Spartanburg County Taxes

Welcome to a comprehensive exploration of Spartanburg County's tax landscape, an essential topic for residents, businesses, and investors alike. Taxes are an integral part of any community's financial ecosystem, influencing economic growth, development, and the overall quality of life. This article aims to provide an in-depth understanding of Spartanburg County's tax system, offering valuable insights and clarity for all stakeholders.

Understanding Spartanburg County’s Tax Structure

Spartanburg County, located in the heart of South Carolina, boasts a robust tax system designed to support its vibrant communities and thriving businesses. The county’s tax structure is intricate yet essential, ensuring the smooth functioning of local government operations and the provision of essential services to its residents.

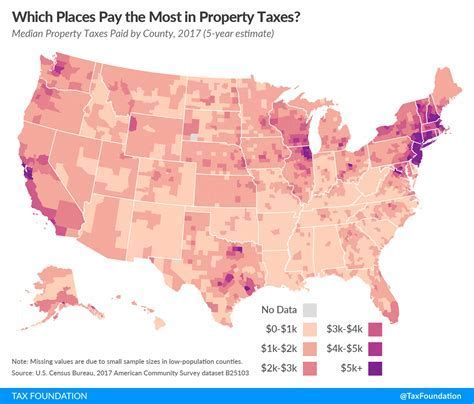

The tax system in Spartanburg County is primarily based on property taxes, which form a significant portion of the county's revenue. These taxes are levied on both real estate and personal property, with rates varying depending on the type of property and its location within the county. The county also collects other forms of taxes, including sales taxes, accommodations taxes, and business license taxes, each playing a vital role in funding various aspects of the local government's operations.

Property Taxes: A Cornerstone of Spartanburg’s Revenue

Property taxes are a cornerstone of Spartanburg County’s tax revenue, contributing significantly to the funding of local services and infrastructure. The county assesses property taxes based on the fair market value of the property, which is determined by the Spartanburg County Assessor’s Office.

| Tax Type | Rate (as of 2023) |

|---|---|

| Real Estate Tax | 6.46% of assessed value |

| Personal Property Tax | 6.46% of assessed value |

It's important to note that these rates are subject to change annually, influenced by factors such as budget requirements, economic conditions, and legislative decisions. The county ensures transparency by publishing the tax rates and assessment procedures on its official website, allowing residents and property owners to stay informed.

Sales and Accommodations Taxes: Supporting Local Businesses and Tourism

Spartanburg County also collects sales taxes and accommodations taxes, which are essential for supporting local businesses and the county’s tourism industry. These taxes are imposed on the sale of goods and services within the county, with the revenue generated being used to fund a range of public services and infrastructure projects.

| Tax Type | Rate (as of 2023) |

|---|---|

| Sales Tax | 6% (includes state and local taxes) |

| Accommodations Tax | 2% on short-term rentals |

The county's sales tax rate is consistent with the state's sales tax rate, ensuring a level playing field for businesses across South Carolina. The accommodations tax, on the other hand, is an additional tax levied on short-term rentals, including hotels, motels, and vacation rentals. This tax revenue is often directed towards supporting tourism-related initiatives and maintaining local attractions.

Business License Taxes: Empowering Local Enterprises

Spartanburg County places emphasis on supporting local businesses by imposing business license taxes. These taxes are levied on businesses operating within the county, with rates varying based on the type of business and its annual gross income. The revenue generated from business license taxes contributes significantly to the county’s economic development initiatives, fostering a business-friendly environment.

| Business Type | Tax Rate |

|---|---|

| Sole Proprietorships and Partnerships | 0.25% of gross income, with a minimum of $50 |

| Corporations | 0.25% of gross income, with a minimum of $100 |

The county's approach to business license taxes is designed to encourage entrepreneurship and support small businesses, which are vital to the local economy. By keeping the tax rates relatively low, Spartanburg County creates an attractive environment for businesses to thrive and expand.

Tax Incentives and Relief Programs

Recognizing the importance of tax incentives and relief programs, Spartanburg County has implemented various initiatives to support its residents and businesses. These programs aim to promote economic growth, attract new investments, and assist those facing financial hardships.

Property Tax Exemptions: Supporting Veterans and the Elderly

Spartanburg County offers property tax exemptions to honor the service of veterans and support the financial well-being of its elderly residents. These exemptions can significantly reduce the property tax burden for eligible individuals, providing much-needed relief.

- Veterans' Property Tax Exemption: Veterans who meet certain criteria, such as having a service-connected disability or being honorably discharged, may be eligible for a partial or full exemption on their property taxes.

- Homestead Exemption: Eligible homeowners aged 65 or older can apply for a homestead exemption, which reduces the assessed value of their property for tax purposes. This exemption helps alleviate the tax burden for seniors on fixed incomes.

Tax Relief for Businesses: Encouraging Economic Growth

To attract new businesses and support existing ones, Spartanburg County offers a range of tax relief programs. These initiatives aim to foster economic growth, create jobs, and enhance the county’s business landscape.

- Job Tax Credits: Businesses that create new jobs within the county may be eligible for tax credits, reducing their tax liability. These credits are designed to encourage businesses to invest in the local labor market and contribute to economic development.

- Investment Tax Credits: Spartanburg County provides tax credits to businesses that make significant investments in capital equipment, buildings, or other infrastructure. These credits aim to incentivize businesses to expand their operations and create a more robust business environment.

- Tax Increment Financing (TIF): TIF districts are established to encourage economic development in specific areas. Within these districts, a portion of the increased property taxes generated by new development is set aside to fund infrastructure improvements, making these areas more attractive for businesses.

Tax Administration and Support

Efficient tax administration is crucial for ensuring a fair and transparent tax system. Spartanburg County has implemented various measures to streamline the tax collection process and provide excellent support to taxpayers.

Online Services: Convenience and Transparency

Spartanburg County offers a range of online services to enhance convenience and transparency for taxpayers. These services include online tax payment options, property tax assessments, and business license renewals. By providing these services digitally, the county ensures that taxpayers can access the information and services they need quickly and efficiently.

- Spartanburg County Tax Portal: This portal allows residents and businesses to access their tax information, view bills, make payments, and track the status of their tax obligations. It also provides resources and tools to help taxpayers understand their tax responsibilities.

- Online Property Search: Taxpayers can search for property information, view assessment details, and access tax history online. This service is particularly useful for real estate professionals, investors, and homeowners who want to stay informed about property values and tax obligations.

Taxpayer Assistance: A Dedicated Support System

Spartanburg County recognizes the importance of providing excellent support to taxpayers. The county has established a dedicated taxpayer assistance program to help residents and businesses navigate the tax system, understand their obligations, and access available relief programs.

- Taxpayer Assistance Center: This center offers in-person support and guidance to taxpayers. Trained professionals are available to assist with tax-related inquiries, provide information on tax obligations, and help taxpayers access relief programs. The center aims to ensure that all taxpayers have the support they need to comply with their tax responsibilities.

- Online Resources and Guides: Spartanburg County provides an extensive library of online resources, including tax guides, FAQs, and informative articles. These resources cover a wide range of tax-related topics, from property tax assessments to business license requirements. By providing comprehensive information, the county empowers taxpayers to make informed decisions and understand their rights and obligations.

Spartanburg County’s Tax Future: A Vision for Sustainable Growth

As Spartanburg County continues to thrive and evolve, its tax system will play a pivotal role in shaping its future. The county’s approach to taxation is focused on sustainability, economic growth, and community development.

Sustainable Taxation: Balancing Revenue and Community Needs

Spartanburg County aims to maintain a balanced approach to taxation, ensuring that the tax system supports the county’s long-term financial health while meeting the needs of its residents and businesses. This approach involves careful consideration of tax rates, exemptions, and incentives to create a sustainable and equitable tax structure.

The county regularly reviews its tax policies and assesses the impact of various tax measures on the local economy. By staying agile and responsive to changing economic conditions, Spartanburg County can adapt its tax system to support economic growth and community development while maintaining financial stability.

Economic Development: Attracting Investments and Businesses

Spartanburg County’s tax system is designed to attract new investments and businesses, contributing to the county’s economic growth. By offering competitive tax rates, targeted tax incentives, and a supportive business environment, the county creates an attractive proposition for entrepreneurs and investors.

The county's tax relief programs, such as job tax credits and investment tax credits, play a crucial role in encouraging businesses to establish and expand within the county. These initiatives not only create jobs but also drive economic diversification, making Spartanburg County a dynamic and resilient economy.

Community Development: Investing in the Future

Beyond economic growth, Spartanburg County’s tax system is committed to supporting community development initiatives. The county recognizes that a thriving community is essential for long-term sustainability and quality of life. Tax revenue is directed towards a range of community projects, including infrastructure improvements, education, healthcare, and social services.

By investing in these areas, Spartanburg County ensures that its residents have access to essential services and a high quality of life. This approach not only enhances the community's well-being but also creates a more attractive environment for businesses and talent, further contributing to the county's economic prosperity.

Conclusion: A Strong and Supportive Tax System

Spartanburg County’s tax system is a robust and supportive framework that underpins the county’s economic and community development. By understanding and leveraging the various tax components, residents, businesses, and investors can make informed decisions and contribute to the county’s success.

From property taxes to sales taxes and business license taxes, each element of the tax system plays a vital role in funding local services, supporting businesses, and fostering economic growth. Additionally, the county's commitment to tax incentives and relief programs ensures that residents and businesses receive the support they need to thrive.

As Spartanburg County continues to grow and evolve, its tax system will remain a key driver of its success, shaping the county's future and ensuring a bright and sustainable path forward. With its balanced approach to taxation, focus on economic development, and commitment to community well-being, Spartanburg County is poised for continued prosperity.

How often do tax rates change in Spartanburg County?

+

Tax rates in Spartanburg County are reviewed annually and may change based on various factors, including budget requirements and economic conditions. The county aims to provide stable and predictable tax rates, but occasional adjustments are made to ensure the county’s financial health and the provision of essential services.

Are there any online tools to estimate property taxes in Spartanburg County?

+

Yes, Spartanburg County offers an online property tax estimator tool on its official website. This tool allows residents and property owners to estimate their annual property taxes based on their property’s assessed value and the current tax rates. It provides a convenient way to understand potential tax obligations.

What are the benefits of Spartanburg County’s tax incentives for businesses?

+

Spartanburg County’s tax incentives for businesses, such as job tax credits and investment tax credits, encourage economic growth, job creation, and business expansion. These incentives make the county an attractive location for businesses, fostering a dynamic and competitive business environment.

How does Spartanburg County support low-income residents with tax relief programs?

+

Spartanburg County offers various tax relief programs, including property tax exemptions for veterans and the elderly. These programs provide financial relief to eligible residents, helping them manage their tax obligations and maintain their financial well-being.

Where can I find more information about Spartanburg County’s tax system and policies?

+

You can find detailed information about Spartanburg County’s tax system, policies, and services on the official county website. The website provides resources, guides, and contact information for taxpayer assistance. Additionally, the Spartanburg County Assessor’s Office and Treasurer’s Office can provide specific details and support regarding property taxes and tax payments.