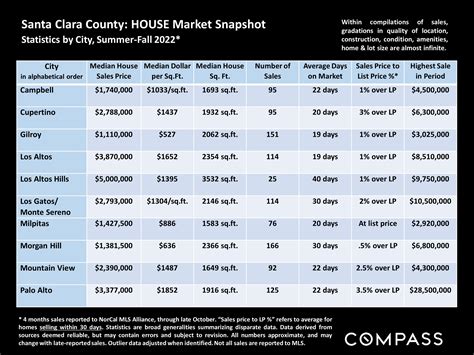

Missouri Auto Sales Tax Calculator

When it comes to purchasing a vehicle in Missouri, understanding the associated taxes and fees is crucial for budgeting and planning. The auto sales tax in Missouri can vary depending on several factors, including the type of vehicle, its purchase price, and the location of the transaction. This guide aims to provide an in-depth analysis of the Missouri auto sales tax, offering valuable insights and calculations to assist buyers in navigating the process seamlessly.

Understanding Missouri’s Auto Sales Tax Structure

Missouri’s Department of Revenue imposes a sales tax on the purchase of motor vehicles, including cars, trucks, motorcycles, and certain types of recreational vehicles. The tax is calculated as a percentage of the vehicle’s purchase price, with some additional fees applicable in specific situations.

The standard sales tax rate for motor vehicles in Missouri is 4.225%, which is applied to the purchase price of the vehicle. However, it's important to note that this rate is not the only tax buyers need to consider. Local taxing jurisdictions may also impose additional sales taxes, which can vary from one area to another.

Calculating the Auto Sales Tax

To calculate the auto sales tax in Missouri, you can use the following formula:

| Sales Tax | Calculated Amount |

|---|---|

| State Sales Tax Rate | 4.225% (as a decimal, 0.04225) |

| Local Sales Tax Rate (if applicable) | Varies by location |

| Total Sales Tax Rate | Sum of state and local rates |

| Purchase Price of Vehicle | Total cost of the vehicle |

| Sales Tax Amount | Total Sales Tax Rate x Purchase Price |

Let's illustrate this with an example. Suppose you're purchasing a car in St. Louis County, where the local sales tax rate is 2.5%. The calculation would be as follows:

Total Sales Tax Rate: 4.225% (state) + 2.5% (local) = 6.725%

Sales Tax Amount: 6.725% x $25,000 (purchase price) = $1,681.25

Additional Fees and Considerations

In addition to the sales tax, buyers in Missouri should be aware of other fees and potential charges that may apply to their vehicle purchase.

Title and Registration Fees

Missouri requires buyers to obtain a vehicle title and register their vehicle with the Missouri Department of Revenue. Title and registration fees vary based on the vehicle type and can range from 2 to 32 for titles and 11 to 24 for registration, depending on the vehicle’s weight class.

Trade-In and Used Vehicle Considerations

If you’re trading in your old vehicle, the sales tax calculation can be more complex. Missouri allows for a trade-in credit, which reduces the taxable value of the new vehicle by the trade-in allowance. This can significantly impact the sales tax amount. Additionally, when purchasing a used vehicle from a private seller, the sales tax calculation may differ, as it is based on the actual purchase price or the “blue book” value, whichever is higher.

Other Potential Fees

Depending on the transaction and vehicle type, buyers may encounter other fees, such as documentation fees, dealer preparation fees, or emission testing fees. It’s essential to discuss these potential charges with the dealer or seller to understand the total cost of the vehicle purchase.

Tax Exemptions and Special Cases

Missouri offers certain tax exemptions and special cases for specific vehicle purchases. These include:

- Military Sales Tax Exemption: Active-duty military personnel and their spouses are exempt from paying sales tax on vehicles purchased in Missouri. This exemption also applies to vehicles purchased outside the state and brought into Missouri.

- Disability Tax Exemption: Missouri residents with certain disabilities may be eligible for a sales tax exemption when purchasing a vehicle equipped with special adaptive devices. This exemption is available for vehicles specifically modified for the disabled driver or passenger.

- Lemon Law Buyback: If a vehicle is repurchased by a manufacturer under Missouri's Lemon Law, the buyer is exempt from paying sales tax on the replacement vehicle.

- Non-Resident Purchases: If you are a non-resident purchasing a vehicle in Missouri and plan to register it in another state, you may be eligible for a refund of the Missouri sales tax paid. However, this refund process can be complex and may require additional documentation.

Tips for a Smooth Transaction

To ensure a seamless vehicle purchase and accurate tax calculation, consider the following tips:

- Research local sales tax rates for your specific location to ensure an accurate calculation.

- Discuss all fees and potential charges with the dealer or seller to avoid unexpected costs.

- Understand the trade-in process and how it affects the sales tax calculation, especially if you're trading in your vehicle.

- Explore tax exemptions and special cases to determine if you qualify for any savings.

- Keep all documentation related to the vehicle purchase, including sales contracts, invoices, and registration paperwork.

Future Implications and Tax Reform

The Missouri auto sales tax structure has remained relatively stable in recent years. However, as with any tax system, there are ongoing discussions and potential reforms on the horizon. Some proposed changes include simplifying the tax structure, introducing new tax incentives for electric vehicles, and adjusting tax rates to align with economic trends.

While these proposals are still in the discussion phase, they highlight the evolving nature of tax policies and the need for buyers and sellers to stay informed about potential changes that could impact vehicle purchases.

Conclusion

Understanding the Missouri auto sales tax is a crucial step in the vehicle-buying process. By calculating the sales tax accurately and being aware of additional fees and potential exemptions, buyers can make informed decisions and plan their finances effectively. As the tax landscape evolves, staying informed and adapting to any changes will ensure a smooth and compliant vehicle purchase experience.

Can I get a refund for the Missouri sales tax if I move out of state with my newly purchased vehicle?

+Yes, if you are a Missouri resident and purchase a vehicle in Missouri but then move out of state, you may be eligible for a refund of the Missouri sales tax paid. However, the refund process can be complex and may require additional documentation. It’s advisable to consult with a tax professional or contact the Missouri Department of Revenue for specific guidance.

Are there any online tools available to calculate the auto sales tax in Missouri?

+Yes, several online calculators and resources are available to help estimate the auto sales tax in Missouri. These tools typically require inputting the vehicle’s purchase price and location to provide an estimated tax amount. However, it’s important to note that these calculators may not account for all potential fees and local variations, so consulting with a professional is recommended for an accurate calculation.

How do I know if I qualify for the military or disability tax exemption in Missouri?

+To determine your eligibility for the military or disability tax exemption in Missouri, you should consult the specific guidelines and requirements outlined by the Missouri Department of Revenue. These exemptions have specific criteria and documentation requirements, so it’s essential to review the official sources to understand if you qualify.