Does Colorado Tax Social Security

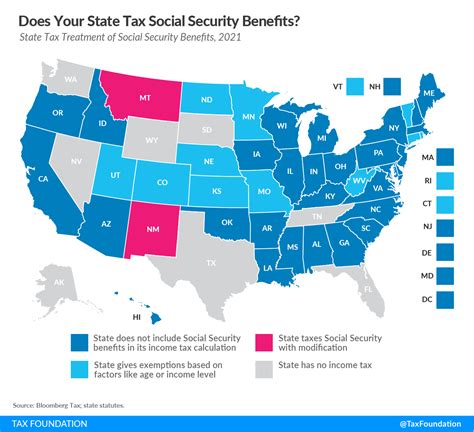

The taxation of Social Security benefits in Colorado is a nuanced topic that involves understanding the state's tax laws and how they interact with federal guidelines. Colorado's approach to taxing Social Security income differs from many other states, and it's essential to delve into the specifics to provide an accurate and comprehensive understanding.

Colorado’s Approach to Taxing Social Security

Colorado is unique in its treatment of Social Security benefits, as it is one of the few states that does not have a state income tax. This means that, in general, Social Security benefits are not subject to state taxation in Colorado.

However, it's crucial to note that Colorado's tax landscape is not entirely straightforward when it comes to Social Security. While the state itself does not tax these benefits, certain local jurisdictions within Colorado may have their own tax rules.

Local Taxes on Social Security

Some cities and counties in Colorado have the authority to levy their own taxes, which can include taxes on Social Security benefits. For instance, the City and County of Denver imposes a Limited Gaming Property Tax, which is a unique tax that applies to various sources of income, including Social Security benefits.

Other local governments in Colorado may have similar tax structures, so it's essential for individuals receiving Social Security benefits to understand the specific tax rules in their area.

| Locality | Tax on Social Security |

|---|---|

| Denver | Limited Gaming Property Tax |

| Boulder | No specific tax, but may be subject to other local taxes |

| Colorado Springs | No city-specific tax, but potential for other local taxes |

These local taxes can vary significantly, and it's advisable for residents to consult with local tax authorities or financial advisors to ensure they understand their specific tax obligations.

Federal Taxation of Social Security Benefits

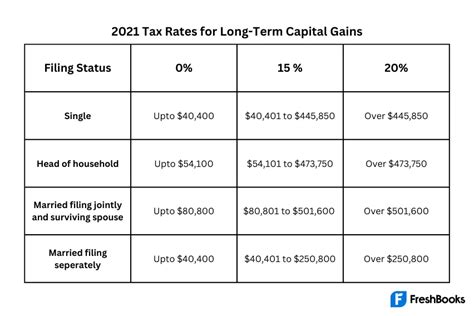

While Colorado’s state-level taxation of Social Security is straightforward, the federal government has its own guidelines for taxing these benefits. The Internal Revenue Service (IRS) determines whether Social Security benefits are taxable based on an individual’s income and marital status.

If an individual's provisional income (adjusted gross income plus nontaxable interest and half of Social Security benefits) exceeds a certain threshold, a portion of their Social Security benefits may be subject to federal income tax. This threshold is $25,000 for single filers and $32,000 for married couples filing jointly.

It's important to note that the taxation of Social Security benefits at the federal level can be complex and may involve other factors, such as tax deductions and credits.

Tips for Navigating Colorado’s Social Security Taxation

Given the potential complexities, here are some tips for individuals in Colorado navigating the taxation of Social Security benefits:

- Understand Local Tax Rules: Research the tax regulations in your specific locality. Reach out to local tax authorities or consult with a tax professional to ensure you're aware of any local taxes that may apply to Social Security benefits.

- Track Income: Keep a record of all your income sources, including Social Security benefits. This will help you determine whether your provisional income exceeds the federal tax threshold.

- Explore Tax Strategies: Work with a financial advisor to develop strategies that can help minimize the tax impact on your Social Security benefits. This might include optimizing other income sources or taking advantage of tax deductions and credits.

- Stay Informed: Tax laws can change, so stay updated on any modifications to Colorado's tax landscape or federal guidelines that might affect Social Security taxation.

By understanding the nuances of Colorado's tax laws and staying informed about federal guidelines, individuals can effectively manage their Social Security benefits and ensure they are compliant with all relevant tax obligations.

FAQ

Does Colorado have a state income tax on Social Security benefits?

+

No, Colorado does not have a state income tax, which means Social Security benefits are generally not subject to state taxation.

Are there any local taxes on Social Security in Colorado?

+

Yes, certain cities and counties in Colorado may have local taxes that apply to Social Security benefits. It’s important to research the specific tax rules in your locality.

How does the federal government tax Social Security benefits?

+

The IRS determines taxability based on provisional income. If this income exceeds certain thresholds, a portion of Social Security benefits may be subject to federal income tax.

What can I do to minimize taxes on my Social Security benefits in Colorado?

+

Work with a financial advisor to develop strategies like optimizing other income sources or taking advantage of tax deductions and credits to reduce the tax impact on your Social Security benefits.