Tax Id For An Estate

In the realm of financial management and estate planning, understanding the intricacies of tax identification is crucial. When dealing with an estate, be it for a business or personal assets, obtaining a unique tax identifier is a fundamental step. This process ensures proper tax filing and compliance, protecting the interests of the estate and its beneficiaries. In this comprehensive guide, we will delve into the world of tax identification for estates, exploring the key steps, considerations, and best practices to ensure a seamless and compliant process.

Understanding the Tax ID Landscape for Estates

A Tax Identification Number (TIN) is a unique identifier assigned by the Internal Revenue Service (IRS) to individuals, businesses, and estates for tax purposes. For estates, the TIN plays a pivotal role in managing financial affairs, reporting income, and complying with tax obligations. There are two primary types of tax IDs for estates: the Employer Identification Number (EIN) and the Individual Taxpayer Identification Number (ITIN). The choice between these depends on the nature and structure of the estate, as well as its specific tax obligations.

Employer Identification Number (EIN) for Estates

The EIN is a nine-digit number issued by the IRS to identify a business entity. For estates, an EIN is typically required when the estate engages in business activities, employs staff, or has financial dealings that necessitate a unique tax identifier. The EIN serves as a critical tool for estates to report income, deductions, and credits on tax returns, ensuring accurate record-keeping and compliance.

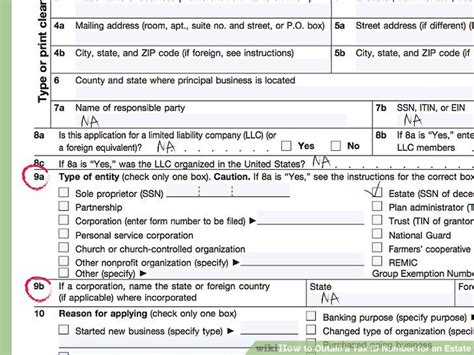

To obtain an EIN for an estate, the executor or administrator must complete Form SS-4, "Application for Employer Identification Number". This form gathers essential information about the estate, including its name, address, and the primary business activity. The IRS provides two methods for submitting the form: online or by mail. The online process offers a faster turnaround, typically providing the EIN immediately upon submission. However, for complex estates or those with unique circumstances, the mail-in option allows for additional documentation and explanation.

| EIN Application Process | Details |

|---|---|

| Online Submission | Real-time issuance of EIN |

| Mail-in Submission | Suitable for complex estates; allows for additional documentation |

Individual Taxpayer Identification Number (ITIN) for Estates

The ITIN is a tax processing number issued by the IRS for individuals who are not eligible for a Social Security Number (SSN) but have U.S. tax filing obligations. For estates, an ITIN may be required when the estate has foreign beneficiaries or when an estate trustee is a non-resident alien. The ITIN ensures that these individuals can comply with their tax obligations, even if they are not eligible for an SSN.

Obtaining an ITIN involves completing Form W-7, "Application for IRS Individual Taxpayer Identification Number", and submitting it with supporting documentation. The application process requires specific identity and foreign status documentation, such as a passport, birth certificate, or national identity card. The IRS provides guidance on acceptable documents and the required level of certification.

| ITIN Application Process | Details |

|---|---|

| Form W-7 Submission | Requires specific identity and foreign status documentation |

| Acceptable Documents | Passport, birth certificate, national identity card, and more |

Navigating the Tax ID Application Process for Estates

Applying for a tax ID for an estate involves a careful consideration of the estate’s structure, business activities, and tax obligations. Here are some key steps and considerations to guide you through the process:

Step 1: Determine the Type of Tax ID Needed

The first step is to assess the nature of the estate and its activities. If the estate engages in business activities, employs staff, or has financial dealings that require a unique tax identifier, an EIN is likely the appropriate choice. On the other hand, if the estate has foreign beneficiaries or a non-resident alien trustee, an ITIN may be necessary to ensure tax compliance.

Step 2: Gather Required Documentation

The application process for both EIN and ITIN requires specific documentation. For an EIN, you’ll need to complete Form SS-4, providing details about the estate’s name, address, and business activities. For an ITIN, Form W-7 must be accompanied by acceptable identity and foreign status documentation.

Step 3: Choose the Application Method

The IRS offers two application methods: online and by mail. The online process is typically faster and more convenient, especially for straightforward applications. However, for complex estates or those with unique circumstances, the mail-in option allows for additional documentation and explanation.

Step 4: Complete and Submit the Application

Carefully review and complete the relevant application form (SS-4 for EIN or W-7 for ITIN) ensuring all information is accurate and up-to-date. Submit the form and supporting documentation to the IRS following their guidelines. For online submissions, ensure you have a reliable internet connection and the necessary software to complete the process.

Step 5: Receive and Manage the Tax ID

Once your application is processed, you will receive the assigned tax ID. For EIN applications, this is typically immediate for online submissions. For ITIN applications, the process may take longer, and you will receive a letter confirming the assigned ITIN. Ensure you securely store the tax ID and use it for all relevant tax filings and financial transactions.

Best Practices for Tax ID Management in Estates

Proper tax ID management is crucial for maintaining compliance and avoiding potential penalties. Here are some best practices to consider:

Keep Accurate Records

Maintain detailed records of all tax-related activities, including the application process, tax returns, and any correspondence with the IRS. This ensures a clear audit trail and facilitates efficient tax management.

Update Contact Information

Keep the IRS informed of any changes in the estate’s contact information, including address, phone number, and email. This ensures that you receive important tax-related communications and can promptly respond to any inquiries.

Stay Informed on Tax Regulations

Tax regulations can change frequently, so stay updated on any new rules or requirements that may impact your estate’s tax obligations. Consult with tax professionals or legal advisors to ensure you are compliant with the latest regulations.

Seek Professional Guidance

Tax ID management for estates can be complex, especially for larger or more complex estates. Consider seeking guidance from tax professionals or estate planning experts who can provide tailored advice and ensure compliance with applicable laws.

Future Implications and Considerations

As the landscape of tax identification for estates evolves, several key considerations and potential implications arise:

Digital Transformation and Tax ID Processes

The IRS is increasingly adopting digital technologies to streamline tax ID applications and management. This trend is expected to continue, with potential for online platforms to offer more sophisticated tools for tax ID management, including real-time tracking of applications and enhanced security features.

Impact of Global Tax Reforms

Global tax reforms, such as the Base Erosion and Profit Shifting (BEPS) project, aim to address tax avoidance and ensure fair taxation. These reforms may impact the tax obligations of estates with international ties, potentially affecting the need for tax IDs and compliance requirements.

Estate Planning and Tax Strategy

The choice of tax ID and its proper management can significantly impact an estate’s tax strategy. Careful planning and consultation with tax advisors can help optimize tax liabilities, ensuring that the estate’s financial goals are met while maintaining compliance.

Compliance and Penalties

Non-compliance with tax ID requirements can result in significant penalties and legal consequences. Estates must ensure they understand their tax obligations and take proactive steps to comply with applicable laws. Consulting with legal and tax professionals can help mitigate these risks.

Conclusion

Obtaining and managing a tax ID for an estate is a critical aspect of financial management and compliance. By understanding the different types of tax IDs, navigating the application process, and adopting best practices for management, estates can ensure smooth financial operations and avoid potential pitfalls. As the tax landscape evolves, staying informed and proactive is key to maintaining compliance and optimizing tax strategies.

Can an estate have both an EIN and an ITIN?

+Yes, an estate can have both an EIN and an ITIN if its circumstances warrant it. For instance, an estate with business activities and foreign beneficiaries may require both identifiers to manage its financial affairs and comply with tax obligations.

How long does it take to receive an EIN for an estate?

+The turnaround time for an EIN application can vary. Online applications are typically processed immediately, while mail-in applications may take several weeks. The complexity of the estate and the volume of applications can also impact processing times.

Are there any penalties for not obtaining a tax ID for an estate?

+Yes, failing to obtain a required tax ID for an estate can result in significant penalties and legal consequences. Estates must ensure they understand their tax obligations and take proactive steps to obtain the necessary identifiers to comply with tax laws.