Fairfax County Car Tax

The topic of car taxes is an important one for vehicle owners, especially in regions like Fairfax County, Virginia, where these taxes can significantly impact personal finances. In this article, we will delve into the specifics of the Fairfax County Car Tax, providing a comprehensive understanding of its implications and offering insights for residents.

Understanding the Fairfax County Car Tax

The Fairfax County Car Tax, officially known as the Vehicle Personal Property Tax, is an annual levy imposed on vehicle owners within the county. It is an essential source of revenue for the county, contributing to the funding of various public services and infrastructure projects. Understanding this tax is crucial for residents, as it directly affects their financial planning and overall cost of vehicle ownership.

Tax Assessment and Calculation

The assessment of the Fairfax County Car Tax is based on the fair market value of the vehicle, which is determined by the Department of Tax Administration (DTA) using industry-standard valuation methods. The tax is calculated as a percentage of this assessed value, with the rate varying depending on the type of vehicle and its usage.

For instance, passenger vehicles are taxed at a different rate compared to commercial vehicles. Additionally, certain vehicle classes, such as electric or hybrid vehicles, may be eligible for tax credits or exemptions, further influencing the final tax amount.

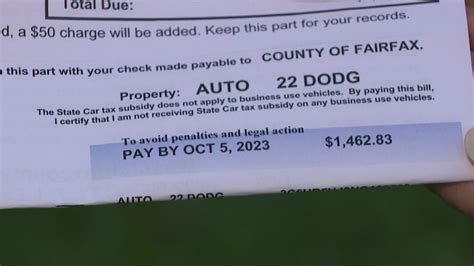

Tax Due Dates and Payment Options

Fairfax County Car Tax bills are typically mailed to vehicle owners in July each year. The tax is due by November 15, and late payments may incur penalties and interest. However, the county offers a variety of payment options to accommodate different financial situations.

Vehicle owners can choose to pay the tax in full by the due date or opt for a two-payment plan, where the tax is divided into two installments, due in November and February. Additionally, the county accepts payments online, by mail, or in person at designated locations, providing flexibility for residents.

| Payment Method | Description |

|---|---|

| Online Payment | Secure online platform for tax payment. |

| Mail-In Payment | Send payment via postal service to the DTA. |

| In-Person Payment | Pay at designated DTA offices or authorized locations. |

Exemptions and Discounts

Fairfax County recognizes certain exemptions and offers discounts to eligible vehicle owners. For instance, veterans and disabled individuals may be entitled to reduced tax rates or exemptions based on specific criteria. Additionally, the county provides a senior citizen discount for residents aged 65 and older.

To claim these exemptions or discounts, vehicle owners must complete the necessary forms and provide supporting documentation to the DTA. It is essential for eligible residents to understand these opportunities to minimize their tax liability.

Managing Car Tax Expenses

For many Fairfax County residents, managing car-related expenses, including the car tax, is a significant financial consideration. Here are some strategies to help residents navigate and minimize the impact of the car tax on their budgets.

Vehicle Selection and Ownership

The choice of vehicle can have a direct impact on the car tax liability. When considering a new vehicle purchase or lease, residents should factor in the potential tax implications. For instance, opting for a lower-value vehicle or a fuel-efficient model can result in a reduced tax assessment.

Additionally, understanding the tax benefits of different vehicle classes, such as electric vehicles or hybrid cars, can be advantageous. These vehicles often qualify for tax credits or reduced tax rates, making them a more financially appealing option in the long term.

Tax Planning and Strategies

Effective tax planning is crucial for managing car tax expenses. Residents should familiarize themselves with the tax rates, due dates, and payment options to ensure they are prepared for the annual tax bill. Budgeting for the car tax as a regular expense can help avoid financial surprises.

Furthermore, staying informed about potential exemptions, discounts, and tax credits can provide opportunities to reduce the tax burden. Regularly reviewing and understanding the tax code, especially when it comes to vehicle ownership, can lead to significant savings over time.

Alternative Transportation Options

For residents seeking to minimize car-related expenses, including the car tax, exploring alternative transportation options can be beneficial. Public transportation, carpooling, or even investing in a more fuel-efficient vehicle can reduce the overall cost of ownership, including the car tax liability.

Additionally, residents can consider sharing transportation costs with others, such as through carpooling or ride-sharing services, which can further reduce individual expenses.

Fairfax County’s Commitment to Transparency

Fairfax County recognizes the importance of transparency and communication when it comes to tax matters. The county strives to provide clear and accessible information to residents regarding the car tax, ensuring that vehicle owners understand their rights, responsibilities, and the impact of the tax on their finances.

Resources and Support

The Department of Tax Administration offers a range of resources to assist residents with their car tax obligations. This includes an online tax calculator, which allows vehicle owners to estimate their tax liability based on their vehicle’s specifications. Additionally, the DTA provides a frequently asked questions (FAQ) section on its website, addressing common concerns and providing guidance on tax-related matters.

Community Engagement and Feedback

Fairfax County actively engages with its residents through community meetings, town halls, and online forums. This provides an opportunity for vehicle owners to voice their concerns, suggest improvements, and receive clarification on tax-related issues. The county values resident feedback and strives to incorporate it into its tax policies and procedures.

Tax Reform and Updates

In its commitment to transparency and fairness, Fairfax County periodically reviews and updates its tax policies. This ensures that the car tax remains aligned with the changing needs of the community and reflects the current economic landscape. Any proposed tax reforms or updates are communicated to residents in advance, allowing for a smooth transition and understanding of any changes.

Future Implications and Outlook

The Fairfax County Car Tax, like many other local taxes, is subject to ongoing evaluation and potential changes. As the county’s needs and priorities evolve, so too may the tax structure and rates. Understanding the potential future implications of the car tax is crucial for residents to make informed financial decisions.

Economic Factors and Tax Stability

The economic climate plays a significant role in determining the future of the car tax. Factors such as inflation, economic growth, and budget constraints can influence the tax rates and the overall tax burden on vehicle owners. Fairfax County strives to maintain a stable and predictable tax environment, ensuring that residents can plan their finances effectively.

Infrastructure Development and Funding

The revenue generated from the car tax is a vital source of funding for infrastructure projects and public services within Fairfax County. As the county continues to grow and develop, the need for adequate funding becomes increasingly important. The car tax plays a crucial role in supporting these initiatives, ensuring that residents have access to well-maintained roads, efficient public transportation, and other essential services.

Alternative Revenue Sources

While the car tax remains a significant source of revenue, Fairfax County is also exploring alternative funding options. This includes diversifying its revenue streams through initiatives such as green energy projects, commercial development, and innovative financing mechanisms. By reducing its reliance on a single tax source, the county can maintain a stable and sustainable financial outlook.

What happens if I don’t pay my Fairfax County Car Tax on time?

+Late payment of the Fairfax County Car Tax may result in penalties and interest. The county encourages timely payments to avoid additional fees. However, if you are unable to pay the full amount by the due date, consider utilizing the two-payment plan or exploring other payment options to avoid late fees.

Are there any tax benefits for electric or hybrid vehicles in Fairfax County?

+Yes, Fairfax County offers tax credits or reduced tax rates for electric and hybrid vehicles. These incentives are designed to encourage the adoption of environmentally friendly vehicles and promote sustainability. Check with the Department of Tax Administration for specific details and eligibility criteria.

How can I stay updated on potential changes to the Fairfax County Car Tax?

+Fairfax County provides regular updates and notifications on its website and through official channels. Subscribe to their newsletters, follow their social media accounts, or visit their website regularly to stay informed about any changes to the car tax, including rate adjustments or new initiatives.