City Of Los Angeles Business Tax

The City of Los Angeles, known for its vibrant culture, diverse industries, and thriving business landscape, has implemented a business tax system to support its economic growth and infrastructure development. This article aims to delve into the intricacies of the City of Los Angeles Business Tax, exploring its purpose, categories, calculation methods, compliance requirements, and its impact on the city's thriving entrepreneurial ecosystem.

Understanding the City of Los Angeles Business Tax

The City of Los Angeles Business Tax, often referred to as the Business Tax Registration Certificate (BTRC), is a vital component of the city’s revenue stream, contributing to the funding of essential public services and urban development projects. This tax is imposed on various business activities within the city limits, making it a significant consideration for entrepreneurs and established businesses alike.

Purpose and Significance

The primary purpose of the Los Angeles Business Tax is to generate revenue to support the city’s infrastructure, including the maintenance and improvement of roads, public transportation, and essential services like police and fire departments. Additionally, it plays a crucial role in funding social programs, ensuring the well-being and prosperity of the city’s diverse population.

Tax Categories and Registration

The city has categorized businesses into various sectors for taxation purposes, each with its own unique registration and tax calculation requirements. These categories encompass a wide range of industries, from retail and hospitality to professional services and manufacturing. Understanding the specific category applicable to your business is crucial for accurate tax compliance.

Here's a simplified breakdown of some common business tax categories in Los Angeles:

| Business Category | Description |

|---|---|

| Retail Stores | Businesses selling goods directly to consumers. |

| Service Providers | Professional services like accounting, legal, or consulting firms. |

| Manufacturing | Companies engaged in the production of goods. |

| Entertainment & Tourism | Businesses related to tourism, hospitality, and entertainment venues. |

| Real Estate | Property management, leasing, and real estate agencies. |

It's important to note that this is a general overview, and specific businesses may fall into more specialized categories. The City of Los Angeles provides detailed guidelines and resources to help businesses determine their correct tax category.

Calculation and Payment Methods

The calculation of the Los Angeles Business Tax varies based on the business’s category and its revenue or gross receipts. The city employs a combination of flat fees, percentage-based calculations, and graduated tax rates to determine the tax liability for each business.

Flat Fees

Some business categories are subject to a flat fee, which remains constant regardless of the business’s revenue. This method is typically applied to smaller businesses or those with a low impact on the local economy.

Percentage-Based Calculation

Many businesses, especially those with higher revenues, are taxed based on a percentage of their gross receipts. The tax rate can vary depending on the specific industry and the city’s tax regulations. For instance, a restaurant might be subject to a tax rate of 0.1% on its gross receipts.

Graduated Tax Rates

Certain business categories have tax rates that increase with the growth of their revenue. This approach ensures that larger businesses contribute proportionally more to the city’s revenue stream. For example, a manufacturing business might have a tax rate of 0.2% on the first 1 million of gross receipts, and the rate increases to 0.3% for revenues exceeding 1 million.

Payment Options and Deadlines

Businesses have the option to pay their Los Angeles Business Tax annually, semi-annually, or quarterly, depending on their tax liability and preference. The city provides a user-friendly online portal for tax registration, calculation, and payment, making the process more accessible and efficient for businesses.

Compliance and Enforcement

The City of Los Angeles takes compliance with its business tax regulations seriously. It has implemented robust systems to ensure businesses accurately report and pay their taxes. Non-compliance can result in penalties, interest, and even legal consequences.

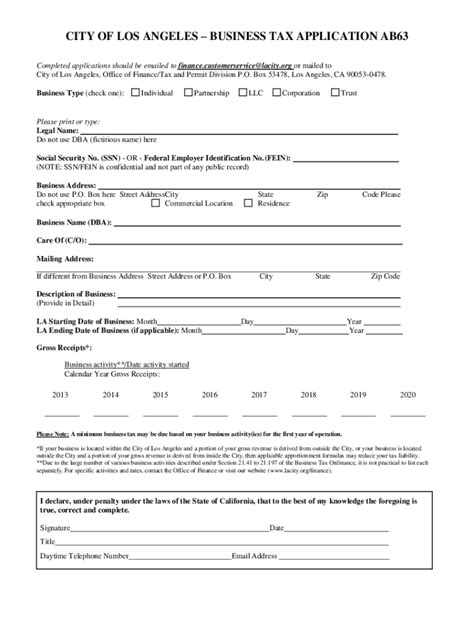

Registration and Reporting Requirements

All businesses operating within the city limits must obtain a Business Tax Registration Certificate (BTRC) before commencing operations. This registration process involves providing detailed information about the business, including its nature, location, and expected revenue. Once registered, businesses are required to file annual tax returns, declaring their actual revenue and calculating their tax liability.

Audit and Enforcement

The city conducts regular audits to verify the accuracy of tax returns and ensure compliance. These audits may involve inspections, reviews of financial records, and interviews with business owners or employees. If discrepancies are found, businesses may be subject to additional taxes, penalties, and interest charges.

Impact on the Business Community

The Los Angeles Business Tax has a significant influence on the city’s business landscape. While it provides essential funding for public services and infrastructure, it also presents challenges for businesses, particularly startups and small enterprises.

Support for Local Businesses

The tax revenue generated benefits the local business community by funding initiatives to improve the business environment. This includes investments in infrastructure upgrades, business support programs, and initiatives to attract and retain businesses in the city.

Challenges for Small Businesses

Small businesses often face unique challenges when it comes to navigating the complexities of the Los Angeles Business Tax. The tax burden can be a significant financial strain, especially for startups with limited revenue. Additionally, the administrative burden of tax compliance can be time-consuming and resource-intensive for small business owners.

Future Outlook and Potential Reforms

As the city continues to evolve and adapt to changing economic landscapes, the Los Angeles Business Tax is likely to undergo periodic reviews and potential reforms. Here are some key considerations for the future of the business tax system:

Digitalization and Streamlined Processes

The city is investing in digital transformation to streamline the tax registration and payment processes. This includes enhancing its online platforms, introducing mobile apps for tax-related services, and exploring blockchain technology for secure and efficient tax transactions.

Incentives for Sustainable Businesses

With a growing emphasis on sustainability and environmental stewardship, the city may consider introducing tax incentives for businesses adopting eco-friendly practices. This could include reduced tax rates for businesses with certified green initiatives or investments in renewable energy.

Simplification of Tax Categories

The current tax category system, while comprehensive, can be complex for businesses to navigate. Simplifying and consolidating categories could make it easier for businesses to understand their tax obligations and reduce administrative burdens.

Tax Reform and Economic Growth

The city may explore tax reform initiatives to stimulate economic growth and attract new businesses. This could involve adjusting tax rates, introducing tax holidays for specific industries, or offering tax credits for businesses creating jobs or investing in the local community.

Conclusion

The City of Los Angeles Business Tax is a vital component of the city’s economic framework, supporting essential public services and infrastructure development. While it presents challenges for businesses, especially small enterprises, the tax system also plays a crucial role in fostering a thriving business environment and ensuring the city’s long-term prosperity. As Los Angeles continues to innovate and adapt, the business tax landscape is poised to evolve, offering new opportunities and incentives for the city’s entrepreneurial ecosystem.

How can I determine my business’s correct tax category in Los Angeles?

+The City of Los Angeles provides a detailed Business Tax Code that outlines specific tax categories and their requirements. You can also consult the Business Tax Registration Center website for guidance. Additionally, seeking advice from tax professionals or legal experts familiar with Los Angeles business regulations can ensure accurate categorization.

What are the consequences of non-compliance with the Los Angeles Business Tax regulations?

+Non-compliance can result in severe penalties, including fines, additional taxes, and interest charges. In some cases, businesses may also face legal action. It’s crucial to stay informed about tax obligations and seek professional advice to ensure compliance.

Are there any tax incentives or support programs available for small businesses in Los Angeles?

+Yes, the city offers various support programs and incentives to assist small businesses. These include tax breaks, grants, and low-interest loans. The Los Angeles Small Business Development Center provides valuable resources and guidance for small business owners.

How can I stay updated with changes and reforms to the Los Angeles Business Tax system?

+The City of Los Angeles publishes updates and announcements on its official websites, including the City of Los Angeles homepage and the City Treasurer’s Office website. Additionally, subscribing to local business news sources and following relevant social media accounts can provide timely information on tax-related changes.