Tarrant County Property Tax Search

Welcome to this comprehensive guide on the Tarrant County Property Tax Search, a vital resource for property owners and investors in the vibrant Tarrant County, Texas. In this detailed article, we will delve into the ins and outs of the property tax system, providing you with valuable insights and practical information. Whether you're a homeowner, a business owner, or a real estate professional, understanding the intricacies of property taxes is crucial for effective financial planning and asset management.

Unveiling the Tarrant County Property Tax Search: A Comprehensive Guide

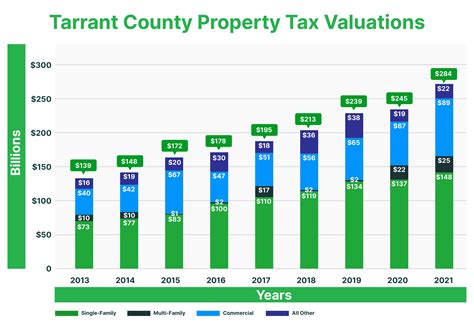

Tarrant County, with its diverse landscapes and thriving communities, is home to a wide range of properties, from residential homes to commercial establishments. The property tax system plays a significant role in the county’s economy, and staying informed about your property tax obligations is essential. In this section, we will explore the key aspects of the Tarrant County Property Tax Search, offering a step-by-step guide to ensure a seamless experience.

Understanding Property Tax Assessments

Property taxes in Tarrant County are based on the assessed value of your property. The Tarrant Appraisal District (TAD), an independent governmental entity, is responsible for appraising properties and determining their taxable value. The appraisal process involves evaluating factors such as location, size, improvements, and market conditions. Property owners receive an annual notice of appraised value, which serves as the basis for tax calculations.

Here's a breakdown of the assessment process:

- Market Value Estimation: TAD appraisers analyze recent sales data and market trends to estimate the market value of properties.

- Property Inspection: Appraisers may conduct physical inspections to assess property features and any improvements.

- Notice of Appraised Value: Property owners receive a notice detailing the appraised value and any changes from the previous year.

- Appeal Process: If you disagree with the appraised value, you have the right to protest and present evidence to support your case.

Exploring the Tarrant County Property Tax Search Portal

The Tarrant County Property Tax Search portal is a user-friendly online platform designed to provide property owners and taxpayers with convenient access to essential information. Here’s how you can make the most of this valuable resource:

- Account Registration: Create an account on the portal to access personalized information and services. Registration is simple and secure.

- Property Search: Utilize the search function to locate your property by address, account number, or parcel ID. The search results provide detailed property information, including ownership details, tax history, and appraisal data.

- Tax Statements and Payments: View and download your current and previous tax statements. The portal offers secure online payment options, allowing you to pay your property taxes conveniently.

- Tax Calendar and Deadlines: Stay informed about important tax dates, deadlines, and payment schedules to ensure timely compliance.

- Assessment Details: Access your property's appraisal records, including the appraised value, exemptions, and any applicable special valuation programs.

- Tax Rate Information: Understand the tax rates applicable to your property, including the county, city, and special district rates. The portal provides transparent tax rate information.

Navigating the Property Tax Payment Process

Paying your property taxes promptly is essential to avoid penalties and maintain a positive relationship with the county. Tarrant County offers a variety of payment methods to accommodate different preferences:

- Online Payments: Make secure payments through the Tarrant County Property Tax Search portal. You can pay with a credit card, debit card, or electronic check.

- Mail-In Payments: Send your tax payment by mail to the designated address, ensuring you include the correct payment coupon.

- In-Person Payments: Visit the Tarrant County Tax Office to make payments in person. The office accepts cash, checks, and money orders.

- Automatic Payment Plans: Enroll in an automatic payment plan to have your taxes deducted from your bank account on a specified date. This option ensures timely payments without the need for manual reminders.

Exemptions and Discounts: Maximizing Your Savings

Tarrant County offers various exemptions and discounts to eligible property owners, helping to reduce their tax liability. Understanding these opportunities can lead to significant savings. Here are some key exemptions and discounts to explore:

| Exemption/Discount | Eligibility Criteria |

|---|---|

| Homestead Exemption | Property must be the primary residence of the owner, and the owner must apply for the exemption. |

| Over-65 Exemption | Property owners who are 65 years or older and meet certain income requirements are eligible. |

| Disabled Veteran Exemption | Veterans with a disability rating of at least 10% may qualify for this exemption. |

| Agricultural Use Valuation | Properties used for agricultural purposes may be eligible for a lower appraisal value. |

| Early Payment Discount | Property owners who pay their taxes early may receive a discount on their tax bill. |

Appealing Your Property Tax Assessment

If you believe your property’s appraised value is inaccurate or unfair, you have the right to appeal. The appeal process allows property owners to present evidence and argue for a lower appraisal. Here’s an overview of the appeal process in Tarrant County:

- Protest Deadline: Property owners have a specified deadline to file a protest, usually within a few months after receiving the notice of appraised value.

- Informal Hearing: Before filing a formal appeal, you may request an informal hearing with the Tarrant Appraisal Review Board (ARB) to discuss your concerns.

- Formal Appeal: If the informal hearing does not resolve the issue, you can file a formal appeal with the ARB. You'll need to provide supporting evidence and arguments to support your case.

- Hearing and Decision: The ARB will schedule a hearing, where you can present your case. The board will make a decision, and you'll receive a written notice of the outcome.

- Further Appeals: If you're not satisfied with the ARB's decision, you have the option to appeal to the District Court or the State Office of Administrative Hearings (SOAH).

Stay Informed: Property Tax News and Updates

Keeping up with the latest news and updates regarding property taxes is essential for making informed decisions. Tarrant County provides various resources to keep taxpayers informed:

- Tarrant County Tax Office Website: Visit the official website for news, announcements, and important updates related to property taxes.

- Email Updates: Subscribe to the Tarrant County Tax Office's email list to receive timely notifications and important reminders.

- Social Media: Follow Tarrant County's social media channels for quick updates and relevant tax-related information.

- Newsletters: Sign up for newsletters or publications specific to property taxes in Tarrant County to stay informed about changes and developments.

Conclusion: Empowering Property Owners with Knowledge

Understanding the Tarrant County Property Tax Search process empowers property owners to manage their tax obligations effectively. By utilizing the online portal, exploring exemptions, and staying informed about tax-related news, you can navigate the property tax landscape with confidence. Remember, timely payments, accurate assessments, and exploring available savings opportunities are key to a smooth and stress-free property tax experience.

How often are property values appraised in Tarrant County?

+Property values in Tarrant County are appraised annually. The Tarrant Appraisal District (TAD) conducts appraisals to determine the taxable value of properties each year.

What happens if I miss the property tax payment deadline?

+Missing the tax payment deadline may result in penalties and interest charges. It’s important to stay informed about payment deadlines and consider enrolling in an automatic payment plan to avoid late payments.

Can I request a copy of my tax statement if I lose it?

+Yes, you can request a copy of your tax statement through the Tarrant County Property Tax Search portal or by contacting the Tarrant County Tax Office. They will provide you with a replacement statement.

Are there any online tools to estimate my property tax bill?

+Yes, the Tarrant County Property Tax Search portal offers an online tax estimator tool. This tool allows you to estimate your property tax bill based on your property’s appraised value and the applicable tax rates.