York County Property Tax

Understanding property taxes is essential for homeowners, especially in York County, Pennsylvania, where the tax system can be complex. This comprehensive guide will delve into the specifics of York County property taxes, providing you with the knowledge to navigate this important aspect of homeownership.

The Fundamentals of York County Property Taxes

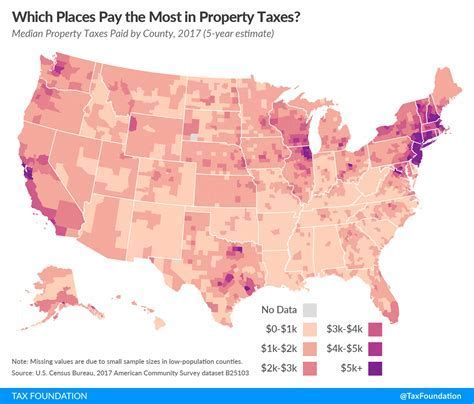

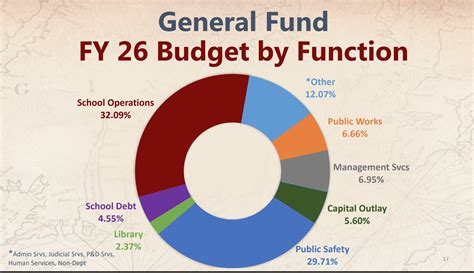

Property taxes in York County are levied on real estate property, including residential, commercial, and industrial properties. These taxes are a significant source of revenue for local governments, schools, and municipalities, funding essential services and infrastructure.

The tax rate in York County is determined by the millage rate, which is set annually by the York County Commissioners. This rate is applied to the assessed value of the property to calculate the tax liability. The millage rate is a decimal representation of the tax rate per thousand dollars of assessed value.

For instance, if the millage rate is set at 15.20 mills, it means that for every thousand dollars of assessed value, the property owner will pay $15.20 in property taxes. This rate can vary each year, and it is essential for property owners to stay informed about the current rate to budget effectively.

Assessed Value and Property Tax Calculation

The assessed value of a property is determined by the York County Assessment Office. This office regularly reassesses properties to ensure that the values remain current and accurate. The assessment process involves evaluating various factors, such as the property’s location, size, condition, and recent sales data of similar properties.

Once the assessed value is determined, it is multiplied by the millage rate to calculate the property tax. For example, if a residential property has an assessed value of $200,000 and the millage rate is 15.20 mills, the annual property tax would be calculated as follows:

Assessed Value x Millage Rate = Property Tax $200,000 x 0.0152 = $3,040

Thus, the property owner would owe $3,040 in property taxes for the year.

Property Tax Exemptions and Discounts

York County offers several property tax exemptions and discounts to eligible homeowners. These programs aim to provide relief to specific groups and promote homeownership.

- Homestead/Farmstead Exemption: This exemption applies to primary residences and can reduce the assessed value of the property by up to $30,000. To qualify, the property must be owner-occupied and the applicant's income must not exceed certain limits.

- Senior Citizen Discount: Senior citizens aged 65 and older may be eligible for a discount on their property taxes. The discount is based on income and the applicant's age. The maximum discount is 50% of the property tax, and the minimum is 20%.

- Veterans Discount: York County provides a property tax discount for honorably discharged veterans. The discount is based on the veteran's level of disability and can reduce the property tax by up to 50%.

It is important to note that these exemptions and discounts have specific eligibility criteria and application processes. Property owners should consult the York County Assessment Office or a tax professional to determine their eligibility and obtain the necessary forms.

Payment Options and Due Dates

York County property taxes are due semi-annually, with payments typically due in March and September. However, it is essential to check the exact due dates each year, as they may vary slightly.

Property owners have several payment options, including:

- Online Payment: The York County Treasurer's Office offers an online payment system, allowing taxpayers to pay their property taxes securely using a credit card, debit card, or electronic check.

- Mail-in Payment: Property owners can also mail their tax payments to the York County Treasurer's Office. The payment should be accompanied by the tax bill and a check or money order made payable to the York County Treasurer.

- In-Person Payment: Taxpayers can visit the York County Treasurer's Office during business hours to make their payments in person. Cash, check, money order, and credit card payments are accepted.

It is crucial to ensure that payments are made on time to avoid penalties and interest. Late payments can incur additional fees, so property owners should mark their calendars and plan their payments accordingly.

Penalty and Interest Calculation

York County applies penalties and interest to late property tax payments. The penalty is calculated at a rate of 10% of the unpaid tax amount for each 30-day period, with a maximum penalty of 50% of the unpaid tax. Interest is charged at a rate of 1% per month, or 12% annually, on the unpaid tax balance.

For example, if a property owner owes $3,000 in property taxes and fails to pay the full amount by the due date, the penalty and interest would accumulate as follows:

Penalty: 10% of $3,000 for each 30-day period Interest: 1% of $3,000 per month

It is advisable for property owners to stay informed about their tax liabilities and payment due dates to avoid unnecessary penalties and interest charges.

Property Tax Appeals and Grievances

If a property owner believes that their assessed value is incorrect or unfair, they have the right to file a property tax appeal. This process allows homeowners to challenge the assessment and potentially reduce their tax liability.

To initiate an appeal, property owners must first submit a formal grievance to the York County Assessment Office. The grievance should outline the reasons why the assessed value is inaccurate and provide supporting evidence, such as recent sales data of comparable properties.

The Assessment Office will review the grievance and may schedule an informal hearing to discuss the matter further. If the property owner is still dissatisfied with the assessment after the informal hearing, they can proceed to a formal hearing before the York County Board of Assessment Appeals.

The Appeal Process

The formal appeal process involves a hearing before the Board of Assessment Appeals, where the property owner presents their case and provides evidence to support their claim. The Board will consider the evidence and make a decision on whether to adjust the assessed value.

If the Board decides in favor of the property owner, the assessed value will be reduced, resulting in lower property taxes. However, if the Board upholds the original assessment, the property owner may still have the option to appeal further, though the process becomes more complex and may require legal representation.

It is advisable for property owners considering an appeal to consult with a tax professional or legal advisor to understand the process and increase their chances of a successful outcome.

Impact of Property Taxes on the Local Community

Property taxes play a crucial role in funding local services and infrastructure in York County. The revenue generated from these taxes is used to support schools, maintain roads and public transportation, provide police and fire protection, and fund various community programs and initiatives.

By paying their property taxes, homeowners contribute directly to the betterment of their community. These funds ensure that essential services are adequately funded and that the local infrastructure remains well-maintained. Property taxes also help promote economic development and enhance the overall quality of life in York County.

Furthermore, the property tax system in York County ensures fairness and equity. The assessment process aims to value properties accurately, ensuring that homeowners pay their fair share based on the value of their property. This system helps maintain a balanced tax burden among property owners and supports the overall financial health of the community.

Frequently Asked Questions

How often are property values reassessed in York County?

+York County conducts a general reassessment every five years. However, individual properties may be reassessed more frequently if significant changes or improvements are made to the property.

What happens if I miss the property tax payment deadline?

+Missing the property tax payment deadline can result in penalties and interest charges. It is important to pay your taxes on time to avoid these additional costs. If you are facing financial difficulties, it is advisable to contact the York County Treasurer’s Office to discuss potential payment plans or relief options.

Can I appeal my property tax assessment if I disagree with the value assigned to my property?

+Yes, you have the right to appeal your property tax assessment if you believe it is inaccurate or unfair. The appeal process involves submitting a formal grievance and attending hearings before the York County Board of Assessment Appeals. It is recommended to gather evidence and seek professional advice to strengthen your case.

Are there any property tax relief programs for low-income homeowners in York County?

+Yes, York County offers the Homestead/Farmstead Exemption program, which can provide significant tax relief to eligible low-income homeowners. To qualify, applicants must meet certain income and residency requirements. It is advisable to check the eligibility criteria and apply for the program if you meet the qualifications.

How can I stay updated on the latest property tax information and due dates in York County?

+The York County Treasurer’s Office and the York County Assessment Office provide regular updates and notifications regarding property taxes. It is recommended to visit their official websites, subscribe to their newsletters, or follow their social media accounts to stay informed. Additionally, local news outlets and community organizations often provide valuable information and reminders.