Wilson County Tax Office Nc

The Wilson County Tax Office in North Carolina plays a vital role in the administration and management of various tax-related affairs for residents and businesses within the county. From property assessments to tax collection, this government entity ensures that Wilson County's financial obligations are met efficiently and effectively. This article will delve into the specific functions, services, and impact of the Wilson County Tax Office, providing a comprehensive overview for those interested in understanding the county's tax operations.

The Wilson County Tax Office: A Key Government Institution

The Wilson County Tax Office is an integral part of the county’s government, responsible for a range of essential tasks that contribute to the financial stability and development of the community. With a dedicated team of professionals, the office undertakes a comprehensive set of duties to ensure the smooth functioning of the county’s tax system.

Property Assessments and Valuations

One of the primary responsibilities of the Wilson County Tax Office is the assessment and valuation of properties within the county. This process involves evaluating the worth of residential, commercial, and industrial properties to determine their fair market value. Accurate property assessments are crucial for ensuring that property taxes are levied fairly and that the county receives adequate revenue for its operations.

The office employs a team of certified assessors who utilize a variety of methods and tools to determine property values. These assessments are conducted regularly, with the frequency varying depending on the type of property and local regulations. For instance, residential properties may be reassessed every few years, while commercial properties might be evaluated more frequently due to the dynamic nature of business operations.

| Property Type | Assessment Frequency |

|---|---|

| Residential | Every 3 years |

| Commercial | Annually |

| Industrial | Every 2 years |

Tax Collection and Payment Processing

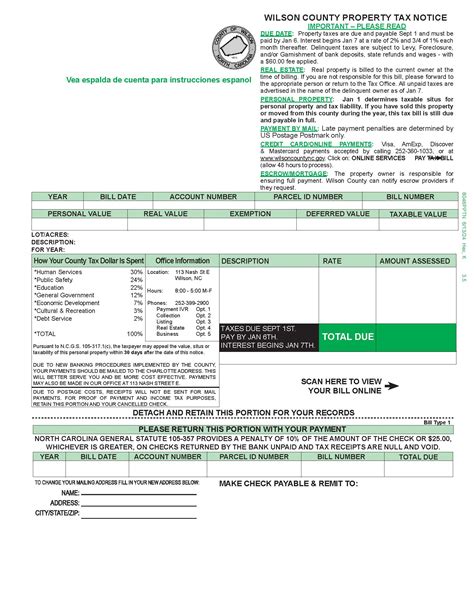

The Wilson County Tax Office is responsible for collecting various taxes levied by the county, including property taxes, personal property taxes, and business taxes. It provides residents and businesses with a streamlined process for paying their taxes, ensuring compliance with the county’s financial regulations.

Property owners in Wilson County receive tax bills annually, detailing the assessed value of their property and the corresponding tax amount. These bills are typically due by a specific deadline, and the office offers several payment options, including online payment portals, mail-in checks, and in-person payments at the tax office.

For businesses, the tax office provides clear guidelines on tax obligations, such as sales tax, business license taxes, and occupancy taxes. It works closely with local businesses to ensure they understand their tax responsibilities and provides support to ensure timely and accurate tax payments.

Tax Appeals and Dispute Resolution

In cases where property owners or taxpayers believe their tax assessment or bill is incorrect, the Wilson County Tax Office provides a fair and transparent process for appeals and dispute resolution. This process allows taxpayers to challenge their tax assessments and seek adjustments if warranted.

The appeals process typically involves a formal review by the county’s Board of Equalization and Review, an independent body that assesses the validity of the appeal and makes recommendations to the tax office. The tax office then has the authority to make adjustments to the tax assessment or bill based on the findings of the review board.

By offering this appeals process, the Wilson County Tax Office ensures that taxpayers have a chance to address any perceived injustices or inaccuracies in their tax assessments, promoting a fair and equitable tax system.

Community Outreach and Education

The Wilson County Tax Office understands the importance of keeping the community informed and educated about tax-related matters. It actively engages in community outreach programs and initiatives to ensure that residents and businesses are aware of their tax obligations and the services provided by the office.

This includes hosting workshops and seminars to educate property owners on the assessment process, tax payment options, and how to navigate the tax system effectively. The office also maintains an active online presence, with a user-friendly website providing resources, forms, and contact information to make it easier for taxpayers to access the services they need.

Additionally, the tax office participates in local events and community gatherings to build relationships and foster trust with the residents it serves. By being accessible and transparent, the office aims to demystify the tax process and create a positive relationship with the community it represents.

The Impact of the Wilson County Tax Office

The Wilson County Tax Office’s contributions to the county’s financial health and stability are significant. Its role in assessing property values ensures that the county’s tax revenue is generated fairly and accurately, providing the funds necessary for essential services such as education, infrastructure development, and public safety.

Furthermore, the tax office’s efficient tax collection processes ensure that the county receives a steady stream of revenue, enabling it to plan and budget effectively for the future. This financial stability contributes to the overall economic growth and development of Wilson County, attracting businesses and residents alike.

The office’s commitment to transparency and community engagement also fosters a positive relationship between the government and its citizens. By providing clear and accessible information, the tax office empowers taxpayers to understand their rights and responsibilities, leading to a more cooperative and engaged community.

Conclusion

In summary, the Wilson County Tax Office is a critical component of the county’s administrative framework, playing a vital role in ensuring the financial well-being and development of the community. From accurate property assessments to efficient tax collection and community outreach, the office’s multifaceted services contribute to the overall success and prosperity of Wilson County.

As a key government institution, the Wilson County Tax Office exemplifies the importance of efficient and transparent tax administration, serving as a model for other counties and jurisdictions striving to balance their financial obligations with community needs.

How often are property assessments conducted in Wilson County?

+Property assessments in Wilson County are conducted on a rolling basis. Residential properties are typically reassessed every 3 years, while commercial and industrial properties may be assessed more frequently, depending on the nature of the business and local regulations.

What payment options are available for tax payments?

+The Wilson County Tax Office offers a variety of payment options, including online payments through a secure portal, mail-in payments with checks or money orders, and in-person payments at the tax office. These options provide flexibility and convenience for taxpayers.

How can I appeal my property tax assessment?

+To appeal a property tax assessment, you must first contact the Wilson County Tax Office to request a formal review. The office will guide you through the process, which typically involves submitting an appeal form and supporting documentation. The appeal will then be reviewed by the Board of Equalization and Review, and a decision will be made based on the evidence presented.