Mansion Tax California

The concept of a mansion tax has sparked considerable interest and debate in California, a state known for its affluent real estate market and high property values. This article aims to delve into the intricacies of the mansion tax proposal, exploring its potential implications, the reasoning behind its consideration, and the impact it could have on California's economy and residents.

Unveiling the Mansion Tax: A Deep Dive into California’s Proposed Legislation

The idea of implementing a mansion tax in California gained momentum as a potential solution to address the state’s growing wealth disparity and rising housing costs. While the term “mansion tax” might evoke images of grand estates, the proposed legislation targets a broader range of high-value properties, aiming to generate revenue for essential public services and infrastructure.

What is the Mansion Tax Proposal?

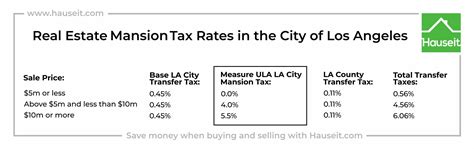

At its core, the mansion tax is a progressive property tax that would apply to residential properties exceeding a certain value threshold. Unlike the standard property tax, which is based on a property’s assessed value, the mansion tax would be levied as a flat rate or a percentage of the property’s market value. This means that homeowners with properties valued above a specific limit would pay an additional tax, with the rate increasing as the property value rises.

For instance, let's consider a proposed threshold of $3 million. Properties valued at or above this amount would be subject to the mansion tax. The tax rate could vary, but a common suggestion is a 0.4% annual tax on the portion of the property's value exceeding the threshold. So, for a property valued at $3.5 million, the additional tax would be calculated as $20,000 (0.4% of $5 million).

| Property Value | Mansion Tax Rate | Additional Tax |

|---|---|---|

| $3.5 million | 0.4% | $20,000 |

| $5 million | 0.4% | $20,000 (on the portion above $3 million) |

| $7 million | 0.4% | $40,000 (on the portion above $3 million) |

The Rationale Behind the Mansion Tax

California, known for its vibrant economy and diverse industries, has also witnessed a significant wealth gap, with a concentration of high-value real estate. Proponents of the mansion tax argue that it is a fair and effective way to address this disparity. By targeting properties with high market values, the tax could generate substantial revenue without impacting the majority of homeowners who own more modest homes.

The revenue generated from the mansion tax is intended to fund critical public services and infrastructure projects. This includes investments in education, healthcare, transportation, and affordable housing initiatives. In a state as diverse and populous as California, such investments are crucial to maintaining a high quality of life and ensuring equal opportunities for all residents.

Potential Impact on California’s Real Estate Market

Introducing a mansion tax could have both positive and negative implications for California’s real estate market. On one hand, it may encourage a more equitable distribution of wealth by deterring excessive property accumulation. It could also stimulate the market for luxury properties, as buyers may be motivated to purchase homes just below the tax threshold.

However, critics argue that a mansion tax could discourage high-net-worth individuals from investing in California's real estate market, potentially leading to a loss of revenue from property sales and related economic activities. Additionally, there are concerns about the administrative complexities and potential challenges in accurately assessing property values for tax purposes.

Comparative Analysis: How California’s Mansion Tax Stacks Up

California is not the first jurisdiction to consider a mansion tax. Several countries and regions, including the United Kingdom and New York City, have implemented similar measures. A comparative analysis of these cases provides valuable insights into the potential outcomes of such a tax.

For instance, the Annual Tax on Enveloped Dwellings (ATED) in the UK imposes an annual tax on residential properties held within a company structure, targeting high-value properties. While the ATED has generated revenue, it has also faced criticism for its complexity and potential impact on foreign investment.

In New York City, the Mansion Tax is a one-time tax applied to residential property sales above a certain threshold. This tax has been a significant revenue generator, contributing to the city's budget and funding essential services. However, critics argue that it may deter high-end property transactions and impact the overall real estate market.

Looking Ahead: The Future of California’s Mansion Tax Proposal

As the discussion surrounding the mansion tax continues, several key factors will shape its future. Public opinion, political support, and economic considerations will play a crucial role in determining whether the proposal gains traction and becomes law.

If implemented, the mansion tax could become a significant tool in California's efforts to address wealth inequality and fund critical public services. However, careful consideration of its potential impact on the real estate market, administrative feasibility, and public acceptance is essential.

Stay tuned as California's policymakers, economists, and residents engage in a lively debate on the merits and challenges of the mansion tax proposal, shaping the future of the state's tax landscape and its impact on the lives of its residents.

How would the mansion tax affect property values in California?

+The mansion tax could have both positive and negative effects on property values. It may encourage a more equitable distribution of wealth, potentially stabilizing property values over time. However, it could also lead to a shift in demand, with buyers favoring properties just below the tax threshold.

What are the potential benefits of a mansion tax for California’s economy?

+A mansion tax could generate substantial revenue for California, which can be allocated to essential public services and infrastructure projects. This revenue stream can help maintain and improve the state’s overall economic health and stability.

How does the mansion tax proposal compare to other states or countries that have implemented similar measures?

+California’s proposal is similar to other jurisdictions’ mansion taxes, aiming to address wealth inequality and generate revenue. However, each region’s implementation and impact vary, and California’s unique economic and social landscape will shape the outcomes of its proposal.