Guilford County Property Tax

Welcome to our comprehensive guide on Guilford County property tax. In this article, we will delve into the intricacies of property taxation in Guilford County, North Carolina, providing you with valuable insights and information to navigate this important aspect of homeownership. Whether you're a current resident or considering a move to this vibrant county, understanding the property tax landscape is crucial for effective financial planning.

Understanding Guilford County Property Taxes

Guilford County, located in the heart of North Carolina, boasts a thriving community and a diverse range of residential areas. As a property owner in this county, you become a vital part of the local economy and are responsible for contributing to its growth and development through property taxes. These taxes not only support essential services but also play a role in shaping the county’s future.

Property taxes in Guilford County are assessed based on the value of your property and are used to fund various public services, including education, public safety, infrastructure, and more. The revenue generated from these taxes ensures that the county can provide quality services to its residents and maintain a high standard of living.

The Tax Assessment Process

The Guilford County Tax Office is responsible for assessing the value of properties within the county. This process involves a thorough evaluation of each property, taking into account factors such as location, size, condition, and recent sales of similar properties. The assessed value is then used as the basis for calculating your property taxes.

It's important to note that the assessment process aims to ensure fairness and accuracy. The Tax Office strives to assign values that reflect the true market value of properties, ensuring that taxpayers are not overburdened while also providing adequate funding for essential services.

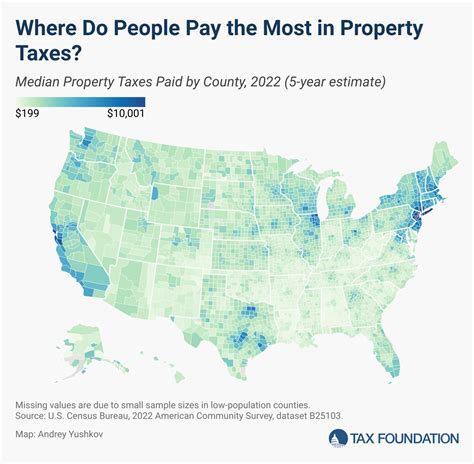

Property Tax Rates in Guilford County

The property tax rate in Guilford County is determined by the county commissioners and is expressed in cents per $100 of assessed property value. This rate can vary from year to year, depending on the budget needs and priorities of the county. It’s essential to stay updated on the current tax rate to accurately estimate your property tax liability.

Currently, the combined tax rate for Guilford County includes both the county tax rate and the tax rates for municipalities within the county. These rates can differ based on the specific municipality in which your property is located. For example, the tax rate for the city of Greensboro may differ from that of High Point or any other municipality.

| Municipality | Tax Rate (per $100 assessed value) |

|---|---|

| Guilford County | 69.70 |

| Greensboro | 59.80 |

| High Point | 55.60 |

| Other Municipalities | Varies |

Calculating Your Property Taxes

To calculate your property taxes in Guilford County, you’ll need to multiply the assessed value of your property by the applicable tax rate for your municipality. Here’s a simple formula to estimate your tax liability:

Property Taxes = Assessed Value x Tax Rate

Let's say your property in Guilford County has an assessed value of $200,000, and you reside in the city of Greensboro. Using the tax rate of 59.80 cents per $100 of assessed value, your annual property tax bill would be calculated as follows:

Property Taxes = $200,000 x 0.0598 = $11,960

This estimation provides a rough idea of your property tax liability. It's worth noting that additional factors, such as any applicable exemptions or discounts, may further impact the final amount.

Property Tax Exemptions and Discounts

Guilford County offers various property tax exemptions and discounts to eligible homeowners, helping to reduce their tax burden. These exemptions and discounts can significantly impact your property tax liability, so it’s crucial to understand the options available to you.

Homestead Exemption

The Homestead Exemption is one of the most common property tax reliefs available in Guilford County. This exemption reduces the taxable value of your primary residence, providing a discount on your property taxes. To qualify for the Homestead Exemption, you must meet specific residency and income requirements, which are subject to change annually.

| Homestead Exemption Eligibility | Criteria |

|---|---|

| Residency | Own and occupy the property as your primary residence |

| Income | Household income must not exceed $34,000 (subject to change) |

Senior Citizen Exemption

Guilford County also offers a Senior Citizen Exemption to eligible homeowners aged 65 or older. This exemption reduces the taxable value of your property, providing a significant discount on your property taxes. To qualify, you must meet specific residency, age, and income requirements.

| Senior Citizen Exemption Eligibility | Criteria |

|---|---|

| Age | At least 65 years old |

| Residency | Own and occupy the property as your primary residence |

| Income | Household income must not exceed $34,000 (subject to change) |

Other Exemptions and Discounts

In addition to the Homestead and Senior Citizen Exemptions, Guilford County offers various other exemptions and discounts, including:

- Disabled Veteran Exemption

- 100% Disabled Person Exemption

- Agricultural and Forestland Use Valuation

- Historic Preservation Exemption

- Environmental Conservation Exemption

Each exemption has its own eligibility criteria and application process. It's recommended to consult with the Guilford County Tax Office or a tax professional to determine which exemptions you may qualify for and to ensure a smooth application process.

Payment Options and Deadlines

Guilford County provides several convenient payment options for property taxes, allowing homeowners to choose the method that best suits their needs. Understanding the payment options and deadlines is crucial to avoid late fees and penalties.

Payment Options

- Online Payment: You can make your property tax payments conveniently online through the Guilford County Tax Office website. This option offers a secure and efficient way to pay your taxes, with real-time confirmation of your payment.

- Mail-In Payment: If you prefer a more traditional approach, you can mail your payment to the Guilford County Tax Office. Ensure that you include the correct remittance form and make your check payable to the “Guilford County Tax Collector.”

- In-Person Payment: For those who prefer face-to-face interactions, the Guilford County Tax Office accepts payments in person during regular business hours. You can visit their office and make your payment by cash, check, or money order.

- Electronic Funds Transfer (EFT): Guilford County offers an EFT option, allowing you to set up automatic payments from your bank account. This method ensures timely payments without the need for manual reminders.

Payment Deadlines

Property taxes in Guilford County are due annually, and it’s important to stay on top of the payment deadlines to avoid late fees and potential interest charges. The Tax Office typically sends out tax bills in the late summer or early fall, with a due date set for early January of the following year.

It's recommended to make your payment as soon as possible after receiving your tax bill to avoid any last-minute rush and potential delays. If you miss the initial due date, you may be subject to a late payment penalty, which can accrue over time.

Appealing Your Property Tax Assessment

If you believe that your property has been overvalued or you have concerns about your tax assessment, Guilford County provides a formal appeals process. This process allows homeowners to challenge their property’s assessed value and potentially reduce their tax liability.

Steps to Appeal

- Review Your Assessment: Carefully review your property tax assessment notice, noting any discrepancies or errors. The assessment notice should provide detailed information about your property’s characteristics and the basis for the assessed value.

- Gather Evidence: Collect evidence to support your appeal, such as recent sales of similar properties in your area, appraisals, or any relevant documentation that demonstrates your property’s true value.

- Contact the Tax Office: Reach out to the Guilford County Tax Office to discuss your concerns and initiate the appeals process. They can provide guidance on the specific procedures and deadlines for filing an appeal.

- File an Appeal: Follow the instructions provided by the Tax Office to file your appeal. This typically involves completing an appeal form and submitting it along with any supporting documentation within the specified timeframe.

- Hearing or Review: Depending on the nature of your appeal, you may be invited to a hearing or a review by the Tax Office or the Guilford County Board of Equalization and Review. Prepare your case and present your evidence to support your claim.

- Decision and Notification: After the hearing or review, the Tax Office or the Board will make a decision on your appeal. You will receive a notification of the outcome, which may result in a change to your property’s assessed value and, consequently, your property taxes.

Tips for a Successful Appeal

- Be timely: Ensure you meet all deadlines for filing your appeal and providing any required documentation.

- Provide comprehensive evidence: Gather as much supporting evidence as possible to strengthen your case.

- Seek professional advice: Consider consulting a tax professional or real estate appraiser to guide you through the appeals process and provide expert insights.

- Stay organized: Keep all relevant documents and correspondence related to your appeal organized and easily accessible.

Stay Informed and Plan Ahead

Understanding the property tax landscape in Guilford County is an essential aspect of responsible homeownership. By staying informed about tax rates, assessment processes, and available exemptions, you can effectively plan your financial strategies and ensure compliance with local regulations.

Remember to regularly check the Guilford County Tax Office website for updates, announcements, and important deadlines. Additionally, consider setting reminders for property tax payment due dates to avoid any unexpected financial burdens.

Conclusion

Guilford County’s property tax system plays a vital role in funding essential services and contributing to the county’s growth. As a homeowner, your property taxes are an investment in the community and its future. By staying informed, utilizing available exemptions, and paying your taxes promptly, you become an active participant in shaping the county’s success.

We hope this comprehensive guide has provided you with valuable insights into Guilford County property taxes. For further information or to explore specific scenarios, don't hesitate to reach out to the Guilford County Tax Office or consult with a trusted tax professional. Stay informed, plan ahead, and continue to be a proud contributor to the vibrant community of Guilford County.

How often are property tax assessments conducted in Guilford County?

+Property tax assessments in Guilford County are conducted annually. The Tax Office reassesses properties each year to ensure that the assessed values remain accurate and up-to-date.

Can I pay my property taxes in installments?

+Yes, Guilford County offers an installment payment plan. You can choose to pay your property taxes in two equal installments, with the first installment due by January 5th and the second installment due by June 5th. This option provides flexibility for homeowners who prefer to spread out their payments.

Are there any penalties for late property tax payments?

+Yes, Guilford County imposes late payment penalties for property taxes. If you fail to pay your taxes by the due date, a penalty of 2% is applied to the unpaid balance for each month or part thereof that the payment is late. It’s important to note that penalties can accumulate over time, so it’s best to pay on time to avoid additional costs.

Can I receive a discount if I pay my property taxes early?

+No, Guilford County does not offer early payment discounts for property taxes. However, by paying your taxes promptly, you can avoid late fees and ensure a smooth financial planning process.