What Is California Sales Tax

California's sales tax is a crucial component of the state's revenue system, playing a significant role in funding public services and infrastructure. It is a consumption tax imposed on the sale of goods and certain services within the state. Understanding California sales tax is essential for both consumers and businesses, as it directly impacts their financial responsibilities and obligations.

How California Sales Tax Works

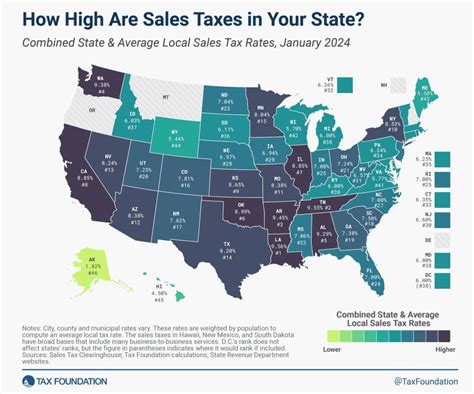

California’s sales tax is a combination of state and local taxes. The state sales tax rate is set at 7.25%, which is added to the retail price of most tangible personal property and some services. However, the total sales tax rate varies across the state due to the addition of local sales taxes imposed by counties and cities.

For instance, in the city of Los Angeles, the sales tax rate includes the state rate of 7.25% plus a city tax of 0.5%, a county tax of 1%, and a district tax of 1%, resulting in a total sales tax of 9.75%. This means that a purchase made in Los Angeles would incur a 9.75% sales tax on top of the item's retail price.

Types of Sales Tax in California

California has a few types of sales taxes, each with its own specific use and purpose.

- State Sales Tax: This is the base sales tax rate set by the state, currently at 7.25%. It applies to most sales across California.

- Local Sales Tax: Counties and cities have the authority to impose additional sales taxes to fund local projects and services. These taxes can vary significantly, ranging from 0.25% to 3%.

- District Sales Tax: Some regions have special districts, like transit or tourism districts, that can add an extra tax. For example, the Los Angeles County Metropolitan Transportation Authority (LACMTA) adds a 1% tax to fund public transportation.

- Special Sales Taxes: These are temporary taxes imposed for specific projects or initiatives. They often require voter approval and are used for infrastructure improvements or to support particular programs.

Taxable Items and Services

California sales tax applies to a wide range of goods and services. Here are some key categories:

| Category | Examples |

|---|---|

| Tangible Personal Property | Clothing, electronics, furniture, vehicles, groceries (except for certain exempt items) |

| Digital Products | E-books, software downloads, streaming services |

| Services | Repairs, installation, admissions (e.g., movie tickets), legal services, and some professional services |

| Rental and Leasing | Vehicle rentals, equipment leases, real estate rentals |

However, there are also many exemptions to California sales tax. These include:

- Most groceries, including produce, dairy, meat, and non-prepared foods.

- Prescription medications.

- Residential rent and certain real estate transactions.

- Educational services and supplies.

- Certain manufacturing and industrial equipment.

Sales Tax Collection and Remittance

The responsibility of collecting and remitting sales tax falls on the seller or retailer. They are required to charge the appropriate sales tax rate on each taxable sale and remit the collected tax to the California Department of Tax and Fee Administration (CDTFA) on a regular basis.

Businesses must register with the CDTFA to obtain a Seller's Permit, which allows them to collect and remit sales tax. The frequency of remittance depends on the business's sales volume and can range from monthly to annually.

Online Sales and Marketplace Facilitator Rules

With the growth of e-commerce, California has implemented specific rules for online sales. Under the Marketplace Facilitator Act, online marketplaces and sellers that facilitate third-party sales are responsible for collecting and remitting sales tax on behalf of the sellers.

This act ensures that even online purchases are subject to sales tax, closing a loophole that had allowed some online sellers to avoid collecting tax.

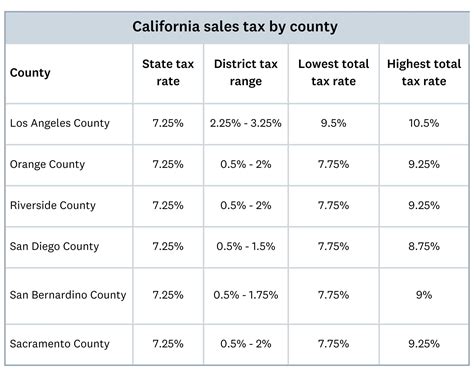

Sales Tax Rates by County

As mentioned earlier, California’s sales tax rates vary by location due to the addition of local taxes. Here are the total sales tax rates for some of the state’s most populous counties:

| County | Total Sales Tax Rate |

|---|---|

| Los Angeles County | 9.75% |

| San Francisco County | 9.50% |

| Orange County | 8.75% |

| San Diego County | 8.75% |

| Riverside County | 8.75% |

| San Bernardino County | 8.75% |

These rates are subject to change, and it's essential to consult the CDTFA's website for the most up-to-date information.

Future Implications and Initiatives

California’s sales tax landscape is dynamic and often subject to change. Proposed initiatives and future developments include:

- Potential changes in tax rates to fund specific projects or address budget shortfalls.

- Continued focus on ensuring tax compliance for online sales and marketplace sellers.

- Exploration of tax incentives or exemptions to encourage economic development and job creation.

- Possible expansion of sales tax to cover additional services or products to broaden the tax base.

Staying informed about these potential changes is crucial for both businesses and consumers to understand their financial obligations and plan accordingly.

Conclusion

California’s sales tax is a complex but essential aspect of the state’s financial system. It funds critical public services and infrastructure while also impacting the cost of living and doing business. Understanding how it works, which items are taxable, and the varying rates across the state is vital for financial planning and compliance.

For businesses, staying informed about sales tax regulations and properly collecting and remitting taxes is not just a legal obligation but also a key aspect of financial management. For consumers, being aware of sales tax rates and exemptions can help with budgeting and financial decision-making.

How often do businesses need to remit sales tax in California?

+The frequency of sales tax remittance depends on a business’s sales volume. Generally, businesses with higher sales volumes remit sales tax more frequently, often on a monthly or quarterly basis. Those with lower sales volumes may remit annually.

Are there any online resources to help calculate sales tax in California?

+Yes, the California Department of Tax and Fee Administration (CDTFA) provides an online Sales Tax Calculator that allows you to input the county and city where the sale occurs to get the total sales tax rate. This tool is a convenient way to estimate sales tax for various locations.

What happens if a business fails to collect or remit sales tax in California?

+Failure to collect or remit sales tax can result in penalties and interest charges. The CDTFA has a process for handling non-compliance, which may include audits, fines, and even legal action in severe cases. It’s essential for businesses to stay compliant to avoid these consequences.