Georgia Grocery Tax Rate

In the state of Georgia, grocery items are subject to a unique tax system that varies depending on the nature of the products purchased. This differentiation in tax rates, particularly in the grocery sector, is an intriguing aspect of the state's tax landscape. While some items are taxed at the standard rate, others are considered exempt, creating a nuanced system that benefits certain grocery purchases. This article aims to provide a comprehensive understanding of the Georgia Grocery Tax Rate, exploring the rates, exemptions, and their implications for consumers and businesses alike.

Understanding the Georgia Grocery Tax Rate Structure

The tax system in Georgia regarding groceries is not a one-size-fits-all scenario. Instead, it is categorized into two primary groups: taxable items and exempt items. This categorization plays a pivotal role in the overall tax burden on consumers and the profitability of grocery businesses in the state.

Taxable Grocery Items in Georgia

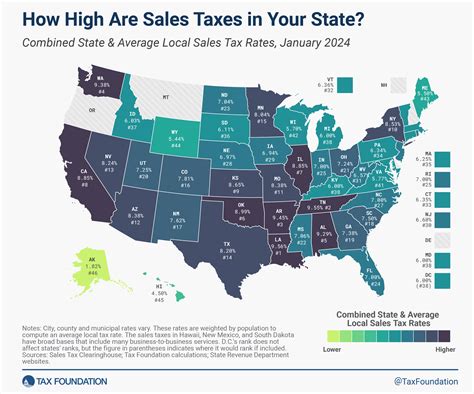

Taxable grocery items in Georgia encompass a broad range of products, including non-essential food items, beverages, and certain household goods. These items are subject to the standard sales tax rate of 4%, which is applied uniformly across the state. This rate is applicable to most grocery purchases, making it a significant consideration for both consumers and retailers.

Here's a table outlining some common taxable grocery items in Georgia and their corresponding tax rates:

| Grocery Category | Tax Rate |

|---|---|

| Processed Foods | 4% |

| Snack Foods | 4% |

| Carbonated Drinks | 4% |

| Alcoholic Beverages | 4% |

| Non-Food Household Items | 4% |

Exempt Grocery Items in Georgia

Georgia’s grocery tax system also includes a category of exempt items, which are not subject to the standard sales tax. This exemption is a significant benefit for consumers, as it reduces the overall cost of certain essential grocery items. The exempt category primarily includes unprepared foods, which are items that require additional preparation or cooking before consumption. These items are considered essential for daily sustenance and are therefore exempt from the state’s sales tax.

The exemption of unprepared foods encourages healthier eating habits by making essential food items more affordable. Here are some examples of exempt unprepared foods in Georgia:

- Fresh Fruits and Vegetables

- Meat and Poultry (unprocessed)

- Eggs

- Dairy Products (milk, cheese, yogurt)

- Bread and Other Bakery Items

Implications for Consumers and Businesses

The nuanced tax system in Georgia has several implications for both consumers and businesses operating in the state’s grocery sector.

Impact on Consumers

For consumers, the varying tax rates on grocery items can significantly impact their household budgets. The exemption of unprepared foods, for instance, encourages healthier eating habits and makes essential groceries more affordable. On the other hand, the standard tax rate on processed and non-essential items can add up over time, especially for larger households or those with specific dietary preferences.

Additionally, the tax system provides an incentive for consumers to purchase healthier, unprepared foods, which can have positive health outcomes in the long run. However, it's essential for consumers to be aware of the tax rates to make informed purchasing decisions and budget effectively.

Impact on Businesses

Grocery businesses in Georgia also face unique challenges and opportunities due to the state’s tax system. On one hand, the tax exemption on unprepared foods can attract more customers, particularly those who are budget-conscious or health-conscious. This can lead to increased sales and profitability for businesses that cater to these consumer preferences.

However, the standard tax rate on other grocery items can impact the overall profitability of these businesses. Businesses may need to strategically price their products to account for the tax burden and remain competitive in the market. Furthermore, understanding the tax system and effectively communicating it to customers can be a strategic advantage for grocery retailers in Georgia.

Future Outlook and Potential Changes

The Georgia grocery tax system is subject to potential changes and developments, particularly as the state’s economy and consumer preferences evolve. While the current system provides a balance between taxing non-essential items and exempting essential foods, there may be calls for reform or adjustments in the future.

One potential development could be an increase in the standard sales tax rate to generate additional revenue for the state. Alternatively, there may be discussions around expanding the list of exempt items to include more grocery categories, especially as the focus on health and wellness continues to grow.

It's important for consumers and businesses alike to stay informed about any potential changes to the Georgia grocery tax rate. Such changes can significantly impact household budgets and business strategies, making it essential to stay updated with the latest tax policies and regulations.

What is the current standard sales tax rate in Georgia for taxable grocery items?

+The standard sales tax rate for taxable grocery items in Georgia is 4%.

Are there any localities in Georgia with additional local sales taxes on groceries?

+Yes, some localities in Georgia may have additional local sales taxes, which can increase the overall tax rate on grocery purchases.

How do I know if a grocery item is taxable or exempt in Georgia?

+Generally, unprepared foods are exempt from sales tax in Georgia, while processed and non-essential items are taxable. It’s advisable to check with the specific retailer or refer to the Georgia Department of Revenue’s guidelines for more detailed information.