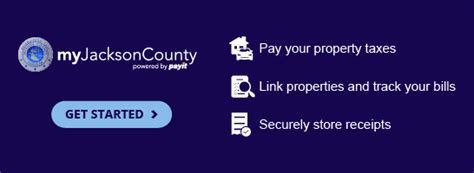

Missouri Pay Taxes Online

Missouri, known as the "Show-Me State," offers its residents and businesses a convenient way to manage their tax obligations online. The state's online tax system, designed to be user-friendly and efficient, provides a range of services that streamline the tax payment process. This article will delve into the various aspects of paying taxes online in Missouri, offering a comprehensive guide for individuals and businesses alike.

The Missouri Tax System: A Digital Overview

Missouri’s tax system is a complex yet well-organized structure, catering to a diverse range of taxpayers. From individual income tax to corporate franchise tax and sales tax, the state’s revenue department has developed an online platform to facilitate the timely and accurate submission of tax returns and payments.

The digital tax system in Missouri is a testament to the state's commitment to technological advancement, making it easier for taxpayers to meet their financial obligations. This system not only benefits taxpayers by offering convenience and efficiency but also aids the state in managing its revenue collection processes more effectively.

Key Features of Missouri’s Online Tax Payment System

Missouri’s online tax payment system boasts several features that make it a preferred choice for taxpayers:

- User-Friendly Interface: The system is designed with simplicity in mind, ensuring that even first-time users can navigate through the process with ease.

- Secure Payment Gateway: Taxpayers can rest assured that their financial transactions are secure, thanks to the state's robust payment infrastructure.

- Real-Time Updates: The online system provides real-time updates on tax payments, balances, and due dates, helping taxpayers stay on top of their obligations.

- Electronic Filing Options: Missouri offers various electronic filing options, allowing taxpayers to submit their returns digitally, reducing paperwork and potential errors.

- Payment Flexibility: The system accommodates multiple payment methods, including credit cards, debit cards, and electronic funds transfer, providing flexibility to taxpayers.

Step-by-Step Guide: Paying Taxes Online in Missouri

Paying taxes online in Missouri is a straightforward process. Here’s a detailed guide to help you navigate through the steps:

Step 1: Access the Missouri Tax System Website

The first step is to visit the official Missouri tax system website. The URL is https://dor.mo.gov. This website serves as the primary portal for all tax-related activities in the state.

Step 2: Register an Account

If you are a first-time user, you’ll need to register an account. The registration process is simple and secure. You’ll be required to provide basic personal information, such as your name, address, and contact details.

Step 3: Select Your Tax Type

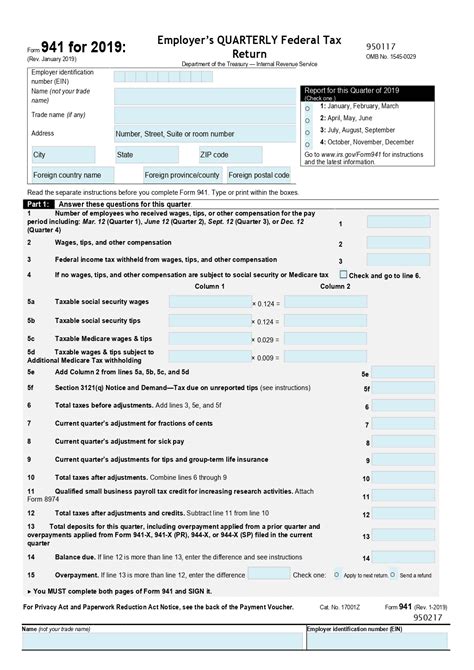

Once logged in, you’ll be prompted to select the type of tax you wish to pay. Missouri offers a wide range of tax categories, including income tax, sales tax, property tax, and more. Choose the relevant tax type based on your obligations.

Step 4: Enter Tax Details

After selecting the tax type, you’ll be guided through a series of steps to enter the necessary tax details. This includes providing information about your income, deductions, or sales data, depending on the tax type you’ve chosen.

Step 5: Choose Your Payment Method

Missouri’s online tax system offers a variety of payment methods to cater to different preferences. You can choose to pay via credit card, debit card, or electronic funds transfer. Each method has its own set of instructions, which are clearly outlined on the website.

Step 6: Confirm and Submit Payment

Once you’ve entered all the required details and chosen your payment method, review your information carefully. Ensure that all the data is accurate before submitting your payment. After confirmation, your payment will be processed, and you’ll receive a receipt for your records.

Benefits of Online Tax Payment in Missouri

Paying taxes online in Missouri offers numerous advantages to taxpayers:

- Convenience: The online system allows taxpayers to manage their tax obligations from the comfort of their homes or offices, eliminating the need for physical visits to tax offices.

- Time Efficiency: Online tax payment saves time, as the process is faster and more streamlined compared to traditional methods.

- Error Reduction: Digital filing and payment reduce the likelihood of errors, as the system automatically calculates and processes tax amounts, minimizing manual calculation mistakes.

- Receipt and Record-Keeping: Online payment systems provide digital receipts, which are easy to store and retrieve, making record-keeping more efficient.

- Access to Real-Time Information: Taxpayers can access their account information and payment history anytime, providing transparency and ease of reference.

Common Challenges and Solutions

While Missouri’s online tax system is designed to be user-friendly, some taxpayers may encounter challenges. Here are some common issues and their solutions:

Issue: Forgotten Login Credentials

Solution: If you’ve forgotten your login credentials, the Missouri tax system website provides a password recovery option. Simply click on the “Forgot Password” link, enter your registered email address, and follow the instructions to reset your password.

Issue: Technical Glitches

Solution: In case of technical issues, the website usually displays error messages with relevant troubleshooting tips. If the problem persists, taxpayers can reach out to the Missouri Department of Revenue’s technical support team for assistance.

Issue: Complex Tax Situations

Solution: For taxpayers with complex tax situations, such as multiple business entities or unique tax scenarios, it’s advisable to consult with a tax professional. They can provide personalized guidance and ensure accurate tax filing and payment.

Future Outlook: Missouri’s Tax System Evolution

Missouri’s online tax system is continuously evolving to meet the changing needs of taxpayers and the state’s revenue management strategies. Here are some potential future developments:

- Enhanced Security Features: As technology advances, the state may implement additional security measures to protect taxpayer data and ensure the integrity of online transactions.

- Integration with Mobile Platforms: Missouri could develop mobile applications to make tax payment and filing even more accessible, allowing taxpayers to manage their obligations on the go.

- AI-Assisted Tax Guidance: Artificial intelligence could be utilized to provide personalized tax guidance, offering taxpayers tailored advice based on their unique circumstances.

- Real-Time Data Integration: The tax system may integrate with other state databases to access real-time data, such as property records or business registrations, simplifying the tax filing process.

Conclusion

Missouri’s online tax payment system is a testament to the state’s commitment to technological innovation and taxpayer convenience. By embracing digital solutions, the state has made tax management more accessible and efficient for its residents and businesses. As the system continues to evolve, taxpayers can expect an even smoother and more personalized experience in the future.

Can I pay my taxes online if I’m not a Missouri resident?

+Yes, non-residents of Missouri can also utilize the online tax payment system if they have tax obligations in the state. The system is open to all taxpayers, regardless of their residency status.

Are there any fees associated with online tax payments in Missouri?

+Yes, there may be fees associated with certain payment methods. For example, credit card payments may incur a convenience fee. It’s advisable to review the fee structure before choosing your payment method.

How long does it take for my online tax payment to be processed?

+Online tax payments are usually processed within a few minutes. However, the exact processing time may vary depending on the payment method and the volume of transactions at the time.

Can I pay my taxes in installments online?

+Yes, Missouri offers an online installment agreement program. Taxpayers can apply for an installment plan through the online system, which allows them to pay their taxes in multiple installments over a specified period.

What security measures are in place for online tax payments?

+Missouri’s online tax system employs robust security measures, including encryption protocols and secure payment gateways, to protect taxpayer data and financial transactions. These measures ensure that sensitive information remains confidential.