Car Property Tax North Carolina

Understanding vehicle taxation is crucial for car owners, and North Carolina offers a unique system. This comprehensive guide aims to provide an in-depth analysis of Car Property Tax in the state, covering everything from legal aspects to practical implications.

The Legal Framework: Unraveling North Carolina’s Property Tax Laws

North Carolina’s property tax system is governed by state statutes and local regulations, creating a unique framework for vehicle taxation. The primary statute, General Statute § 105-389, outlines the taxation of vehicles and mobile homes. According to this statute, all vehicles are subject to ad valorem taxation, which means the tax is based on the vehicle’s assessed value.

The state's ad valorem tax system is implemented by the North Carolina Department of Revenue (NCDOR), which provides guidelines and regulations for local governments. These local governments, typically counties, have some flexibility in setting tax rates and assessing vehicle values. This decentralized approach can lead to variations in tax burdens across the state.

Key points to note include:

- Vehicle taxation is a vital source of revenue for local governments in North Carolina, covering essential services and infrastructure development.

- The ad valorem tax system ensures that vehicle owners contribute proportionally to the state's resources based on their vehicle's value.

- The state's vehicle tax system is regularly updated to account for inflation and changes in vehicle values, ensuring fairness and stability.

Assessing Vehicle Value: A Critical Factor in Property Taxation

Vehicle valuation is a complex process, and North Carolina employs specific methods to determine the assessed value of a car for taxation purposes. The state primarily uses the Blue Book value, which is a widely recognized guide for vehicle valuation. This book, published by the National Automobile Dealers Association (NADA), provides estimated values for various vehicles based on make, model, year, and condition.

The Blue Book value is adjusted by local governments to account for regional differences and market conditions. This adjustment ensures that the assessed value is an accurate representation of the vehicle's current worth in the local market. The assessed value is then multiplied by the tax rate set by the county to calculate the property tax due.

Here's a simplified breakdown of the valuation process:

- Determine the vehicle's make, model, year, and condition.

- Consult the Blue Book for an estimated value.

- Local governments adjust the value based on regional factors.

- Multiply the assessed value by the tax rate to calculate the property tax.

For example, if a vehicle's Blue Book value is $20,000 and the county tax rate is 0.5%, the property tax would be $100.

Tax Rates and Exemptions: Navigating the North Carolina Landscape

Tax rates in North Carolina vary significantly across counties, ranging from 0.15% to 1.5%. These rates are set by local governments and can change annually. It’s crucial for vehicle owners to stay informed about their county’s tax rate to understand their tax obligations accurately.

North Carolina offers various exemptions and deductions for property taxes on vehicles. These exemptions aim to alleviate the tax burden for specific groups and circumstances. Here are some notable exemptions:

| Exemption Category | Description |

|---|---|

| Disabled Veteran Exemption | Veterans with a 100% service-connected disability are exempt from property taxes on one vehicle. |

| Senior Citizen Exemption | Seniors aged 65 or older may be eligible for a reduced tax rate on their vehicles. |

| Agricultural Use Valuation | Vehicles used primarily for agricultural purposes may be assessed at a lower value. |

| Manufactured Home Exemption | Owners of manufactured homes may be eligible for a partial exemption. |

It's essential to check with the local tax office or the NCDOR for specific details on exemptions and eligibility criteria.

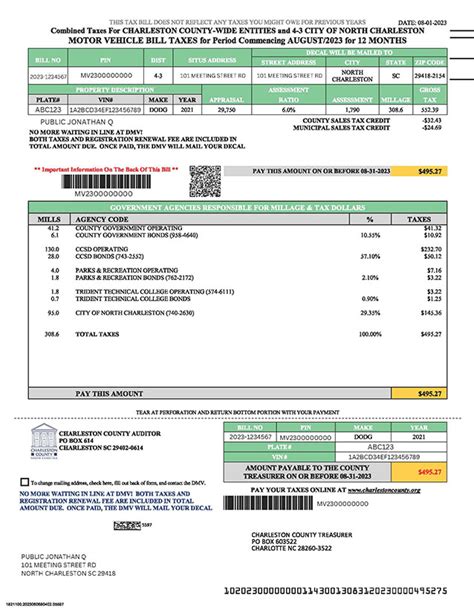

Payment and Due Dates: A Comprehensive Overview

Property taxes on vehicles in North Carolina are typically due annually. The specific due dates and payment methods can vary by county, so it’s crucial to check with the local tax office. Many counties offer online payment portals, allowing vehicle owners to pay their taxes conveniently.

Late payments can incur penalties and interest, so it's essential to stay on top of due dates. If a vehicle is sold or disposed of during the tax year, the owner is still responsible for the full year's tax unless they notify the tax office promptly. In such cases, the new owner becomes responsible for future tax payments.

Payment Options and Deadlines

North Carolina counties offer a range of payment options, including:

- Online payments through secure portals.

- In-person payments at the county tax office.

- Mail-in payments with a check or money order.

- Automatic payments set up with the tax office.

Due dates can vary, but most counties have deadlines in the late summer or early fall. It's advisable to pay before the deadline to avoid late fees.

Penalty and Interest Charges

Late payments in North Carolina can result in penalties and interest charges. The specific amounts and calculation methods can vary by county, but generally, penalties are assessed at a certain percentage of the tax due, and interest is charged on a monthly basis.

For example, a county may charge a 10% penalty on the unpaid tax and 1% interest per month on the outstanding balance. It's crucial to pay on time to avoid these additional costs.

Appealing Property Tax Assessments: A Step-by-Step Guide

Vehicle owners in North Carolina have the right to appeal their property tax assessments if they believe the assessed value is inaccurate. The appeal process is managed by the county’s Board of Equalization and Review, and it’s essential to follow the correct procedures to ensure a successful appeal.

Step 1: Understanding the Assessment

Before appealing, it’s crucial to understand the assessment process and the factors that influenced the vehicle’s valuation. This includes reviewing the Blue Book value, local adjustments, and any exemptions or deductions applied.

Step 2: Gather Evidence

Collect evidence to support your claim that the assessed value is incorrect. This can include:

- Recent sale prices of similar vehicles in the area.

- Expert appraisals or evaluations.

- Documentation of any mechanical issues or damages.

- Proof of any applicable exemptions or deductions.

Step 3: File an Appeal

File an appeal with the county’s Board of Equalization and Review within the specified deadline. This typically involves completing an appeal form and providing supporting documentation.

Step 4: Attend a Hearing

The Board will schedule a hearing to review your appeal. Attend the hearing and present your case, providing clear and concise evidence to support your claim.

Step 5: Await the Decision

The Board will make a decision based on the evidence presented. If your appeal is successful, the assessed value of your vehicle will be adjusted, and your property tax bill will be recalculated.

Conclusion: Navigating North Carolina’s Car Property Tax Landscape

Understanding North Carolina’s Car Property Tax system is essential for vehicle owners in the state. From legal frameworks to valuation methods and payment processes, this guide has provided a comprehensive overview. By staying informed and proactive, vehicle owners can navigate the tax landscape effectively and ensure they are treated fairly.

Remember, the specific details of vehicle taxation can vary by county, so always check with your local tax office for the most accurate and up-to-date information. With a clear understanding of the system, vehicle owners can contribute responsibly to their community while ensuring their rights are respected.

FAQ

How often do property tax rates change in North Carolina counties?

+

Property tax rates can change annually, as they are set by local governments. It’s advisable to check with your county tax office each year to stay updated on any rate adjustments.

Are there any online tools to estimate my vehicle’s property tax in North Carolina?

+

Yes, many counties in North Carolina provide online calculators or estimators on their websites. These tools allow you to input your vehicle’s details and estimate the property tax based on the current tax rate.

What happens if I move to a different county within North Carolina during the tax year?

+

If you move to a different county within North Carolina during the tax year, you’ll be responsible for the property taxes in both counties. It’s important to notify both county tax offices of your change of address to ensure accurate billing.

Can I receive a refund if I sell my vehicle during the tax year?

+

Yes, if you sell your vehicle during the tax year, you may be eligible for a partial refund of the property tax. You’ll need to provide proof of sale to the county tax office to initiate the refund process.

How can I stay informed about property tax changes and deadlines in my county?

+

You can stay informed by subscribing to your county’s tax office newsletter or following their social media accounts. They often provide updates and reminders about tax changes, deadlines, and other important information.