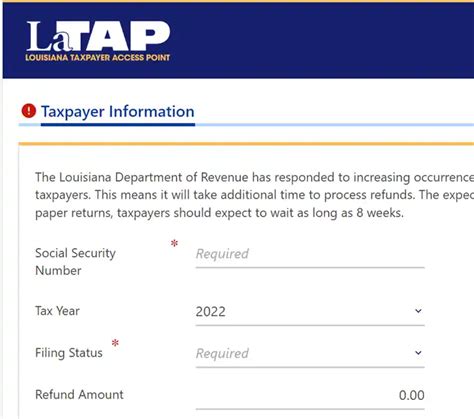

File Electronically: Ohio encourages electronic filing, which is faster and more secure. You can use the state’s official website or authorized e-file providers to transmit your return electronically. Ensure you have the necessary software or tools to complete this step efficiently.

-

Payment Options: If you owe taxes, you can pay electronically through the state’s website or by mail using the payment voucher included with your return. Ohio offers various payment methods, including credit cards, debit cards, and electronic funds transfer.

-

Review and Submit: Carefully review your completed return for accuracy. Ensure all calculations are correct and that you’ve included all relevant information. Once satisfied, submit your return through the chosen filing method.

Common Challenges and Considerations

While filing your Ohio state tax return, you may encounter specific challenges or considerations that require attention. Understanding these aspects can help you navigate the process more smoothly and ensure compliance.

Tax Filing Status

Your filing status is an important consideration when filing your Ohio state tax return. The state recognizes the following filing statuses:

- Single: If you are unmarried and have no qualifying dependents, you file as Single.

- Married Filing Jointly: Married couples can file a joint return, combining their incomes and deductions.

- Married Filing Separately: Married individuals can choose to file separate returns if they prefer.

- Head of Household: This status applies to unmarried individuals who maintain a household for a qualifying dependent.

- Qualifying Widow(er) with Dependent Child: This status is available for a specified period after the death of a spouse.

Tax Deductions and Exemptions

Ohio allows for a range of deductions and exemptions to reduce your taxable income. These include:

- Standard Deduction: You can choose to take the standard deduction or itemize your deductions if it results in a lower taxable income.

- Personal Exemptions: You can claim exemptions for yourself, your spouse, and any qualifying dependents.

- Medical Expenses: You can deduct qualified medical and dental expenses that exceed a certain threshold.

- Charitable Contributions: Donations to qualified charitable organizations may be deductible.

- State and Local Taxes: You can deduct the state and local income taxes you paid during the tax year.

Tax Credits

Ohio offers various tax credits to eligible taxpayers. These credits can reduce your tax liability or increase your refund. Some common tax credits include:

- Earned Income Tax Credit (EITC): This credit is available to low- and moderate-income workers and families.

- Child and Dependent Care Credit: If you incur expenses for childcare or dependent care, you may be eligible for this credit.

- Credit for the Elderly or Disabled: Ohio provides a credit for certain elderly or disabled individuals.

- Education Credits: There are credits available for higher education expenses, such as the Ohio Tuition Credit.

Future Implications and Tax Planning

Understanding the current tax landscape in Ohio is essential, but it’s equally important to consider future implications and tax planning strategies. As tax laws and regulations can change over time, staying informed and adapting your financial strategies accordingly is crucial.

Potential Tax Law Changes

Ohio’s tax system, like any other, is subject to legislative changes and updates. Keeping an eye on proposed and enacted tax reforms is essential to ensure you’re prepared for any upcoming changes. Some potential areas of change include:

- Tax Rates: The state may adjust tax rates to address budget concerns or economic shifts.

- Deduction Limits: Changes in federal tax laws can impact state-level deductions, affecting your taxable income.

- Tax Credits: The availability and eligibility criteria for tax credits may evolve, impacting your refund or liability.

Long-Term Tax Planning Strategies

Effective tax planning can help you minimize your tax burden and optimize your financial position. Consider the following strategies for long-term tax planning in Ohio:

- Maximize Deductions: Take advantage of all eligible deductions, such as contributing to retirement accounts or making charitable donations.

- Review Tax Credits: Stay informed about available tax credits and ensure you meet the eligibility criteria. Some credits, like the Earned Income Tax Credit, can provide significant savings.

- Consider Tax-Advantaged Investments: Explore investment options that offer tax benefits, such as 529 plans for education savings or tax-free municipal bonds.

- Plan for Business Taxes: If you own a business, consult with a tax professional to optimize your tax strategy. This may involve structuring your business for tax efficiency or taking advantage of business tax credits.

FAQs

What is the deadline for filing my Ohio state tax return?

+The deadline for filing your Ohio state tax return is typically April 15th of each year. However, if this date falls on a weekend or a holiday, the deadline is extended to the next business day. It’s essential to stay updated on any changes or extensions due to exceptional circumstances.

Can I file my Ohio state tax return electronically?

+Yes, Ohio encourages electronic filing for state tax returns. You can use the state’s official website or authorized e-file providers to transmit your return securely. Electronic filing is faster and more efficient, reducing the risk of errors and ensuring a timely submission.

Are there any penalties for late filing or payment of Ohio state taxes?

+Yes, Ohio imposes penalties for late filing and late payment of state taxes. The penalties vary depending on the specific circumstances and the amount owed. It’s crucial to file and pay your taxes on time to avoid additional fees and potential interest charges.

How can I estimate my Ohio state tax liability before filing my return?

+You can estimate your Ohio state tax liability by using the state’s tax tables and calculators available on the official website. These tools consider your taxable income, deductions, and credits to provide an estimate of your tax obligation. It’s a useful way to plan your finances and ensure you have sufficient funds to cover any taxes owed.

Where can I find more information and assistance with my Ohio state tax return?

+The Ohio Department of Taxation provides comprehensive resources and guidance on their official website. You can find detailed instructions, forms, and publications related to state tax filing. Additionally, consider consulting a tax professional or using tax preparation software for personalized assistance and accurate filing.