Police Tax

In the realm of public services and government operations, the concept of a "Police Tax" has emerged as a crucial topic of discussion and debate. This tax, dedicated specifically to funding police departments and related law enforcement activities, has garnered significant attention from policymakers, economists, and the public alike. As society grapples with issues of public safety, criminal justice reform, and the allocation of tax dollars, the Police Tax stands as a critical mechanism for ensuring the financial sustainability of law enforcement agencies.

This article aims to delve deep into the intricacies of the Police Tax, exploring its historical context, economic implications, and the multifaceted impact it has on communities and individuals. By analyzing real-world examples, we will gain a comprehensive understanding of how this tax functions, its effectiveness in supporting police operations, and the potential alternatives and reforms that could shape its future.

The Evolution of Police Taxation: A Historical Perspective

The concept of taxing citizens to fund law enforcement is not a novel idea; its roots can be traced back to ancient civilizations. In ancient Rome, for instance, a vigilantur tax was levied on citizens to finance night watchmen and security forces. Similarly, medieval European towns often relied on local taxes to maintain their own militias or police forces.

In the modern era, the concept reemerged as urban areas struggled with crime and disorder. The early 19th century saw the rise of professional police forces in Europe, which were initially funded through a combination of local taxes and government grants. This model was adopted by many Western countries, including the United States, where police departments became a fixture of local government.

The 20th century brought significant changes to police funding. With the expansion of government services and the introduction of income taxes, police budgets became increasingly integrated into broader municipal or state budgets. This shift meant that police funding was no longer a distinct line item but rather a part of the overall tax base, often subject to fluctuations in economic conditions and political priorities.

Understanding the Police Tax: Definitions and Mechanisms

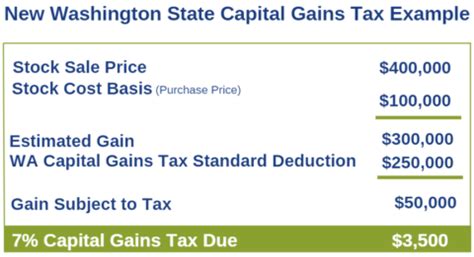

The term "Police Tax" can encompass a range of taxation methods aimed at supporting law enforcement. These include dedicated property taxes, sales taxes earmarked for police operations, or special assessments on businesses or individuals.

Dedicated Property Taxes

In many jurisdictions, a portion of property taxes is specifically allocated to fund police departments. For instance, in the city of Chicago, a 0.12% property tax surcharge is imposed to support the Chicago Police Department. This additional tax is typically calculated as a percentage of the assessed property value, with the proceeds going directly to the police budget.

| Jurisdiction | Police Tax Rate |

|---|---|

| Chicago, IL | 0.12% |

| Los Angeles County, CA | 0.01% |

| New York City, NY | 0.17% |

Sales Taxes for Law Enforcement

Some regions opt for a sales tax approach, where a portion of the sales tax revenue is dedicated to police operations. For example, in the state of California, a 1% statewide sales tax is used to fund local law enforcement agencies. This tax is levied on the sale of most goods and services, with the proceeds distributed to police departments based on population and crime statistics.

Special Assessments and Fees

In certain cases, police departments may impose special assessments or user fees to generate revenue. These can range from licensing fees for businesses, such as liquor licenses or towing services, to special assessments on properties with higher-than-average crime rates. These mechanisms are designed to ensure that those who benefit from police services contribute directly to their funding.

Economic Impact and Allocation of Police Tax Funds

The economic implications of a Police Tax are multifaceted. For taxpayers, it represents an additional financial burden, especially in regions with high property values or sales tax rates. However, advocates argue that this tax ensures a stable and dedicated funding stream for police operations, which can lead to improved public safety and reduced crime rates.

The allocation of Police Tax funds is a critical aspect of its effectiveness. In many jurisdictions, these funds are used to support a wide range of police activities, including:

- Salaries and benefits for police officers and staff.

- Equipment and technology upgrades, such as body-worn cameras, vehicles, and communication systems.

- Training programs to enhance officer skills and community relations.

- Community outreach initiatives aimed at crime prevention and engagement.

- Specialized units like SWAT teams or K-9 units.

- Maintenance and operational costs of police facilities.

The specific allocation varies based on local needs and priorities. For instance, in regions with high gang activity, a larger portion of the Police Tax might be directed towards gang task forces and community intervention programs. Conversely, in areas with aging infrastructure, a significant share could be allocated to facility upgrades.

Case Studies: Real-World Examples of Police Tax Implementation

Los Angeles County's Property Tax Allocation

Los Angeles County, California, is home to one of the largest and most diverse populations in the United States. To fund its extensive law enforcement operations, the county has implemented a 0.01% property tax dedicated solely to the Los Angeles County Sheriff's Department. This tax, though small in percentage, generates substantial revenue due to the county's high property values.

The proceeds from this tax are used to support a wide range of services, including:

- Patrol operations in unincorporated areas and contract cities.

- Investigation of major crimes, including homicides and sexual assaults.

- Management of county jails and detention facilities.

- Specialized units for gang enforcement and homicide prevention.

- Community programs focused on youth development and crime prevention.

New York City's Sales Tax for Law Enforcement

New York City, known for its high sales tax rate, has allocated a 0.17% sales tax specifically for law enforcement purposes. This tax, which is added to the city's already elevated sales tax, generates significant revenue for the New York Police Department (NYPD). The funds are used to support various initiatives, including:

- Counterterrorism efforts and intelligence gathering.

- Community policing programs in high-crime neighborhoods.

- Technology upgrades for real-time crime analysis and surveillance.

- Training and recruitment to maintain a robust police force.

- Special events and crowd control operations.

Criticisms and Alternatives to the Police Tax

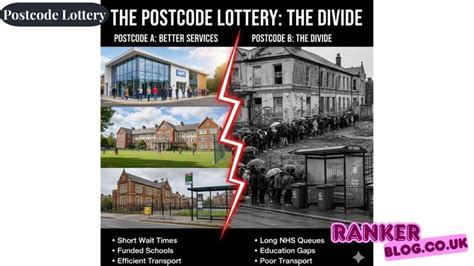

Despite its widespread implementation, the Police Tax has faced criticism from various quarters. Critics argue that it places an undue burden on taxpayers, especially those in low-income communities, and may not always lead to improved public safety outcomes.

Alternatives to the Police Tax include:

General Fund Allocation

In some jurisdictions, police funding is derived from the general fund, which is a pool of revenue from various taxes and fees. This approach allows for more flexibility in budget allocation, as police departments compete with other government services for funding. However, it can also lead to funding shortages during economic downturns or when other government priorities emerge.

Community-Based Policing Initiatives

Another alternative is to shift focus towards community-based policing initiatives, which emphasize crime prevention through community engagement and social services. These programs often rely on grants and donations rather than dedicated taxes. While they may not provide the same level of funding as a Police Tax, they can foster stronger community-police relations and address root causes of crime.

The Future of Police Taxation: Reforms and Implications

As society continues to grapple with issues of public safety, criminal justice reform, and economic inequality, the future of the Police Tax remains uncertain. Some policymakers advocate for a reevaluation of the tax, suggesting that it could be restructured to provide more equitable funding or to incentivize certain types of policing practices.

One potential reform is the introduction of a progressive Police Tax, where higher-income earners or property owners contribute a larger share. This approach could alleviate the burden on lower-income individuals while still providing adequate funding for law enforcement. Additionally, some experts suggest linking Police Tax revenues to performance metrics, ensuring that departments with effective strategies receive additional funding.

Furthermore, the growing emphasis on data-driven policing and evidence-based practices may lead to a shift in how Police Tax funds are allocated. Departments that demonstrate successful crime reduction strategies or innovative community engagement programs could receive greater funding, incentivizing the adoption of best practices.

In conclusion, the Police Tax represents a critical mechanism for funding law enforcement operations, with real-world implications for public safety and community well-being. As we navigate the complexities of modern policing, a nuanced understanding of the Police Tax's role, impact, and potential for reform is essential. By examining its historical context, economic implications, and real-world applications, we can make informed decisions about its future and ensure that our law enforcement agencies are adequately funded and aligned with the needs and values of the communities they serve.

What is the primary purpose of a Police Tax?

+

The primary purpose of a Police Tax is to provide dedicated funding for police departments and law enforcement agencies. This tax ensures a stable revenue stream for essential services such as salaries, equipment, training, and community programs.

How is the Police Tax different from other forms of taxation?

+

The Police Tax is specifically earmarked for law enforcement, whereas other forms of taxation contribute to a broader range of government services. This dedicated funding mechanism ensures that police departments have the necessary resources to operate effectively.

Are there any alternatives to the Police Tax for funding law enforcement?

+

Yes, alternatives include allocating funds from the general fund, which is a pool of revenue from various taxes and fees, or relying on grants and donations for community-based policing initiatives. These approaches offer different advantages and considerations.

How does the Police Tax impact taxpayers?

+

The impact on taxpayers varies based on the type of Police Tax and the jurisdiction. Property taxes, for instance, may affect homeowners more significantly, while sales taxes can impact all consumers. However, the dedicated funding can lead to improved public safety outcomes.

What are some potential reforms for the Police Tax system?

+

Potential reforms include introducing a progressive Police Tax to alleviate the burden on lower-income individuals and linking funding to performance metrics. These reforms aim to make the system more equitable and incentivize effective policing practices.