Santa Clara Real Estate Tax

The real estate tax landscape in Santa Clara, California, is a topic of interest for both residents and investors. With its thriving technology industry and proximity to Silicon Valley, Santa Clara has experienced significant growth and development, leading to a dynamic real estate market. Understanding the tax implications is crucial for anyone considering property ownership in this vibrant city.

Unraveling the Santa Clara Real Estate Tax System

The real estate tax system in Santa Clara operates under the principles outlined by the California State Board of Equalization and local regulations. Property taxes play a vital role in funding essential services, including schools, public safety, and infrastructure development.

One of the key aspects of the Santa Clara real estate tax system is the annual assessment. Properties are assessed based on their market value as of January 1st of each year. This assessment determines the taxable value of the property, which serves as the basis for calculating the annual tax bill.

The tax rate in Santa Clara is composed of a base rate set by the county, along with voter-approved special taxes and bond measures. These additional taxes fund specific projects or services, such as schools, transportation improvements, or public safety initiatives. As a result, the overall tax rate can vary across different areas within Santa Clara.

To illustrate, consider the example of a residential property located in the heart of Santa Clara. This property, assessed at a market value of $1.2 million, would be subject to the base tax rate of 1.05% as mandated by the county. However, due to various special taxes and bond measures approved by voters, the effective tax rate for this property could increase to approximately 1.2%.

Factors Influencing Real Estate Taxes

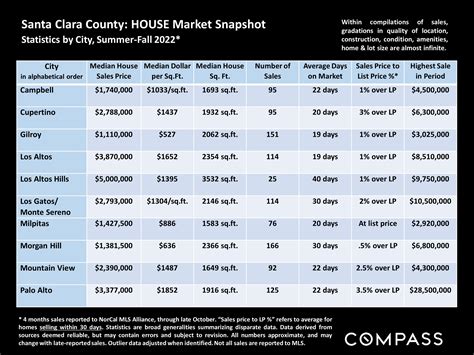

Several factors come into play when determining the real estate tax liability in Santa Clara. One significant factor is the type of property. Residential, commercial, and industrial properties are subject to different tax rates and assessment methodologies.

Additionally, the property's location within Santa Clara can impact the tax rate. Different neighborhoods or districts may have varying tax assessments and additional levies to support local initiatives. For instance, a property situated in a rapidly developing area with ongoing infrastructure projects might face higher taxes to fund these improvements.

Another crucial factor is the property's age and condition. Older properties may be eligible for property tax reductions or exemptions under certain circumstances, such as the Proposition 13 tax relief program. This program limits property tax increases to a maximum of 2% annually, providing stability for long-term property owners.

| Property Type | Tax Rate |

|---|---|

| Residential | 1.05% (base rate) + Special Taxes |

| Commercial | 1.1% (base rate) + Special Taxes |

| Industrial | 1.2% (base rate) + Special Taxes |

Understanding the Tax Assessment Process

The tax assessment process in Santa Clara is overseen by the Santa Clara County Assessor’s Office. Assessors are responsible for determining the fair market value of properties and ensuring compliance with state and local tax laws.

The assessment process typically involves the following steps:

- Data Collection: Assessors gather information about the property, including its physical characteristics, recent sales data, and market trends.

- Property Inspection: In some cases, assessors may conduct physical inspections to verify the property's condition and make accurate assessments.

- Valuation: Using the collected data and valuation methods, assessors determine the property's market value as of January 1st.

- Tax Calculation: Once the taxable value is established, the assessor calculates the property tax liability by applying the appropriate tax rate.

- Notice of Assessment: Property owners receive a Notice of Assessed Value, detailing the assessed value and the corresponding tax amount.

Property owners have the right to appeal their assessed value if they believe it is inaccurate or excessive. The appeal process involves submitting evidence and supporting documentation to the Assessor's Office to request a review and potential adjustment.

Real Estate Tax Strategies and Planning

Navigating the real estate tax landscape in Santa Clara requires careful planning and consideration. Here are some strategies to manage tax obligations effectively:

- Understand the Tax Code: Familiarize yourself with the tax laws and regulations specific to Santa Clara. Stay updated on any changes or new initiatives that may impact your tax liability.

- Property Tax Deductibility: Consult with a tax professional to explore the deductibility of real estate taxes on your federal and state tax returns. Maximizing deductions can help offset the tax burden.

- Review Special Assessments: Carefully review any special assessments or bond measures that may be applicable to your property. Understanding these additional taxes can help you budget effectively.

- Consider Tax-Saving Opportunities: Explore potential tax incentives or exemptions that you may be eligible for. For instance, senior citizens or veterans may qualify for property tax relief programs.

- Long-Term Planning: If you plan to own the property for an extended period, consider the impact of annual tax increases. Strategies like refinancing or leveraging tax-efficient investment options can help manage long-term tax obligations.

The Impact of Real Estate Taxes on Santa Clara’s Economy

Real estate taxes play a crucial role in shaping Santa Clara’s economic landscape. The revenue generated from property taxes funds vital public services, contributing to the overall well-being and development of the community.

The tax revenue supports:

- Education: A significant portion of real estate tax revenue is allocated to local schools, ensuring access to quality education for residents.

- Public Safety: Property taxes help fund police and fire departments, enhancing public safety measures and emergency response capabilities.

- Infrastructure Development: Tax revenue is invested in improving roads, transportation systems, and public facilities, benefiting both residents and businesses.

- Community Services: From parks and recreational facilities to social services, real estate taxes contribute to the overall quality of life in Santa Clara.

The stability and predictability of the real estate tax system in Santa Clara attract investors and promote economic growth. However, it is essential to strike a balance between generating revenue and maintaining a competitive tax environment to ensure the city's continued prosperity.

Future Implications and Trends

As Santa Clara continues to evolve, the real estate tax landscape is likely to experience certain shifts and trends. Here are some potential developments to consider:

- Technological Advancements: The implementation of advanced assessment technologies and data analytics may streamline the tax assessment process, enhancing accuracy and efficiency.

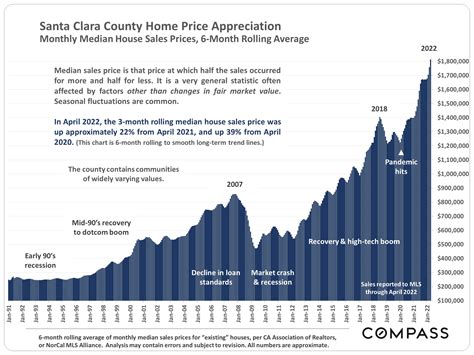

- Population Growth and Development: As Santa Clara's population expands, the demand for housing and commercial spaces will increase. This could lead to rising property values and potentially higher tax assessments.

- Voter Initiatives: Future voter-approved measures could introduce new taxes or bond initiatives to fund specific projects, impacting the overall tax rate.

- Economic Fluctuations: Economic downturns or recessions may influence property values and, consequently, tax assessments. It is essential to stay informed about economic trends and their potential impact on real estate taxes.

- Policy Changes: Changes in state or local tax policies, such as adjustments to the base tax rate or modifications to tax relief programs, can have significant implications for property owners.

Staying informed about these trends and actively participating in the local community can help property owners navigate the evolving real estate tax landscape in Santa Clara.

Conclusion

Understanding the intricacies of the Santa Clara real estate tax system is essential for property owners and investors. By familiarizing yourself with the assessment process, tax rates, and potential strategies, you can effectively manage your tax obligations and contribute to the vibrant community of Santa Clara.

As the city continues to thrive, staying abreast of the latest developments and trends will ensure that you make informed decisions regarding your real estate investments and tax planning.

How are property taxes calculated in Santa Clara?

+Property taxes in Santa Clara are calculated based on the assessed value of the property and the applicable tax rate. The assessed value is determined by the Santa Clara County Assessor’s Office, taking into account factors such as market value and property characteristics. The tax rate includes a base rate set by the county and additional voter-approved special taxes.

Are there any tax relief programs available for property owners in Santa Clara?

+Yes, Santa Clara offers several tax relief programs. One notable program is Proposition 13, which limits annual property tax increases to a maximum of 2%. Additionally, there are programs specifically designed for senior citizens and disabled veterans, providing property tax exemptions or reductions.

How can I appeal my property’s assessed value in Santa Clara?

+If you believe your property’s assessed value is inaccurate, you can file an appeal with the Santa Clara County Assessor’s Office. The appeal process involves submitting evidence and supporting documentation to justify a change in the assessed value. It is recommended to consult a tax professional or seek guidance from the Assessor’s Office for a successful appeal.

What are some strategies to minimize real estate taxes in Santa Clara?

+To minimize real estate taxes in Santa Clara, consider the following strategies: stay informed about tax laws and changes, explore tax-deductible options, review special assessments, take advantage of tax relief programs, and plan for long-term tax obligations. Consulting with tax professionals can provide personalized advice based on your specific circumstances.

How do real estate taxes impact the local economy in Santa Clara?

+Real estate taxes in Santa Clara play a vital role in funding essential public services, including education, public safety, and infrastructure development. The revenue generated supports the overall well-being and economic growth of the community, attracting investors and promoting a thriving local economy.