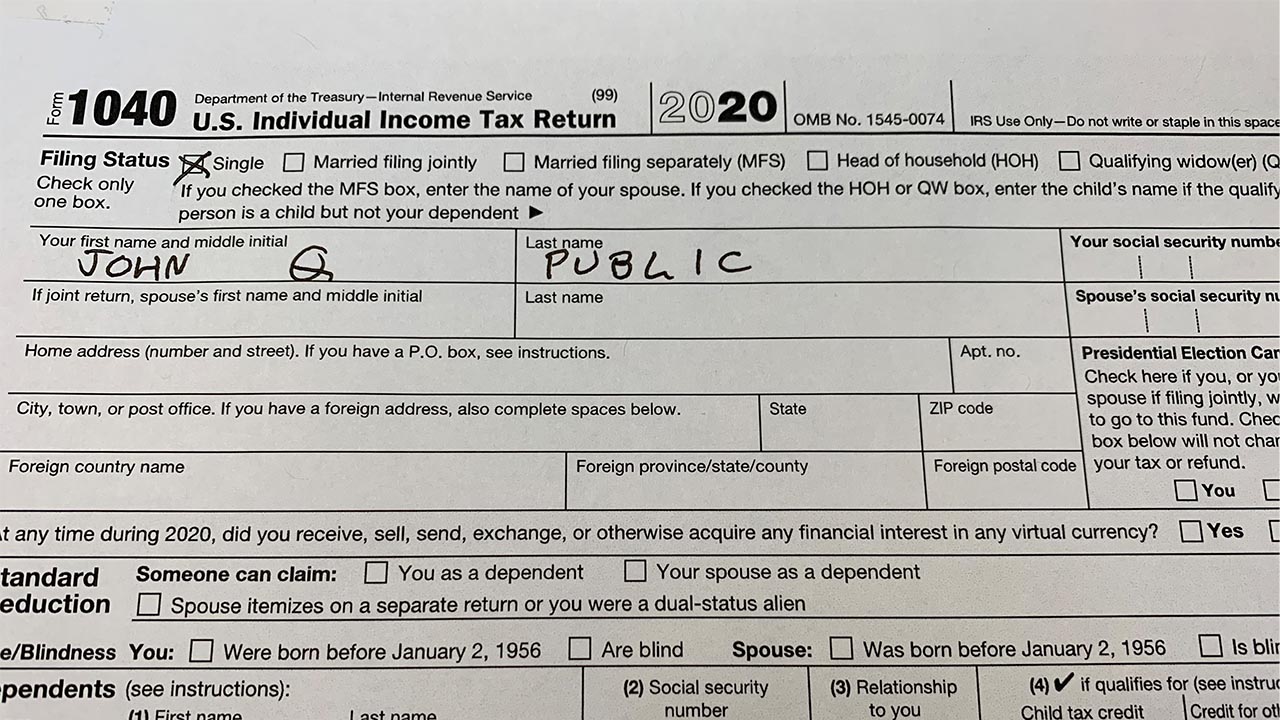

2020 Tax Return

The 2020 tax year was an extraordinary period, marked by the global pandemic and its economic repercussions. This unprecedented situation presented unique challenges and opportunities for taxpayers, making the 2020 tax return a pivotal event for many individuals and businesses.

Understanding the Context: The Impact of COVID-19

The onset of the COVID-19 pandemic in 2020 disrupted lives and economies worldwide. Governments implemented various measures to mitigate the crisis, including stimulus packages, tax relief, and extended filing deadlines. These extraordinary circumstances created a complex landscape for taxpayers, requiring a nuanced understanding of the evolving tax regulations.

For instance, the CARES Act, a significant legislative response in the US, introduced stimulus payments, expanded unemployment benefits, and provided relief for businesses. Understanding how these measures intersected with personal and business finances was crucial for an accurate 2020 tax return.

Key Considerations for the 2020 Tax Return

Stimulus Payments and Tax Credits

One of the most notable aspects of the 2020 tax return was the treatment of stimulus payments and tax credits. The Economic Impact Payments (EIP) provided a much-needed financial boost to millions of Americans. However, many taxpayers received these payments based on their 2018 or 2019 tax returns, which might not reflect their 2020 financial situation accurately. It was essential to ensure that the correct amount of EIP was reported and that any adjustments were made to avoid overpayment or underpayment.

Additionally, the Child Tax Credit and Recovery Rebate Credit were expanded under the CARES Act. Taxpayers needed to navigate these changes carefully, especially those with eligible children or those who qualified for the Recovery Rebate Credit based on their 2020 income.

Tax Relief for Businesses

Businesses faced significant challenges in 2020, and the tax code offered several relief measures. The Paycheck Protection Program (PPP) provided forgivable loans to small businesses, and the forgiveness of these loans had tax implications. It was critical for businesses to understand the tax treatment of PPP loans and ensure they were correctly reflected on their tax returns.

Furthermore, businesses could take advantage of various tax credits and deductions, such as the Employee Retention Credit and the Work Opportunity Tax Credit. These incentives were designed to support businesses and encourage the retention of employees during the economic downturn.

Extended Filing Deadlines

The IRS and many state tax authorities extended filing deadlines in response to the pandemic. The initial deadline for the 2020 tax return was moved from April 15, 2021, to May 17, 2021, providing taxpayers with additional time to gather the necessary documentation and navigate the complex tax landscape.

However, despite the extended deadline, it was essential for taxpayers to remain diligent and not delay their tax preparation unnecessarily. Early filing ensured a faster refund and reduced the risk of errors or penalties.

Navigating the 2020 Tax Landscape

The 2020 tax return required a careful analysis of individual and business circumstances. Taxpayers needed to consider their financial position, the impact of government relief measures, and the changing tax regulations.

For individuals, key considerations included:

- The impact of job loss or reduced income on tax liability.

- Eligibility for tax credits and deductions, such as the Earned Income Tax Credit and Child and Dependent Care Credit.

- Reporting stimulus payments and any adjustments needed.

Businesses, on the other hand, faced challenges such as:

- Determining the tax treatment of PPP loans and other government assistance.

- Maximizing tax credits and deductions to improve cash flow.

- Navigating complex tax regulations, especially for those operating in multiple states.

The Role of Tax Professionals

The complexity of the 2020 tax landscape highlighted the importance of tax professionals. CPAs, enrolled agents, and tax attorneys played a crucial role in guiding taxpayers through the process. Their expertise ensured that taxpayers understood their rights, obligations, and opportunities under the tax code.

Tax professionals provided valuable services such as:

- Interpreting the impact of COVID-19 relief measures on tax returns.

- Maximizing tax credits and deductions to reduce tax liability.

- Assisting with the accurate reporting of stimulus payments and forgivable loans.

- Providing strategic advice to businesses on tax planning and compliance.

Looking Ahead: The Legacy of the 2020 Tax Return

The 2020 tax return served as a testament to the resilience and adaptability of taxpayers and the tax system. It highlighted the importance of staying informed about tax regulations, especially during times of economic upheaval.

As we move forward, the lessons learned from the 2020 tax year will continue to shape tax planning and compliance. Taxpayers and professionals must remain vigilant and proactive, especially with the potential for further economic disruptions.

The 2020 tax return also underscores the value of tax planning throughout the year. By staying informed and seeking professional guidance, taxpayers can optimize their tax positions and ensure compliance with the ever-evolving tax landscape.

Key Takeaways

- The 2020 tax return was a complex process due to the impact of the COVID-19 pandemic.

- Taxpayers had to navigate stimulus payments, tax credits, and relief measures while adhering to extended filing deadlines.

- Tax professionals played a vital role in guiding taxpayers through this challenging tax landscape.

- The lessons learned from the 2020 tax year emphasize the importance of proactive tax planning and staying informed about tax regulations.

Conclusion

The 2020 tax return was a unique and challenging experience, but it also presented opportunities for taxpayers to optimize their tax positions. By understanding the impact of the pandemic on their finances and seeking professional guidance, taxpayers were able to navigate the complex tax landscape and emerge with a clearer understanding of their tax obligations and opportunities.

FAQs

How did the COVID-19 pandemic affect the 2020 tax return process?

+The COVID-19 pandemic significantly impacted the 2020 tax return process. Governments implemented various relief measures, extended filing deadlines, and introduced new tax credits and deductions. Taxpayers had to navigate these changes while adapting to the economic challenges brought about by the pandemic.

What were some of the key tax credits and deductions available in the 2020 tax return?

+The 2020 tax return offered several key tax credits and deductions, including the Economic Impact Payments (stimulus checks), the Child Tax Credit, the Recovery Rebate Credit, the Earned Income Tax Credit, and the Child and Dependent Care Credit. Businesses also had access to tax credits like the Employee Retention Credit and the Work Opportunity Tax Credit.

How did the Paycheck Protection Program (PPP) loans impact the 2020 tax return for businesses?

+The PPP loans provided forgivable funding to small businesses during the pandemic. The tax treatment of these loans was a critical consideration for businesses. The forgiveness of PPP loans was generally excluded from taxable income, but businesses needed to ensure they met the requirements for forgiveness and accurately reported the loans on their tax returns.

What role did tax professionals play in the 2020 tax return process?

+Tax professionals, including CPAs, enrolled agents, and tax attorneys, played a vital role in guiding taxpayers through the complex 2020 tax landscape. They provided expert advice on interpreting COVID-19 relief measures, maximizing tax credits and deductions, and ensuring compliance with tax regulations.

Are there any long-term implications of the 2020 tax return for taxpayers and the tax system?

+The 2020 tax return serves as a reminder of the importance of proactive tax planning and staying informed about tax regulations, especially during times of economic uncertainty. It highlights the value of seeking professional tax advice to optimize tax positions and ensure compliance. Going forward, taxpayers and professionals should remain vigilant and adapt to any future economic disruptions.