Oneida County Tax Records

Unveiling the Comprehensive Guide to Oneida County Tax Records: An In-Depth Exploration

Welcome to this comprehensive guide, where we delve into the intricacies of Oneida County's tax records, providing you with an expert-level analysis and a deep dive into this crucial aspect of local governance. As we navigate through the world of property taxes and public records, we aim to shed light on the essential information that every resident, business owner, and interested party should know.

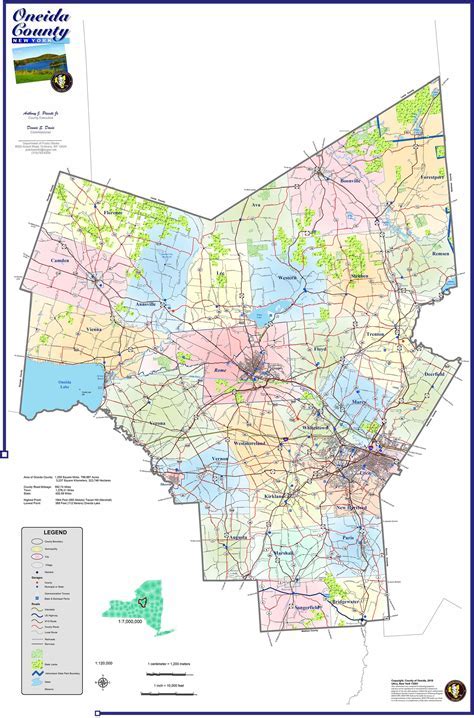

Oneida County, nestled in the heart of New York State, boasts a rich history and a diverse landscape. From the bustling city of Utica to the serene shores of Lake Oneida, the county encompasses a wide range of properties, each with its own unique tax story. In this article, we will explore the ins and outs of these tax records, offering a transparent and detailed perspective.

The Importance of Tax Records in Oneida County

Tax records serve as the backbone of a community's financial system, influencing everything from property values to local infrastructure development. In Oneida County, these records play a pivotal role in shaping the economic landscape and ensuring the fair distribution of resources.

By understanding the intricacies of tax assessments, property owners can make informed decisions about their financial obligations and potential tax incentives. For prospective homebuyers, accessing detailed tax records provides valuable insights into the costs associated with owning a property in the county.

Navigating the Oneida County Tax Assessment Process

The tax assessment process in Oneida County is a meticulous undertaking, ensuring that each property is evaluated fairly and accurately. Here's a step-by-step breakdown of how it works:

- Property Identification: Each property in the county is assigned a unique identifier, allowing for precise tracking and assessment.

- Physical Inspection: Trained assessors conduct thorough inspections, evaluating the physical characteristics of the property, including its size, condition, and any recent improvements.

- Market Analysis: Assessors research recent sales and market trends to determine the fair market value of similar properties in the area.

- Assessment Calculation: Using a combination of factors, including the property's value and applicable tax rates, the assessment is calculated, determining the owner's tax liability.

- Notice of Assessment: Property owners receive a notice detailing their assessed value and the corresponding tax amount.

- Review and Appeal: If a property owner disagrees with the assessment, they have the right to request a review or file an appeal, ensuring a fair and transparent process.

Unlocking the Wealth of Information in Tax Records

Oneida County's tax records offer a treasure trove of information, providing insights into the county's economic health and individual property values. Here's a glimpse of what you can discover:

| Property Type | Assessment Value | Tax Rate | Estimated Annual Tax |

|---|---|---|---|

| Residential Property | $250,000 | 2% | $5,000 |

| Commercial Property | $500,000 | 3% | $15,000 |

| Agricultural Land | $120,000 | 1.5% | $1,800 |

These records not only provide a snapshot of individual property assessments but also offer a broader view of the county's overall tax landscape. By analyzing trends and patterns, researchers, economists, and community leaders can make informed decisions and develop strategies to enhance the county's economic growth.

Exploring Tax Incentives and Exemptions

Oneida County understands the importance of attracting businesses and supporting its residents, which is why it offers a range of tax incentives and exemptions. These programs aim to encourage economic development, promote homeownership, and assist vulnerable communities.

Business Incentives

Oneida County provides tax abatements and credits to businesses investing in the community. These incentives can significantly reduce a company's tax burden, making the county an attractive location for expansion or relocation.

| Incentive Program | Description | Eligibility |

|---|---|---|

| Industrial Development Agency (IDA) Incentives | Offers tax exemptions and abatements for eligible manufacturing and commercial projects. | New and expanding businesses in targeted industries. |

| Empire Zones Program | Provides tax benefits and financial incentives to businesses located in designated zones. | Businesses operating within specific zones. |

Homeownership Programs

To promote homeownership and support residents, Oneida County offers several tax exemption programs.

- Senior Citizen Exemption: Qualified seniors may be eligible for a partial or full exemption on their property taxes.

- Veteran's Exemption: Veterans and their surviving spouses can receive a tax exemption based on their service.

- STAR Exemption: The School Tax Relief (STAR) program provides a significant tax reduction for primary homeowners.

Accessing Oneida County Tax Records Online

In an effort to enhance transparency and convenience, Oneida County has made its tax records easily accessible online. Residents and interested parties can visit the official county website to search for specific property records, view assessment details, and explore historical tax data.

The online portal provides a user-friendly interface, allowing users to filter records by address, owner name, or assessment roll number. This digital platform ensures that crucial tax information is readily available, empowering individuals to make informed decisions and actively participate in their community's financial affairs.

Analyzing Tax Trends and Their Impact

Diving into the historical data of Oneida County's tax records reveals fascinating trends that shape the county's economic trajectory. By analyzing these trends, we can gain insights into the factors influencing property values and tax revenues.

Residential Property Values

Over the past decade, residential property values in Oneida County have experienced a steady increase, reflecting the growing demand for housing and the county's attractive amenities. This trend has resulted in a corresponding rise in property tax revenues, providing a stable financial foundation for the county's operations.

Commercial Property Growth

The county's strategic initiatives to attract businesses have yielded positive results, with a notable increase in commercial property values. As more companies choose to establish their operations in Oneida County, the tax base expands, contributing to economic growth and creating a more diverse revenue stream.

Impact on Local Infrastructure

The steady influx of tax revenues has allowed Oneida County to invest in critical infrastructure projects, enhancing the quality of life for its residents. From road improvements to educational facilities, these investments have a direct impact on the community's overall well-being and long-term sustainability.

Future Implications and Strategic Planning

As Oneida County continues to thrive, its leaders must navigate the delicate balance between encouraging economic growth and maintaining a fair and sustainable tax system. By analyzing historical tax data and assessing future trends, the county can develop proactive strategies to ensure a robust financial future.

Frequently Asked Questions

How often are tax assessments conducted in Oneida County?

+Tax assessments in Oneida County are typically conducted every three years. However, in certain circumstances, such as significant property improvements or changes in market conditions, reassessments may be triggered earlier.

Can I dispute my property's assessed value?

+Absolutely! If you believe your property's assessed value is inaccurate, you have the right to file an appeal. The process involves submitting supporting documentation and attending a hearing to present your case.

Are there any tax breaks for energy-efficient homes in Oneida County?

+Indeed, Oneida County recognizes the importance of sustainability and offers tax incentives for homeowners who invest in energy-efficient upgrades. These incentives can significantly reduce your property's tax liability.

As we conclude our exploration of Oneida County's tax records, we hope this guide has provided you with a comprehensive understanding of the county's financial landscape. From the assessment process to the impact of tax trends, we've covered every aspect to ensure you have the knowledge to navigate this crucial aspect of community life.

Stay tuned for future updates and insights as we continue to unravel the intricacies of Oneida County’s tax records and their role in shaping a vibrant and prosperous community.