Trump Child Support Income Tax

The topic of Donald Trump's child support obligations and their potential impact on his income tax filings has sparked curiosity and discussion, particularly given the former President's complex financial dealings and long-standing tax controversies.

As a prominent public figure, Trump's personal life and business dealings have been under intense scrutiny, with his tax returns becoming a subject of great interest to many. While Trump has faced numerous lawsuits and investigations, one aspect that has not received much attention is his potential child support payments and how these might affect his income tax obligations.

Understanding Donald Trump’s Child Support Payments

Donald Trump has five children from three marriages. His child support obligations, if any, would stem from his marriages to Ivana Trump and Marla Maples, as his current wife, Melania Trump, is not eligible for child support under New York law due to their marriage status.

Trump's first marriage to Ivana resulted in three children: Donald Jr., Ivanka, and Eric. His second marriage to Marla produced a daughter, Tiffany. While the details of Trump's child support agreements are not publicly available, it is common for high-profile individuals to negotiate private settlements that may include financial support, asset division, and other arrangements.

Child Support Laws and Agreements

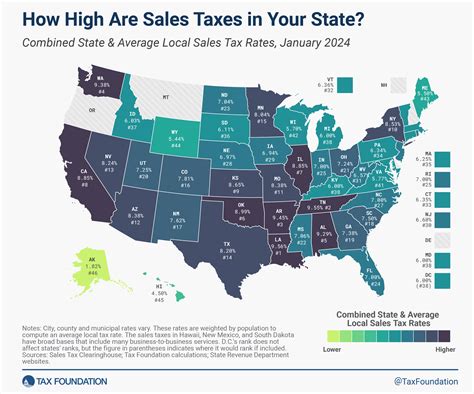

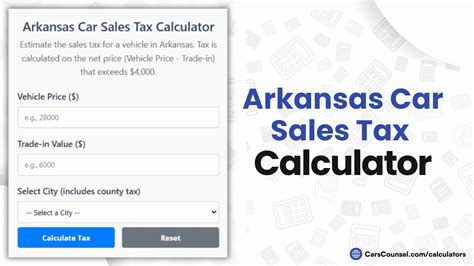

Child support laws vary by state, but typically involve payments from a non-custodial parent to help cover the costs of raising a child. These payments are intended to ensure the child’s well-being and provide for their basic needs, including education, healthcare, and other expenses.

In the case of Trump, if he has private child support agreements with his former wives, these arrangements would likely be governed by the laws of the states in which the agreements were made. Such agreements are typically confidential, and their terms are not disclosed to the public.

| State | Child Support Guidelines |

|---|---|

| New York | The state uses a formula based on the combined parental income and the number of children. Support obligations typically continue until the child turns 21 or becomes emancipated. |

| California | The state uses a similar formula, considering parental income and the needs of the child. Support obligations usually end when the child turns 18 or graduates from high school, whichever occurs later. |

| Florida | Child support is determined based on a guideline amount calculated from the parents' incomes and the number of children. Support typically continues until the child reaches the age of 18 or graduates from high school. |

The Intersection of Child Support and Income Tax

Child support payments and income tax are interconnected in several ways, and understanding these relationships is crucial for anyone with child support obligations.

Tax Deductibility of Child Support Payments

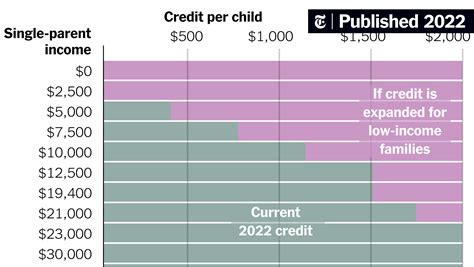

One of the key aspects of child support and taxes is the deductibility of these payments. In the United States, child support payments are generally not tax-deductible for the payer. This means that Trump, or any other individual paying child support, would not be able to reduce their taxable income by the amount of their child support payments.

However, there are certain exceptions and nuances to this rule. For instance, if a child support agreement includes alimony or spousal support payments, those portions may be deductible by the payer and taxable to the recipient. Alimony and child support are treated differently for tax purposes, and it's important to distinguish between the two when drafting legal agreements.

Tax Treatment for Child Support Recipients

On the other hand, child support payments received are generally not taxable to the recipient. This means that if Trump’s former wives receive child support payments, they would not have to include those amounts in their taxable income.

However, as mentioned earlier, if the child support agreement includes alimony or spousal support, those portions may be taxable to the recipient. It's crucial to understand the specific terms of any legal agreement to accurately report and pay taxes.

Reporting Child Support on Tax Returns

When filing income tax returns, individuals with child support obligations or recipients must report these payments accurately. Failure to do so can result in penalties and interest, as well as potential legal consequences.

For payers, the Internal Revenue Service (IRS) may require them to report child support payments on Schedule 1 of Form 1040, the U.S. Individual Income Tax Return. This ensures that the IRS is aware of these payments and can verify the payer's compliance with their tax obligations.

Recipients of child support should also report these payments, even though they are not taxable. This is done to provide transparency and ensure that the IRS has a complete picture of an individual's financial situation.

Trump’s Potential Tax Strategies with Child Support

Given Donald Trump’s reputation for aggressive tax strategies and his history of complex financial dealings, it is reasonable to consider the potential tax implications of his child support obligations.

Structuring Child Support Agreements for Tax Efficiency

When negotiating child support agreements, high-net-worth individuals like Trump may seek to structure these agreements in a way that minimizes their tax liabilities. This could involve incorporating tax-efficient strategies into the terms of the agreement.

For instance, Trump might have negotiated agreements that include provisions for paying child support through a trust or other tax-advantaged vehicle. This could potentially reduce his tax burden by shifting the income and associated tax obligations to the trust or other entity.

Additionally, Trump could have negotiated agreements that allow for the deduction of certain expenses related to his children's upbringing, such as education costs or medical expenses. These deductions could further reduce his taxable income and, consequently, his tax liability.

The Impact of Child Support on Trump’s Tax Controversies

Trump’s child support obligations could have played a role in his tax controversies, particularly if they were not properly reported or accounted for in his tax filings. Given the complex nature of his finances and the numerous investigations into his tax practices, it is possible that child support payments may have been a factor in these disputes.

For example, if Trump failed to report child support payments accurately or attempted to deduct them inappropriately, it could have raised red flags with tax authorities. Such actions could result in audits, penalties, and even criminal investigations.

Furthermore, if Trump's child support obligations were significant and impacted his overall financial situation, they could have influenced his tax strategies and decisions. For instance, he might have chosen to engage in tax-saving strategies or shelter his income through various means to offset the cost of child support payments.

Legal and Ethical Considerations

When discussing child support and taxes, it’s important to consider the legal and ethical implications of various strategies.

Legal Compliance and Reporting

Individuals must ensure that they comply with all legal requirements when it comes to child support and tax obligations. This includes accurately reporting child support payments and other financial arrangements on their tax returns.

Failure to comply with these requirements can result in legal consequences, including fines, penalties, and even criminal charges. It is crucial to seek professional advice and guidance to ensure compliance with the law.

Ethical Considerations in Tax Planning

While tax planning is a legitimate and often necessary practice, it is essential to approach it ethically. Individuals should not engage in tax avoidance or evasion strategies that are illegal or unethical. Instead, they should focus on legal and transparent methods to minimize their tax liabilities.

Trump's reputation for aggressive tax strategies has led to scrutiny and criticism, particularly in light of his refusal to release his tax returns. While it is legal to structure one's finances in a tax-efficient manner, it is important to do so within the bounds of the law and ethical standards.

Conclusion: The Complex World of Child Support and Taxes

The intersection of child support and income tax is a complex and often challenging area of personal finance. For individuals like Donald Trump, with high-profile lives and complex financial situations, this complexity is amplified.

While we may never know the full details of Trump's child support agreements and their impact on his taxes, it is clear that these obligations could have significant financial and legal implications. It is a reminder of the importance of transparency, accuracy, and ethical behavior when dealing with child support and tax obligations.

As we continue to learn more about Trump's financial dealings and the ongoing investigations into his tax practices, it is essential to keep a watchful eye on the potential role of child support in these matters. It serves as a cautionary tale for anyone navigating the intricate world of child support and taxes.

Are child support payments tax-deductible for the payer?

+Generally, child support payments are not tax-deductible for the payer. However, if the agreement includes alimony or spousal support, those portions may be deductible.

Are child support payments taxable for the recipient?

+Typically, child support payments are not taxable for the recipient. However, if the agreement includes alimony or spousal support, those portions may be taxable.

How should child support payments be reported on tax returns?

+Payers should report child support payments on Schedule 1 of Form 1040, while recipients should report them to provide transparency, even though they are not taxable.