Personal Property Tax Va

In the state of Virginia, personal property tax is an essential aspect of local government revenue, playing a crucial role in funding vital public services and infrastructure. This tax is levied annually on tangible personal property owned by individuals, businesses, and other entities, and it significantly contributes to the financial stability and development of communities across the Commonwealth.

The administration of personal property tax in Virginia is decentralized, with each locality responsible for assessing, billing, and collecting these taxes. This system allows for a certain level of autonomy and flexibility in tax rates and assessment methods, catering to the unique needs and circumstances of each community. However, it also introduces complexities and variations that can impact taxpayers differently across the state.

Understanding the ins and outs of personal property tax in Virginia is key for both residents and businesses, as it directly affects their financial obligations and planning. This comprehensive guide aims to demystify the process, shedding light on how personal property tax works in Virginia, its implications, and strategies to manage this tax effectively.

Understanding Personal Property Tax in Virginia

Personal property tax in Virginia is a tax levied on tangible personal property, which includes items such as vehicles, boats, airplanes, recreational vehicles, machinery, and equipment. It is distinct from real property tax, which is assessed on real estate, and is an essential source of revenue for localities, funding various public services and infrastructure projects.

The Role of Personal Property Tax in Virginia's Economy

Personal property tax is a significant contributor to Virginia's economy, providing a stable revenue stream for local governments. The tax revenue funds essential services such as public safety, education, transportation, and social services. It also plays a crucial role in maintaining and developing the state's infrastructure, including roads, bridges, and public facilities.

The decentralized administration of personal property tax allows localities to tailor their tax rates and assessment methods to their specific needs and priorities. This flexibility ensures that tax revenues are directed towards addressing local concerns and demands, fostering a sense of community control and investment.

How is Personal Property Tax Calculated in Virginia

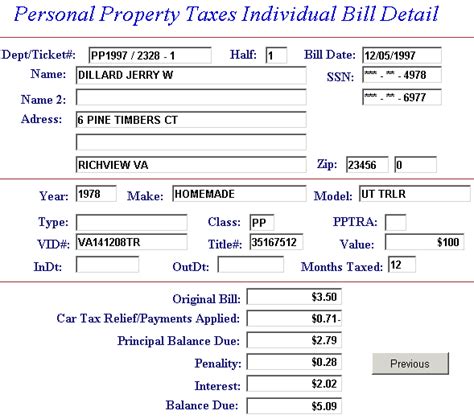

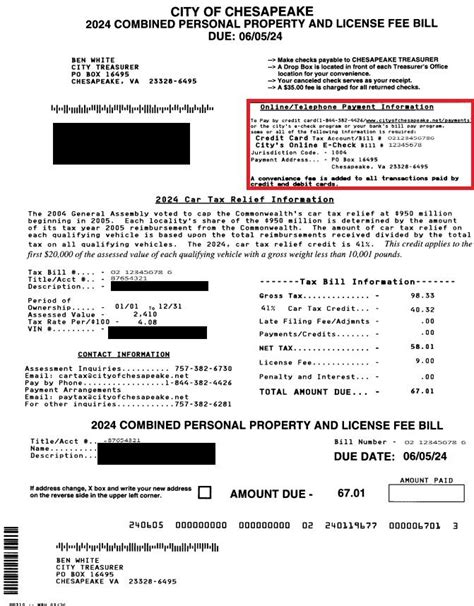

The calculation of personal property tax in Virginia involves several key steps, starting with the assessment of the property's value. Localities employ different methods for valuation, which can include the property's original cost, its current market value, or a predetermined percentage of its value.

Once the property's value is determined, it is multiplied by the applicable tax rate, which is set by the locality. This rate can vary significantly across Virginia, reflecting the diverse financial needs and circumstances of each community. The resulting figure is the annual personal property tax liability for the property owner.

| Assessment Method | Tax Rate (%) | Example Calculation |

|---|---|---|

| Market Value | 4% | $50,000 (property value) x 4% = $2,000 (annual tax) |

| Predetermined Percentage | 3% | $100,000 (property value) x 3% = $3,000 (annual tax) |

It's important to note that certain types of personal property may be exempt from taxation or eligible for reduced rates, depending on the locality and the nature of the property. These exemptions and reductions can significantly impact the overall tax liability for property owners.

The Impact of Personal Property Tax on Individuals and Businesses

Personal property tax in Virginia has a direct and significant impact on both individuals and businesses. For individuals, this tax can represent a substantial financial obligation, particularly for those with valuable personal property such as high-end vehicles or recreational vehicles.

Businesses, on the other hand, may face a more complex situation. They often own a diverse range of tangible personal property, from vehicles and machinery to office equipment and inventory. The accumulation of personal property tax on these assets can lead to a substantial tax burden, impacting the business's cash flow and overall financial health.

Strategies for Managing Personal Property Tax

To effectively manage personal property tax in Virginia, individuals and businesses can employ several strategies. These include:

- Understanding Local Tax Rates: Knowing the tax rates applicable in your locality is crucial. This information can be obtained from the local tax commissioner's office or the locality's website. By understanding these rates, you can better anticipate your tax liability and plan accordingly.

- Staying Informed About Exemptions and Reductions: Virginia offers various exemptions and reduced tax rates for certain types of personal property. For instance, some localities may offer reduced rates for historic vehicles or exempt certain agricultural equipment. Staying informed about these exemptions can help you take advantage of potential savings.

- Maintaining Accurate Records: Proper record-keeping is essential for personal property tax management. Keep detailed records of your personal property, including purchase dates, original costs, and any improvements or upgrades. This information can be valuable when assessing the value of your property for tax purposes.

- Consideration of Tax Implications in Business Planning: For businesses, it's crucial to consider personal property tax implications when making financial decisions. This includes factoring in tax liabilities when budgeting for new equipment purchases or expansion plans. By integrating tax considerations into business planning, you can minimize unexpected tax burdens.

- Exploring Tax Deferral Options: In some cases, Virginia offers tax deferral programs for certain types of personal property, such as agricultural or commercial equipment. These programs allow taxpayers to defer the payment of personal property tax until a later date, providing temporary relief from immediate tax obligations.

By implementing these strategies, individuals and businesses can better manage their personal property tax obligations in Virginia, ensuring they are well-prepared for this annual financial responsibility.

Personal Property Tax Relief Programs in Virginia

Virginia recognizes the potential burden of personal property tax on certain segments of the population and has established various relief programs to assist eligible individuals and businesses. These programs aim to ease the financial strain of personal property tax, making it more manageable for those who qualify.

The Senior Citizen and Disabled Persons Personal Property Tax Relief Program

The Senior Citizen and Disabled Persons Personal Property Tax Relief Program is a significant initiative in Virginia, offering eligible seniors and disabled individuals a credit or reduction on their personal property tax liability. This program is designed to provide financial relief to those who may have limited income and assets but still own personal property subject to taxation.

To qualify for this program, individuals must meet specific criteria, including age and income requirements. The program provides a credit of up to $750 on the personal property tax bill, helping seniors and disabled persons manage their financial obligations more comfortably.

The Agricultural Equipment Personal Property Tax Relief Program

Virginia's Agricultural Equipment Personal Property Tax Relief Program is aimed at supporting the state's agricultural sector by offering reduced tax rates on certain types of equipment used in agricultural operations. This program recognizes the unique challenges faced by farmers and aims to provide them with financial relief.

Eligible agricultural equipment includes tractors, harvesting machinery, irrigation equipment, and other specialized agricultural tools. By offering reduced tax rates on these items, the program helps to lower the overall tax burden for farmers, supporting their operations and promoting the growth of the agricultural industry in Virginia.

The Historic Vehicle Personal Property Tax Relief Program

The Historic Vehicle Personal Property Tax Relief Program is designed to encourage the preservation and appreciation of historic vehicles in Virginia. This program offers a reduced tax rate for vehicles that meet specific historic criteria, such as being at least 25 years old and maintained in a state of historical preservation.

By providing a reduced tax rate for these vehicles, the program incentivizes their preservation and continued use, contributing to the cultural heritage of the state. This initiative also recognizes the unique nature and value of historic vehicles, which often require specialized care and maintenance.

The Future of Personal Property Tax in Virginia

The landscape of personal property tax in Virginia is continually evolving, influenced by various factors such as economic conditions, legislative changes, and technological advancements. As the state's economy and demographics shift, so too will the personal property tax system, adapting to meet the changing needs and circumstances of Virginia's residents and businesses.

Potential Reforms and Their Impact

There is ongoing discussion among policymakers and stakeholders about potential reforms to Virginia's personal property tax system. These discussions often center around finding a balance between providing adequate funding for local governments and easing the tax burden on individuals and businesses.

Potential reforms could include adjusting tax rates, revisiting assessment methods, or exploring new avenues for tax relief. For instance, there have been proposals to introduce a personal property tax cap, which would limit the amount of tax an individual or business could pay on their personal property, providing a safeguard against excessive tax liabilities.

Other potential reforms may focus on streamlining the assessment process, making it more efficient and less burdensome for taxpayers. This could involve leveraging technology to improve data collection and analysis, leading to more accurate assessments and a more transparent tax system.

Emerging Trends and Their Implications

Several emerging trends are shaping the future of personal property tax in Virginia. One such trend is the increasing use of technology in tax administration. Localities are exploring digital platforms and online tools to enhance the tax filing and payment process, making it more convenient and accessible for taxpayers.

Additionally, there is a growing focus on data-driven decision-making in tax administration. By leveraging data analytics, localities can make more informed decisions about tax rates and assessment methods, ensuring that the tax system remains fair and equitable. This data-driven approach can also help identify potential issues or inefficiencies in the system, leading to continuous improvement.

Another emerging trend is the increasing collaboration between localities in tax administration. Some localities are sharing best practices and resources, working together to streamline processes and enhance taxpayer services. This collaborative approach can lead to more consistent and efficient tax administration across Virginia, benefiting both taxpayers and local governments.

Conclusion

Personal property tax in Virginia is a vital component of the state's fiscal landscape, funding essential public services and infrastructure. While it can represent a significant financial obligation for individuals and businesses, understanding the system and employing effective management strategies can help mitigate its impact.

Virginia's personal property tax system, with its decentralized administration and diverse tax rates, provides both opportunities and challenges. However, the state's commitment to tax relief programs and ongoing efforts to reform and improve the system demonstrate a dedication to supporting its residents and businesses. As the future unfolds, Virginia's personal property tax system is poised to adapt and evolve, ensuring it remains a stable and sustainable source of revenue for local governments while also being manageable for taxpayers.

Frequently Asked Questions

What types of personal property are exempt from taxation in Virginia?

+Certain types of personal property are exempt from taxation in Virginia, including household goods, personal effects, and clothing. Additionally, some localities may offer exemptions for specific types of property, such as historic vehicles or agricultural equipment.

How often is personal property tax assessed in Virginia?

+Personal property tax in Virginia is assessed annually. Taxpayers typically receive their tax bill in the late summer or early fall, with payment due by a specified deadline, usually in December or January of the following year.

Can I appeal my personal property tax assessment in Virginia?

+Yes, taxpayers have the right to appeal their personal property tax assessment if they believe it is inaccurate or unfair. The process involves submitting an appeal to the local tax commissioner’s office, providing supporting evidence for the appeal, and potentially attending a hearing to present your case.

Are there any tax incentives for purchasing energy-efficient vehicles in Virginia?

+Yes, Virginia offers a tax credit for the purchase of electric vehicles. This credit is available for both new and used vehicles and can significantly reduce the personal property tax liability for these environmentally friendly vehicles.

How can I stay updated on changes to personal property tax laws and regulations in Virginia?

+To stay informed about changes to personal property tax laws and regulations in Virginia, you can regularly check the Virginia Department of Taxation’s website or subscribe to their email updates. Additionally, you can consult with a tax professional or seek guidance from your local tax commissioner’s office.