Tax Rate For Az

Understanding the tax landscape is crucial for individuals and businesses, especially when considering a move to a new state. Arizona, known for its sunny climate and vibrant communities, offers a unique tax environment that is worth exploring. In this comprehensive guide, we will delve into the intricacies of the tax system in Arizona, providing you with an in-depth analysis and expert insights to help you navigate the financial aspects of living or operating a business in this vibrant state.

Taxation in Arizona: An Overview

Arizona’s tax system is designed to support economic growth and provide essential services to its residents. The state’s tax structure is relatively straightforward, focusing on a combination of income taxes, sales taxes, and property taxes. However, it’s the nuances and specific rates that make the system intriguing and worth examining.

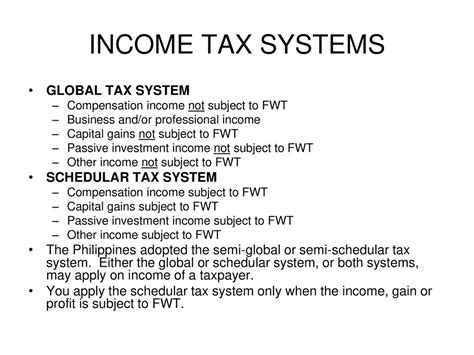

Income Tax: A Personalized Approach

Arizona’s income tax system is tailored to individual circumstances, offering a range of tax brackets and rates. As of the latest information, the state’s income tax structure is as follows:

- Single filers: The tax rate starts at 2.59% for taxable income up to 10,000 and increases progressively up to a maximum rate of 4.50% for income exceeding 150,000.

- Joint filers: The rates are slightly different, with a starting rate of 2.84% for income up to 20,000 and a top rate of 4.50% for income above 300,000.

- Head of Household: This filing status has its own set of brackets, with rates ranging from 2.67% to 4.50% depending on income levels.

It's worth noting that Arizona offers several tax credits and deductions that can significantly impact your overall tax liability. These include credits for dependents, education, and even a credit for being a first-time homebuyer. The state also provides incentives for those engaged in certain business activities, such as research and development.

Sales Tax: A Local Affair

Arizona’s sales tax is a key revenue generator for the state and is applied to the sale of tangible goods and some services. The base sales tax rate in Arizona is 5.6%, but it’s important to understand that this is just the starting point.

Arizona operates on a system of local sales tax jurisdictions, meaning that the total sales tax you pay can vary significantly depending on your location. Each county and city has the authority to levy additional sales taxes, and these can range from 0% to over 5% in some areas. For example, in the bustling city of Phoenix, the total sales tax is currently 8.3%, with the extra percentage points coming from city and county taxes.

To illustrate the variation, let's consider a few examples:

- Tucson: The total sales tax here is 7.1%, making it a more favorable option for those who enjoy a lower tax burden.

- Flagstaff: With a total sales tax of 7.75%, this mountain town offers a slightly higher rate but still competitive compared to other states.

Arizona's sales tax system is complex, and it's crucial to understand the rates in your specific area to make informed financial decisions.

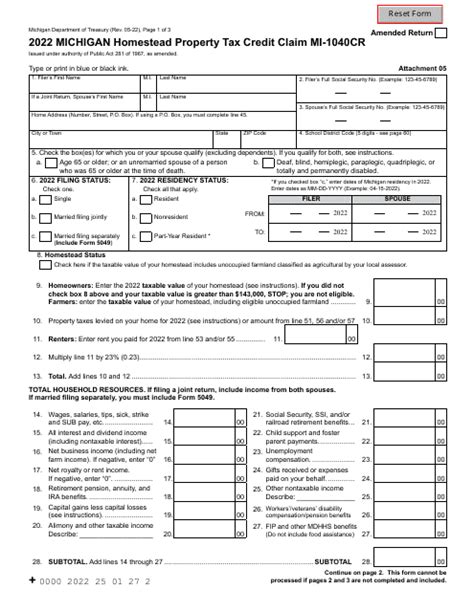

Property Tax: A Fair Assessment

Property taxes in Arizona are assessed on the value of real estate, including land and improvements. The state aims to provide a fair and equitable system, and the rates can vary depending on the location and type of property.

As of the latest data, the average effective property tax rate in Arizona is approximately 0.75%, which is lower than the national average. This rate is calculated based on the assessed value of the property and the tax rate set by the local government. For instance, in Maricopa County, which includes Phoenix, the average effective rate is slightly higher at around 0.85%.

Arizona offers several property tax exemptions and reductions to eligible homeowners, such as the homeowner's exemption, which can reduce the assessed value of a primary residence by up to $10,000.

| County | Average Effective Property Tax Rate |

|---|---|

| Maricopa County | 0.85% |

| Pima County | 0.70% |

| Yavapai County | 0.72% |

| Coconino County | 0.80% |

| Pinal County | 0.78% |

Comparative Analysis: Arizona vs. Other States

To provide a comprehensive understanding, let’s compare Arizona’s tax system with a few other states.

Arizona vs. California

California and Arizona are neighboring states with diverse tax landscapes. While California is known for its high income tax rates, Arizona offers a more competitive environment.

- Income Tax: California has a top marginal rate of 13.3%, significantly higher than Arizona’s 4.5%. This makes Arizona a more tax-friendly option for high-income earners.

- Sales Tax: California’s sales tax is generally higher, with a base rate of 7.25%. However, like Arizona, local jurisdictions can add additional taxes, making the total sales tax variable.

- Property Tax: California’s property tax system is based on Proposition 13, which limits the annual increase in assessed value to 2% or the inflation rate, whichever is lower. This can make Arizona’s property tax system more appealing for long-term homeowners.

Arizona vs. Texas

Texas is often touted as a low-tax state, so how does Arizona compare?

- Income Tax: Texas has no state income tax, giving it a clear advantage over Arizona. However, Arizona’s income tax rates are still relatively low compared to many other states.

- Sales Tax: Texas has a higher base sales tax rate of 6.25%, but local taxes can push the total rate even higher. In some areas, the combined rate can exceed 8%, making Arizona’s sales tax more competitive.

- Property Tax: Texas has one of the highest property tax rates in the nation, with an average effective rate of around 1.75%. Arizona’s property tax rates are significantly lower, making it a more attractive option for homeowners.

Future Implications and Expert Insights

Arizona’s tax system is designed to encourage economic growth and attract businesses and individuals. The state’s competitive tax rates, particularly in income and property taxes, make it an appealing destination.

However, it's essential to stay informed about potential changes. Arizona's tax landscape is not static, and legislative decisions can impact rates and regulations. For instance, the state has recently implemented tax incentives for certain industries, such as film production, to boost the local economy.

Experts suggest that Arizona's tax system is well-positioned to support the state's growing economy. The combination of low taxes and a business-friendly environment is likely to continue attracting investors and businesses, contributing to Arizona's economic prosperity.

As you consider your financial plans, whether personal or business-related, understanding Arizona's tax system is a crucial step. It's a dynamic and evolving landscape, and staying informed can help you make the most of the opportunities it presents.

What are the tax advantages for businesses in Arizona?

+Arizona offers several tax incentives for businesses, including a competitive corporate income tax rate of 4.9% and tax credits for research and development activities. Additionally, the state has no inventory tax or personal property tax, making it an attractive choice for businesses looking to reduce their tax burden.

Are there any tax breaks for homeowners in Arizona?

+Absolutely! Arizona provides property tax exemptions and reductions for homeowners. The homeowner’s exemption, for instance, can reduce the assessed value of a primary residence by up to $10,000, resulting in lower property taxes. Additionally, there are programs like the Property Tax Reassessment Exclusion for Seniors, which can provide significant savings for eligible homeowners.

How does Arizona’s tax system impact retirees?

+Arizona’s tax system is generally favorable for retirees. The state does not tax Social Security benefits, and only a portion of pension and annuity income is taxable. Additionally, the low property tax rates and various tax exemptions make Arizona an attractive retirement destination.