Estate Tax California

California's estate tax system, often a topic of discussion among residents and those considering a move to the Golden State, is an important aspect of financial planning and estate management. With a unique interplay between federal and state tax laws, California's estate tax landscape is distinct and bears careful consideration.

In this comprehensive guide, we delve into the intricacies of California's estate tax, providing an expert analysis to help you navigate this complex area of tax law. From the fundamental principles to the latest developments, we aim to offer a clear understanding of the state's estate tax system and its implications for individuals and families.

Understanding California’s Estate Tax

California, like many states, has its own estate tax regulations that operate in conjunction with federal estate tax laws. This dual-level taxation system can be complex, but understanding the key principles is essential for effective estate planning.

At its core, estate tax is a tax on the transfer of wealth upon an individual's death. It is distinct from inheritance tax, which is levied on the recipients of the estate. In California, the estate tax is based on the value of the taxable estate, which includes most assets owned by the decedent, such as real estate, financial accounts, business interests, and personal property.

California’s Exemption Levels

One critical aspect of California’s estate tax is its exemption levels. As of [Date], the state’s exemption amount is set at [Dollar Amount], which means that estates valued below this threshold are not subject to California’s estate tax. This exemption amount is aligned with the federal estate tax exemption, ensuring that only larger estates incur the state tax.

| California Estate Tax Exemption | [Date] |

|---|---|

| Exemption Amount | [Dollar Amount] |

Tax Rates and Calculations

California’s estate tax rates are progressive, meaning the tax rate increases as the value of the taxable estate increases. The state’s tax rates range from [Lowest Rate]% to [Highest Rate]%, with different rates applying to different tiers of estate values. These rates are applied to the taxable estate amount, which is calculated after deductions and exemptions are applied.

For example, consider an estate valued at [Dollar Amount]. After deductions and exemptions, the taxable estate amount is [Taxable Estate Amount]. The applicable tax rate for this estate, based on its value, is [Applicable Rate]%, resulting in an estate tax liability of [Calculated Tax Amount].

| California Estate Tax Rates | Tax Rate |

|---|---|

| Up to [Threshold Amount] | [Lowest Rate]% |

| [Threshold Amount] to [Threshold Amount] | [Rate]% |

| Above [Threshold Amount] | [Highest Rate]% |

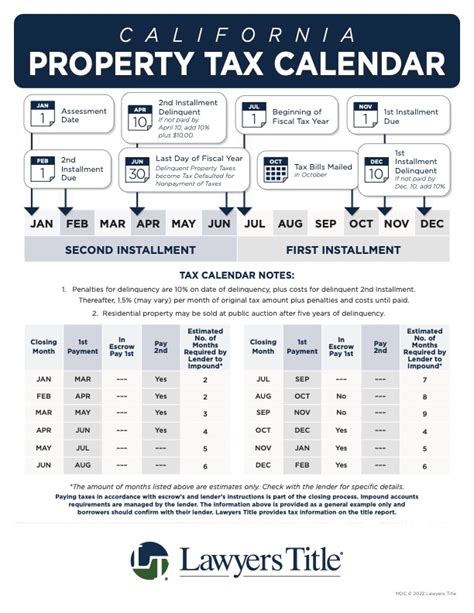

Filing and Payment Deadlines

Estate tax returns in California must be filed within nine months of the decedent’s date of death. This deadline is crucial to ensure timely compliance with the state’s tax regulations. The estate tax is due at the time of filing, and penalties and interest may apply for late payments.

In some cases, an extension of time to file may be granted by the California Franchise Tax Board. However, this extension does not extend the deadline for payment of the estate tax, and interest will continue to accrue on any unpaid tax.

Estate Tax Planning Strategies

Effective estate tax planning can help reduce the tax burden on an estate and ensure more of the decedent’s wealth is passed on to their heirs. Here are some strategies commonly employed in California:

Gifting and Lifetime Transfers

Gifting assets during one’s lifetime can be an effective way to reduce the value of an estate and potentially avoid estate taxes. California, like many states, allows individuals to make annual gifts of up to [Dollar Amount] per recipient without incurring gift taxes. These gifts can include cash, investments, or even real estate.

Lifetime transfers can also include establishing trusts, which can provide asset protection and tax benefits. For example, an irrevocable life insurance trust can own a life insurance policy on the decedent, ensuring the death benefit is not subject to estate taxes.

Charitable Giving

Donations to qualified charitable organizations can offer significant tax benefits. Charitable contributions are deductible from the taxable estate, reducing the overall value of the estate and potentially lowering the estate tax liability. Additionally, charitable gifts can be structured to provide income to the donor or their family for a set period, followed by the remainder going to the charity.

Estate Tax Portability

California, like many states, recognizes the concept of estate tax portability. This allows a surviving spouse to utilize any unused portion of their deceased spouse’s estate tax exemption. By filing Form 706 with the California Franchise Tax Board, the surviving spouse can ensure they maximize their combined estate tax exemption, potentially reducing their overall tax liability.

The Impact of Federal Estate Tax Laws

California’s estate tax system is closely tied to federal estate tax laws. While the federal estate tax exemption is significantly higher than California’s, the interplay between the two systems can create complex tax planning scenarios.

For example, if an estate exceeds the federal exemption but not the California exemption, it may be subject to federal estate tax but not California estate tax. In such cases, careful planning is essential to minimize the federal tax burden while ensuring compliance with state regulations.

Federal Exemption and Portability

The federal estate tax exemption, which is currently set at [Dollar Amount], provides a significant threshold before estate taxes become applicable. This exemption amount is portable between spouses, similar to California’s portability provisions. This means that a surviving spouse can utilize their deceased spouse’s unused exemption, effectively doubling the amount they can pass tax-free.

Real-World Examples and Case Studies

To illustrate the practical implications of California’s estate tax, let’s explore a few case studies.

Case Study 1: Single Individual with High-Value Estate

Consider an individual, John, who resides in California and has an estate valued at [Dollar Amount]. With no surviving spouse or dependents, John’s entire estate is subject to estate tax. After deductions and exemptions, the taxable estate is valued at [Taxable Estate Amount]. Applying California’s tax rates, John’s estate incurs a tax liability of [Calculated Tax Amount].

Case Study 2: Married Couple with Complex Assets

Now, let’s consider a married couple, Sarah and David, who have a combined estate valued at [Dollar Amount]. They have a variety of assets, including real estate, business interests, and significant investment holdings. By utilizing estate planning strategies such as gifting, charitable giving, and portability, they can potentially reduce their overall estate tax liability. For instance, by making annual gifts to their children and establishing a charitable remainder trust, they can lower the taxable value of their estate and take advantage of the tax benefits offered by charitable contributions.

Conclusion: Navigating California’s Estate Tax Landscape

California’s estate tax system, while complex, can be effectively navigated with the right strategies and expert guidance. By understanding the state’s exemption levels, tax rates, and planning opportunities, individuals and families can ensure their estates are structured to minimize tax burdens and maximize the wealth passed on to their heirs.

For those considering a move to California or seeking to optimize their estate planning in the state, it is essential to consult with experienced tax professionals who can provide personalized advice based on your unique circumstances. With careful planning and a proactive approach, you can ensure your estate is managed efficiently and your legacy is protected.

What is the current estate tax exemption in California?

+As of [Date], the estate tax exemption in California is set at [Dollar Amount]. This means that estates valued below this threshold are not subject to California’s estate tax.

How often are California’s estate tax exemption levels adjusted?

+California’s estate tax exemption levels are indexed for inflation and typically adjusted annually to keep pace with rising asset values.

Can I gift assets to reduce my estate’s value for tax purposes?

+Yes, gifting assets during your lifetime can be an effective strategy to reduce the value of your estate and potentially avoid estate taxes. California allows individuals to make annual gifts of up to [Dollar Amount] per recipient without incurring gift taxes.

Are there any tax benefits for charitable contributions in California?

+Absolutely! Donations to qualified charitable organizations can provide significant tax benefits. Charitable contributions are deductible from the taxable estate, potentially reducing your overall estate tax liability.