City Of Boston Tax Collector

The City of Boston's Tax Collector's Office is a vital department that plays a crucial role in the financial administration of the city. With a focus on efficient tax collection and management, the office ensures that the city's revenue streams are secured, enabling the provision of essential services and infrastructure development. This article delves into the various aspects of the Tax Collector's Office, its responsibilities, and its impact on the city's financial landscape.

Overview of the Tax Collector’s Office

The City of Boston’s Tax Collector’s Office, headed by the Tax Collector, is a dedicated team of professionals responsible for the assessment, collection, and enforcement of various taxes and fees within the city. This office is a key component of the city’s fiscal machinery, contributing significantly to Boston’s financial stability and growth.

The office operates under the guidance of the Boston Revenue Department, which oversees the city's revenue-generating activities. The Tax Collector's role is pivotal, as they are responsible for ensuring that the city's residents, businesses, and property owners fulfill their tax obligations in a timely and accurate manner.

Key Responsibilities and Services

The Tax Collector’s Office handles a wide range of tax-related responsibilities, including but not limited to:

- Property Tax Management: One of the primary functions is the assessment and collection of property taxes. The office maintains accurate records of all taxable properties in Boston and ensures that property owners receive their tax bills promptly. They also provide assistance to taxpayers in understanding their property assessments and offer payment plans for those facing financial difficulties.

- Business Taxes: The office is responsible for the collection of business taxes, including but not limited to, corporate income tax, payroll tax, and local business taxes. They ensure that businesses operating within Boston’s boundaries comply with tax regulations and contribute to the city’s revenue.

- Real Estate Transfer Tax: When properties change hands in Boston, the Tax Collector’s Office is involved in collecting the Real Estate Transfer Tax. This tax is a significant source of revenue for the city and is crucial for maintaining its financial health.

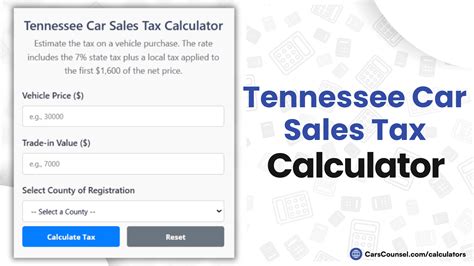

- Personal Property Tax: Businesses and individuals owning personal property within Boston are subject to personal property taxes. The Tax Collector’s Office ensures the accurate assessment and collection of these taxes, which cover items such as vehicles, boats, and other tangible assets.

- Taxpayer Assistance: The office provides valuable assistance to taxpayers, offering guidance on tax regulations, payment options, and resolving any queries or concerns. They also facilitate tax exemptions and abatements for eligible individuals and organizations.

| Tax Category | Tax Rate (%) |

|---|---|

| Property Tax | 1.075 |

| Business Tax | Varies by Industry |

| Real Estate Transfer Tax | 4.5 |

| Personal Property Tax | Varies by Asset Type |

Tax Collection Process and Enforcement

The Tax Collector’s Office employs a systematic approach to tax collection, ensuring that all taxpayers are treated fairly and consistently. Here’s an overview of the process:

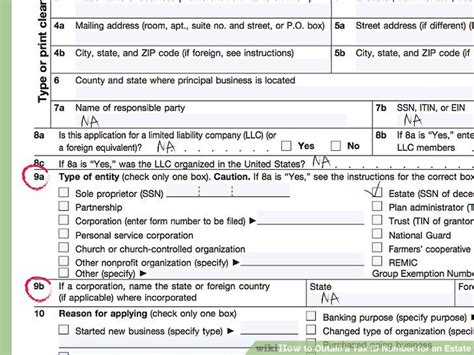

Assessment and Billing

The office begins by assessing the value of taxable properties and businesses within Boston. This process involves analyzing market trends, property records, and other relevant data to determine fair and accurate tax assessments. Once the assessments are finalized, the office generates tax bills and distributes them to taxpayers.

Payment Options and Due Dates

Taxpayers are offered a range of payment options, including online payments, direct bank transfers, and in-person payments at designated locations. The Tax Collector’s Office provides clear guidelines on payment due dates, which are typically aligned with the fiscal year. Late payments may incur penalties and interest, as per the city’s tax regulations.

Enforcement and Collection Actions

In cases where taxpayers fail to meet their tax obligations, the Tax Collector’s Office employs a series of enforcement actions to recover the outstanding taxes. These actions may include:

- Issuing demand notices and reminder letters.

- Placing liens on properties or businesses to secure the tax debt.

- Initiating collection proceedings, which may involve court actions and the potential seizure of assets.

- Working with taxpayers to establish repayment plans to resolve tax debts.

The Tax Collector's Office maintains a balanced approach, aiming to recover tax debts while also providing support and guidance to taxpayers facing financial challenges.

Impact on the City’s Financial Health

The role of the Tax Collector’s Office extends beyond tax collection; it has a profound impact on the city’s financial stability and long-term growth. Here’s how:

Revenue Generation and Budget Allocation

Taxes collected by the office are a primary source of revenue for the city. This revenue is crucial for funding essential services, such as public safety, education, infrastructure development, and social programs. The Tax Collector’s Office ensures that the city’s budget is adequately funded, enabling the delivery of high-quality services to Boston’s residents.

Economic Development and Business Support

By efficiently managing tax collections, the office contributes to a stable and attractive business environment. This encourages economic growth and development, as businesses can plan their financial strategies with certainty. The office’s support and assistance to businesses ensure that they can operate smoothly within the city’s tax framework.

Community Engagement and Equity

The Tax Collector’s Office actively engages with the community to ensure that tax policies are fair and equitable. They provide resources and education to taxpayers, helping them understand their rights and responsibilities. This community engagement fosters trust and ensures that tax collections are conducted in a transparent and accountable manner.

Data-Driven Decision Making

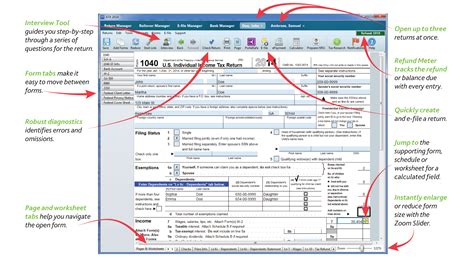

The office utilizes advanced data analytics and technology to optimize tax collection processes. This data-driven approach enables them to identify trends, detect potential tax evasion, and make informed decisions to enhance revenue collection. By leveraging technology, the office can streamline operations and improve overall efficiency.

Conclusion

The City of Boston’s Tax Collector’s Office is a critical pillar of the city’s financial infrastructure. Through its diligent efforts in tax assessment, collection, and enforcement, the office ensures the city’s financial stability and contributes to its long-term prosperity. By providing essential services, supporting economic growth, and promoting community engagement, the Tax Collector’s Office plays a pivotal role in shaping Boston’s future.

How can I pay my taxes to the City of Boston?

+You can pay your taxes to the City of Boston through various methods, including online payments, direct bank transfers, or in-person payments at designated locations. The Tax Collector’s Office provides detailed guidelines on payment options and due dates on their official website.

What happens if I don’t pay my taxes on time?

+Late payments may result in penalties and interest charges. The Tax Collector’s Office will issue reminder notices and take appropriate enforcement actions to recover the outstanding taxes. It’s important to contact the office if you’re facing financial difficulties to discuss potential repayment plans.

Are there any tax exemptions or abatements available in Boston?

+Yes, the City of Boston offers various tax exemptions and abatements to eligible individuals and organizations. These may include senior citizen exemptions, veteran’s exemptions, or abatements for specific circumstances. The Tax Collector’s Office provides information and guidance on applying for these exemptions.

How does the Tax Collector’s Office ensure fair tax assessments?

+The Tax Collector’s Office employs a comprehensive assessment process that considers market trends, property records, and other relevant data. They ensure that tax assessments are accurate and fair, taking into account the unique characteristics of each property or business. Taxpayers can also appeal their assessments if they believe they are incorrect.

What resources does the Tax Collector’s Office offer to taxpayers?

+The Tax Collector’s Office provides a wealth of resources to assist taxpayers. This includes online payment portals, tax guides, and informational brochures. They also offer in-person assistance at their offices and regularly conduct outreach programs to educate taxpayers about their rights and responsibilities.