Contra Costa County Tax

Welcome to a comprehensive guide on the intricacies of Contra Costa County Tax, a subject of utmost importance for residents, businesses, and anyone interested in understanding the tax landscape of this vibrant region. In this expert-level article, we will delve deep into the specifics, providing an in-depth analysis that will leave no stone unturned. From the historical context to the modern-day tax structures, we aim to equip you with a comprehensive understanding of Contra Costa County's tax system.

A Historical Perspective on Contra Costa County Taxes

To truly grasp the present tax structure, we must first journey back in time to understand the historical context of Contra Costa County’s tax system. The county, established in 1850, has a rich history of taxation policies that have evolved over the decades to meet the changing needs of its residents and businesses.

In the early days, Contra Costa County's tax system primarily relied on property taxes, a common practice during the 19th century. These property taxes were a significant source of revenue for the county, funding various essential services such as education, infrastructure development, and law enforcement.

However, as the county grew and diversified, the tax system needed to adapt. The introduction of the California Revenue and Taxation Code in the mid-20th century brought about significant changes, standardizing tax practices across the state and providing a framework for Contra Costa County to develop its tax policies.

One notable development was the implementation of the Property Tax System, which remains a cornerstone of Contra Costa County's tax structure today. This system, based on the assessed value of properties, ensures a fair and equitable distribution of tax responsibilities among property owners.

| Historical Tax Event | Impact |

|---|---|

| Introduction of Property Taxes | Funded essential services and development. |

| California Revenue and Taxation Code | Standardized tax practices, providing a uniform framework. |

| Property Tax System Implementation | Fair and equitable tax distribution based on property value. |

Understanding the Modern Tax Structure of Contra Costa County

Fast forward to the present day, and Contra Costa County boasts a robust and diverse tax structure, catering to the needs of its diverse population and businesses. Here’s a breakdown of the key components of the modern tax system.

Property Taxes: The Backbone of County Revenue

Property taxes continue to be a significant revenue source for Contra Costa County. The county utilizes a sophisticated assessment process to determine the value of properties, ensuring that tax obligations are fairly distributed among property owners.

The Property Tax System is governed by Proposition 13, a landmark legislation passed in 1978. Proposition 13 limits the tax rate to 1% of the assessed value of the property and restricts annual increases to no more than 2% or the inflation rate, whichever is lower.

Additionally, Contra Costa County offers various exemptions and discounts to eligible taxpayers, such as the Homeowners' Exemption, which reduces the taxable value of a primary residence, and the Disabled Veterans' Exemption, providing tax relief to qualifying veterans.

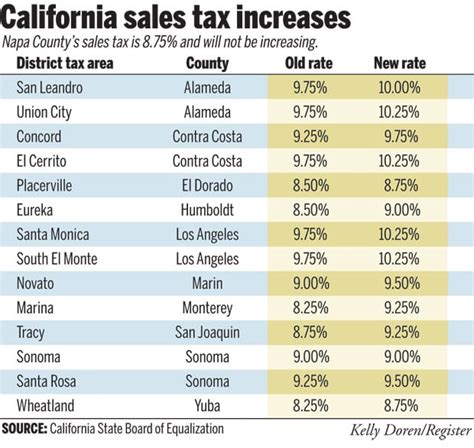

Sales and Use Taxes: Funding Essential Services

Contra Costa County also collects sales and use taxes, which play a vital role in funding various public services and infrastructure projects. These taxes are applied to the sale or use of goods and services within the county.

The sales tax rate in Contra Costa County is comprised of both state and local components. As of [current year], the state sales tax rate is [state sales tax rate]%, while the local rate varies across the county's jurisdictions, ranging from [lowest local rate]% to [highest local rate]%. These local rates are often dedicated to specific projects or services, such as transportation improvements or public safety initiatives.

In addition to sales taxes, the county also imposes a use tax on goods purchased outside of the county but used or stored within its borders. This tax ensures that businesses and individuals contribute to the county's revenue stream, regardless of where their purchases are made.

Business Taxes: Supporting Economic Growth

Contra Costa County recognizes the importance of supporting local businesses and fostering economic growth. As such, the county has implemented a range of business taxes and fees designed to generate revenue while promoting a thriving business environment.

One notable business tax is the Transient Occupancy Tax, also known as the hotel tax. This tax is levied on the rental of rooms or accommodations within the county, providing a steady stream of revenue for the county's tourism and hospitality industries. The tax rate for this varies depending on the location and type of accommodation, with some areas offering reduced rates to encourage tourism.

Additionally, the county imposes a Business License Tax, which is based on the gross receipts of businesses operating within Contra Costa County. This tax ensures that businesses contribute to the county's revenue in proportion to their scale of operations.

| Tax Type | Rate/Details |

|---|---|

| Property Tax Rate | 1% of assessed value, with annual increases capped at 2% or inflation rate. |

| Sales Tax Rate | State rate: [state sales tax rate]%. Local rates: [lowest local rate]% to [highest local rate]%. |

| Use Tax Rate | Matches the sales tax rate of the jurisdiction where the goods are used. |

| Transient Occupancy Tax | Varies by location and accommodation type. |

| Business License Tax | Based on gross receipts, with rates varying by business type and location. |

The Role of Tax Assessor-Collectors in Contra Costa County

At the heart of Contra Costa County’s tax system are the Tax Assessor-Collectors, elected officials responsible for the assessment, collection, and distribution of taxes within the county. These officials play a crucial role in ensuring the smooth functioning of the tax system and the equitable treatment of taxpayers.

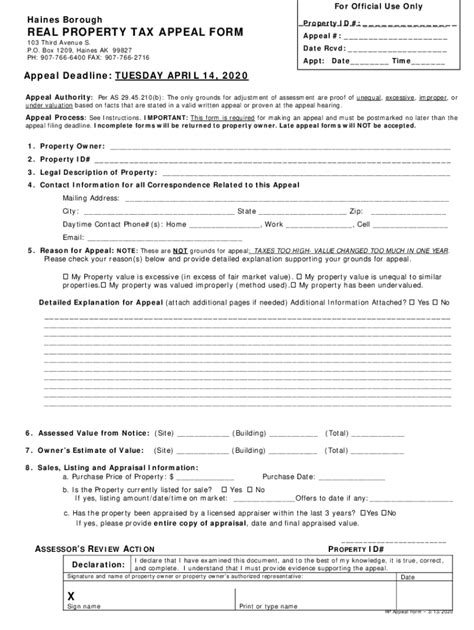

The Tax Assessor is responsible for appraising the value of properties within the county, ensuring accuracy and fairness in the assessment process. This involves conducting periodic reviews of properties, considering factors such as market conditions, improvements, and comparable sales data.

On the other hand, the Tax Collector is tasked with collecting the taxes assessed by the Assessor. This involves sending out tax bills, managing payment plans, and enforcing collection procedures. The Tax Collector's office also provides assistance to taxpayers, offering guidance on payment options and resolving any queries or disputes.

Both the Tax Assessor and Collector work in collaboration to ensure that the tax system operates efficiently and effectively, benefiting the residents and businesses of Contra Costa County.

The Future of Contra Costa County Taxes: Insights and Projections

As we look ahead, it’s essential to consider the future of Contra Costa County’s tax system and how it may evolve to meet the changing needs of its residents and businesses. Here are some insights and projections based on current trends and industry expertise.

Technology and Tax Administration

The integration of technology is set to play a significant role in the future of Contra Costa County’s tax administration. With advancements in digital platforms and data analytics, the county can streamline tax processes, improve efficiency, and enhance taxpayer experiences.

For instance, online tax filing and payment systems can offer convenience and ease of use for taxpayers, while also reducing administrative burdens for the county. Additionally, data analytics can provide valuable insights into tax trends, helping the county identify areas for improvement and optimize tax policies.

Sustainable Funding for Public Services

As the county continues to grow and develop, the need for sustainable funding sources to support essential public services becomes increasingly important. Contra Costa County may explore innovative tax structures or partnerships to ensure long-term financial stability.

One potential avenue is the implementation of a local income tax, which could provide a stable revenue stream for the county. Additionally, the county may consider establishing public-private partnerships to fund specific projects or initiatives, leveraging private sector expertise and resources.

Tax Equity and Social Justice

Contra Costa County has a long-standing commitment to tax equity and social justice. As the county’s population diversifies, it will be crucial to ensure that tax policies remain fair and equitable for all residents.

The county may explore initiatives to reduce the tax burden on low-income individuals and families, such as expanding tax credits or exemptions. Additionally, efforts to promote tax literacy and education can empower residents to understand their tax obligations and rights, fostering a sense of ownership and engagement in the tax system.

Conclusion: A Dynamic Tax System in Contra Costa County

In conclusion, Contra Costa County’s tax system is a dynamic and evolving entity, shaped by historical context, modern-day needs, and the county’s commitment to fairness and progress. From its early reliance on property taxes to its diverse tax structure today, the county has adapted and innovated to meet the challenges and opportunities of each era.

As we've explored, the county's tax system is characterized by a robust Property Tax System, a well-managed Sales and Use Tax structure, and a range of business taxes that support economic growth. The role of the Tax Assessor-Collectors is pivotal in ensuring the system's effectiveness and equity.

Looking ahead, Contra Costa County's tax system is poised for continued growth and innovation. With a focus on technology integration, sustainable funding, and tax equity, the county can ensure that its tax policies remain fair, efficient, and responsive to the needs of its residents and businesses.

We hope this comprehensive guide has provided you with a deeper understanding of Contra Costa County's tax landscape. For further insights and updates, be sure to stay tuned to our platform, where we continue to explore the intricate world of taxation and its impact on our communities.

What is the average property tax rate in Contra Costa County?

+The average property tax rate in Contra Costa County is approximately 1.1% of the assessed value of the property, as per Proposition 13. However, this rate can vary slightly based on the specific location within the county.

How often are property taxes assessed in Contra Costa County?

+Property taxes in Contra Costa County are assessed annually. The assessed value is based on the property’s value as of the lien date, which is typically January 1st of each year.

Are there any tax incentives for renewable energy installations in Contra Costa County?

+Yes, Contra Costa County offers tax incentives for renewable energy installations. Property owners who install solar panels or other renewable energy systems may be eligible for property tax exclusions or exemptions, reducing their tax burden.