Nh Property Tax

Welcome to an in-depth exploration of the NH Property Tax, a critical component of the state's fiscal landscape. This comprehensive guide will delve into the intricacies of property taxation in New Hampshire, providing valuable insights for homeowners, investors, and anyone interested in understanding the economic dynamics of the state.

Understanding NH Property Tax: An Overview

New Hampshire’s property tax system is a vital source of revenue for the state and its municipalities, playing a significant role in funding essential services and infrastructure. The NH Property Tax, often referred to as the “ad valorem” tax, is based on the assessed value of real estate properties, which includes land and improvements (such as buildings and structures). This system ensures that property owners contribute to the financial well-being of their communities in proportion to the value of their holdings.

Assessment Process: Accuracy and Fairness

The assessment process in New Hampshire is a rigorous and standardized procedure. It involves the evaluation of properties by local assessors, who determine the fair market value of each property. This value is then used to calculate the property tax bill, ensuring that all taxpayers contribute their fair share based on the value of their property.

To maintain fairness and accuracy, the state requires that assessments be conducted at regular intervals, typically every 3 to 5 years. During these assessments, properties are re-evaluated to account for changes in market conditions and property improvements. This process helps to ensure that property owners are taxed based on the current value of their holdings.

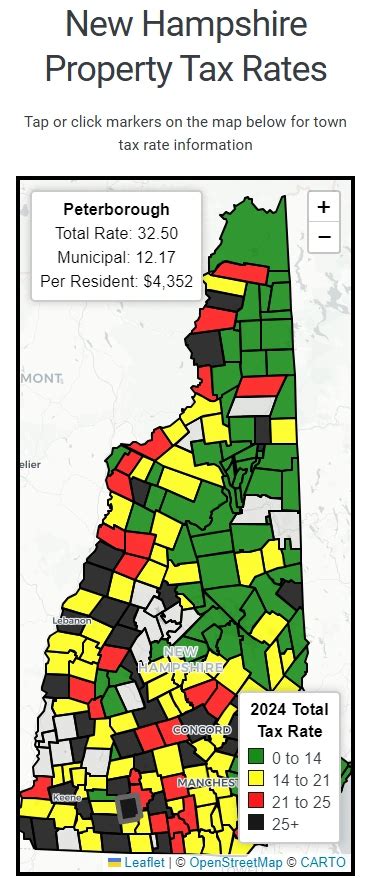

Tax Rates and Calculations: A Detailed Breakdown

The NH Property Tax is calculated using a straightforward formula: Tax Rate x Assessed Value = Property Tax Bill. The Tax Rate, also known as the mill rate, is set annually by local governments, including cities, towns, and school districts. This rate is expressed in mills, with one mill representing 1 of tax for every 1,000 of assessed property value.

| Tax Rate (Mills) | Tax Rate in Dollars |

|---|---|

| 10 mills | $10 per $1,000 of assessed value |

| 25 mills | $25 per $1,000 of assessed value |

| 50 mills | $50 per $1,000 of assessed value |

For instance, if a property is assessed at $200,000 and the tax rate is 25 mills, the property tax bill would be calculated as follows: $200,000 x 0.025 = $5,000. This means the property owner would owe $5,000 in property taxes for that year.

Tax Relief Programs: Supporting Homeowners

New Hampshire recognizes the importance of supporting its residents, especially those who may face financial challenges when it comes to property taxes. To alleviate the burden, the state offers a range of tax relief programs, including the Property Tax Relief Program and the Tax Deferral Program.

The Property Tax Relief Program provides financial assistance to eligible homeowners, helping them cover a portion of their property taxes. This program is particularly beneficial for seniors and those with limited incomes. To qualify, homeowners must meet certain income thresholds and have owned and occupied their property for a specified period.

The Tax Deferral Program, on the other hand, allows eligible senior citizens and permanently and totally disabled individuals to defer their property taxes. This program helps these individuals manage their finances by providing a payment plan for deferred taxes, ensuring they can maintain their homes without facing immediate financial strain.

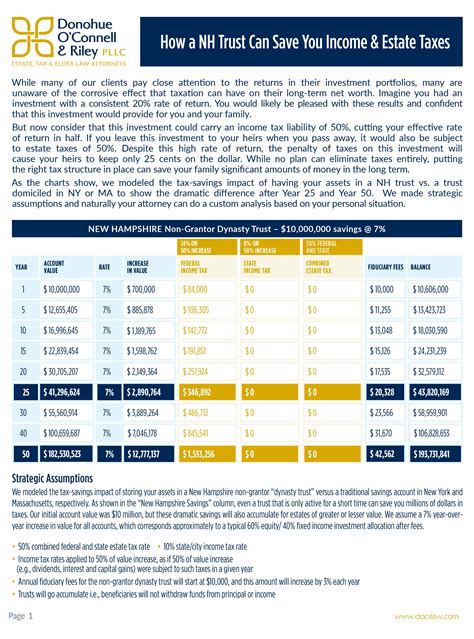

NH Property Tax: A Comparative Analysis

When compared to other states, New Hampshire’s property tax system stands out for its simplicity and fairness. Unlike some states that rely heavily on income or sales taxes, New Hampshire relies primarily on property taxes to fund its operations. This approach ensures that the burden of taxation is distributed across all property owners, based on the value of their holdings.

Efficiency and Transparency: A Key Advantage

One of the strengths of the NH Property Tax system is its efficiency and transparency. The standardized assessment process, coupled with regular reassessments, ensures that property values are accurately reflected in tax calculations. This transparency builds trust among taxpayers and promotes a sense of fairness within the community.

Impact on the Housing Market: A Balanced Approach

The NH Property Tax system also has a notable impact on the state’s housing market. By basing taxes on property value, the system encourages homeowners to maintain and improve their properties, which can lead to increased property values over time. This, in turn, can attract investors and contribute to the overall economic growth of the state.

Additionally, the tax relief programs offered by the state help to support homeowners, especially those who may face financial challenges. By providing assistance to seniors and those with limited incomes, the state ensures that property ownership remains accessible and sustainable for a broader range of residents.

The Future of NH Property Tax: A Forward-Thinking Perspective

As New Hampshire continues to evolve, so too will its property tax system. With an eye towards the future, the state is committed to maintaining a fair and efficient tax system that supports its residents and communities.

Embracing Technology: Streamlining Assessments

To enhance the assessment process, New Hampshire is exploring the use of advanced technologies. By leveraging data analytics and digital tools, assessors can more efficiently and accurately evaluate properties. This approach not only improves the accuracy of assessments but also reduces the time and resources required for the process.

Equitable Taxation: Addressing Community Needs

The state is also focused on ensuring that its tax system remains equitable, addressing the needs of all its communities. This includes continuing to offer tax relief programs and exploring additional initiatives to support homeowners, especially those who may be vulnerable or face unique challenges.

By staying committed to fairness, transparency, and efficiency, New Hampshire's property tax system is well-positioned to support the state's economic growth and the well-being of its residents for years to come.

How often are property assessments conducted in New Hampshire?

+Property assessments in New Hampshire are typically conducted every 3 to 5 years. However, this interval may vary based on local regulations and the specific needs of the municipality.

Are there any exemptions or reductions available for NH Property Tax?

+Yes, New Hampshire offers several tax relief programs, including the Property Tax Relief Program and the Tax Deferral Program. These programs provide financial assistance to eligible homeowners, helping them manage their property tax obligations.

How can I estimate my NH Property Tax bill?

+To estimate your NH Property Tax bill, you can use the formula: Tax Rate x Assessed Value = Property Tax Bill. You can find your property’s assessed value on your most recent assessment notice, and the tax rate is set annually by your local government.