Futures Tax Rate In Florida

The taxation landscape for futures contracts in Florida presents a unique and dynamic environment, with various factors influencing the applicable tax rates. This article aims to delve into the specifics of futures tax rates within the Sunshine State, exploring the legal framework, tax obligations, and implications for traders and investors. By examining the intricacies of Florida's tax laws, we will provide a comprehensive guide to understanding and managing the tax implications of futures trading in this vibrant market.

Understanding Futures Tax Rates in Florida

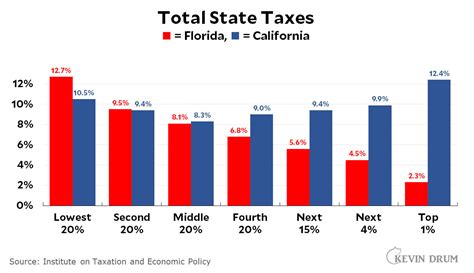

Florida’s tax system, particularly in relation to futures contracts, is a multifaceted topic that requires a deep understanding of the state’s legislation and regulatory environment. The taxation of futures transactions involves a delicate balance between federal and state regulations, with each jurisdiction exerting its own influence on the tax landscape.

At the federal level, the Internal Revenue Service (IRS) classifies futures contracts as Section 1256 contracts, which carry specific tax implications. These contracts are subject to a 60/40 tax treatment, where 60% of the gains are treated as long-term capital gains, while the remaining 40% is considered short-term capital gains. This classification provides a favorable tax structure for traders, especially those engaged in long-term strategies.

However, the story becomes more intricate when we shift our focus to Florida's state-specific regulations. Florida is one of the few states that does not impose a personal income tax on its residents, which at first glance, might suggest a tax-free environment for futures traders. But, the state's tax laws are not devoid of complexities.

State Tax Obligations

While Florida may not levy a personal income tax, it does have other tax obligations that indirectly impact futures traders. For instance, the state imposes a documentary stamp tax on certain financial transactions, including the purchase or sale of stocks, bonds, and other securities. Although futures contracts are not explicitly mentioned in the documentary stamp tax statutes, there have been instances where this tax has been applied to certain types of derivative transactions.

Additionally, Florida's sales and use tax regulations may also come into play for futures traders. This tax is applied to the purchase of goods and services within the state, and it can extend to certain financial transactions. For instance, if a futures trader utilizes software or services from a Florida-based provider, they may be subject to sales tax obligations.

| Tax Category | Rate | Description |

|---|---|---|

| Federal Tax on Futures | 60/40 Split | 60% Long-term, 40% Short-term Capital Gains |

| Documentary Stamp Tax | Varies | Applied to certain financial transactions, may include derivatives. |

| Sales and Use Tax | 6.0% | General sales tax rate, may apply to software/services for traders. |

It is crucial for futures traders operating in Florida to stay informed about these potential tax obligations, as they can significantly impact their overall profitability and compliance with state regulations.

Navigating the Legal Landscape

Understanding the legal intricacies of futures tax rates in Florida requires a keen eye for detail and a comprehensive understanding of the state’s tax code. Florida’s tax laws are continually evolving, with new interpretations and regulations emerging over time. Traders and investors must stay abreast of these changes to ensure they are operating within the legal framework and optimizing their tax strategies accordingly.

One of the key considerations for traders is the classification of their futures transactions. The IRS guidelines for Section 1256 contracts provide a clear framework for federal tax obligations, but traders must also consider how these transactions are treated under Florida's laws. Misclassification can lead to significant tax implications and potential legal complications.

Furthermore, traders should be mindful of the state's reporting requirements. Florida's Department of Revenue has specific guidelines for tax reporting, and futures traders must ensure they are adhering to these guidelines to avoid penalties and legal repercussions.

Tax Strategies for Futures Traders in Florida

Navigating the tax landscape in Florida as a futures trader requires a strategic approach to optimize profitability and minimize tax obligations. Here are some key strategies that traders can employ to manage their tax exposure effectively.

Maximizing Long-Term Gains

The federal tax structure for Section 1256 contracts offers a significant advantage for traders who can hold their futures positions for longer durations. By qualifying for long-term capital gains treatment on 60% of their gains, traders can significantly reduce their tax liability. This strategy is particularly beneficial for those engaged in swing trading or position trading, where holding periods are typically longer.

However, traders must also consider the potential impact of Florida's documentary stamp tax. If certain derivative transactions fall under this tax category, it may offset some of the benefits gained from the federal tax treatment. Thus, a thorough understanding of both federal and state tax laws is essential for an effective long-term trading strategy.

Utilizing Tax-Efficient Trading Platforms

The choice of trading platform can have a significant impact on a trader’s tax obligations. Some platforms offer advanced tax reporting features, which can simplify the process of filing taxes and ensure compliance with Florida’s regulations. Traders should evaluate the tax-related features of different platforms and choose one that aligns with their specific needs and preferences.

Additionally, traders should consider the location of their trading activities. If they utilize a platform that is based outside Florida, they may be able to avoid certain state-specific taxes, such as the sales and use tax. However, this decision should be made carefully, considering the potential for cross-border tax obligations and the need for compliance with international regulations.

Managing Taxable Events

Futures traders in Florida must carefully manage their taxable events to optimize their tax position. This involves strategic timing of trades, understanding the tax implications of different trading strategies, and staying informed about market trends and regulatory changes.

For instance, traders should consider the tax implications of rolling over futures contracts. While this strategy can provide continuity in a trading position, it may also trigger taxable events. By understanding the tax treatment of rollovers and other common trading strategies, traders can make more informed decisions and minimize their tax liability.

Seeking Professional Guidance

The tax landscape for futures traders in Florida is complex and ever-evolving. As such, seeking professional guidance from tax advisors or accountants who specialize in the financial industry is highly recommended. These experts can provide personalized advice, help traders navigate the legal and regulatory framework, and ensure compliance with all applicable tax laws.

Furthermore, tax professionals can assist traders in developing tailored tax strategies that align with their trading goals and risk tolerance. This may involve implementing tax-loss harvesting strategies, optimizing tax-efficient withdrawal plans, or structuring their trading entity in a tax-advantaged manner.

The Future of Futures Tax Rates in Florida

The taxation of futures contracts in Florida is an evolving field, influenced by a myriad of factors including legislative changes, market trends, and technological advancements. As the state continues to attract financial institutions and traders, the tax landscape is likely to become more nuanced and complex.

One potential development is the state's consideration of a financial transaction tax (FTT). While Florida has not yet implemented an FTT, there have been discussions and proposals for such a tax in the past. An FTT could significantly impact futures traders, as it would apply to a wide range of financial transactions, including derivatives.

Additionally, the continued growth of the financial industry in Florida may lead to increased scrutiny and regulatory oversight. This could result in more stringent tax reporting requirements and potential changes to the state's tax laws. Traders must stay informed about these developments to ensure they are prepared for any future changes in the tax landscape.

Furthermore, technological advancements, such as the rise of cryptocurrency and blockchain-based derivatives, present new challenges and opportunities for the tax system. As these innovative financial instruments gain traction, the tax treatment of these assets will need to be clarified and incorporated into Florida's tax framework.

Conclusion

In conclusion, understanding and managing the tax implications of futures trading in Florida requires a comprehensive understanding of the state’s unique tax landscape. From federal tax obligations to state-specific regulations, traders must navigate a complex web of laws and regulations to ensure compliance and optimize their tax strategies.

By staying informed, seeking professional guidance, and adopting strategic tax management practices, futures traders in Florida can maximize their profitability while maintaining compliance with the state's tax laws. The evolving nature of the tax landscape underscores the importance of continuous education and adaptation, ensuring traders are prepared for any future changes and opportunities.

What is the federal tax rate for futures contracts in Florida?

+Futures contracts are subject to a 60⁄40 tax treatment under federal law. This means 60% of the gains are treated as long-term capital gains, while the remaining 40% is considered short-term capital gains.

Are there any state-specific taxes on futures trading in Florida?

+Florida does not impose a personal income tax, but traders may be subject to other state taxes such as the documentary stamp tax and sales and use tax, depending on the specific transaction and services utilized.

How can futures traders in Florida optimize their tax strategies?

+Traders can optimize their tax strategies by maximizing long-term gains, utilizing tax-efficient trading platforms, managing taxable events strategically, and seeking professional guidance to develop tailored tax plans.

What potential developments could impact futures tax rates in Florida in the future?

+Potential developments include the implementation of a financial transaction tax (FTT), increased regulatory oversight, and the need to clarify the tax treatment of emerging financial instruments such as cryptocurrency derivatives.