Tax Refund Status Arkansas

The Arkansas Department of Finance and Administration (DFA) offers convenient options for residents to check the status of their tax refunds. As an informed resident of Arkansas, it's beneficial to know how to navigate the refund process and access the latest information about your tax refund status. This article will guide you through the various methods to check your refund status, providing clarity and peace of mind during the tax season.

Understanding the Arkansas Tax Refund Process

In Arkansas, the tax refund process is managed by the DFA’s Revenue Division. It involves several stages, from the initial filing of tax returns to the issuance of refunds. Here’s an overview of the key steps:

- Filing Tax Returns: Taxpayers in Arkansas are required to file their tax returns by a specified deadline, typically aligned with the federal tax filing deadline. This involves providing accurate financial information and calculating the amount owed or the refund due.

- Processing Tax Returns: Once the tax returns are filed, the DFA's Revenue Division begins processing them. This stage involves a thorough review of the submitted information to ensure accuracy and compliance with state tax laws.

- Determining Refunds: After processing the tax returns, the DFA calculates the amount of refund, if any, that is due to the taxpayer. This calculation is based on the taxpayer's income, deductions, and other relevant factors.

- Issuing Refunds: Once the refund amount is determined, the DFA initiates the refund process. Refunds can be issued through various methods, including direct deposit, check, or pre-paid debit cards.

Checking Your Arkansas Tax Refund Status

The DFA provides multiple ways for taxpayers to check the status of their tax refunds. Here are the primary methods:

1. Online Refund Status Lookup

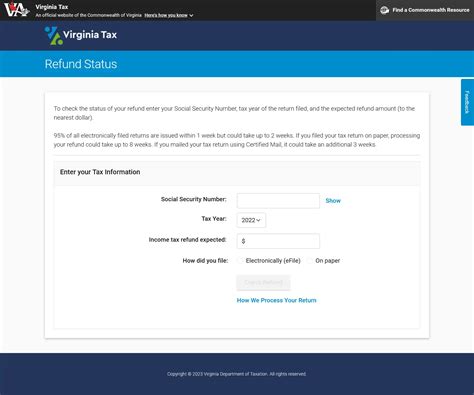

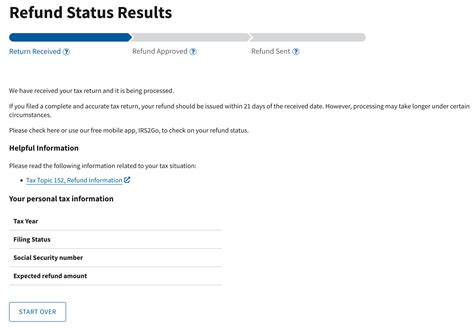

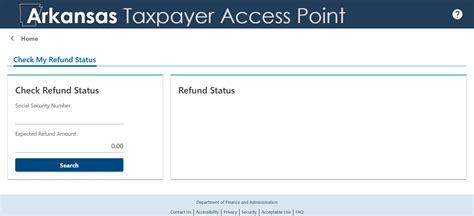

The most convenient way to check your Arkansas tax refund status is through the DFA’s online portal. By accessing the DFA’s Refund Status Lookup tool, you can quickly and securely obtain information about your refund.

To use this service, you will need the following information:

- Social Security Number (SSN): Your SSN is a unique identifier used to track your tax information.

- Tax Year: The specific tax year for which you are checking the refund status.

- Refund Amount: The expected refund amount as shown on your tax return.

Once you have these details, follow these steps to check your refund status online:

- Go to the DFA’s Refund Status Lookup page.

- Enter your SSN, tax year, and expected refund amount.

- Click on the “Submit” button to retrieve your refund status.

The online lookup tool provides real-time information about your refund, including the current status, the date it was issued, and the expected delivery method.

2. Phone Inquiry

If you prefer to check your refund status over the phone, the DFA offers a dedicated refund inquiry line. You can reach the Arkansas Tax Refund Hotline at 1-800-829-8833 (toll-free). This service is available Monday through Friday, excluding state holidays, from 8:00 a.m. to 4:30 p.m. Central Time.

When calling, have your SSN and tax year ready to provide to the customer service representative. They will assist you in obtaining the latest information about your refund status.

3. Mail Inquiry

For those who prefer a more traditional approach, the DFA accepts refund status inquiries via mail. You can send a written request to the following address:

Arkansas Department of Finance and Administration

Revenue Division

Income Tax Section

P.O. Box 1272

Little Rock, AR 72203

In your written request, include the following details:

- Your full name and address.

- Your SSN.

- The tax year for which you are inquiring about the refund status.

Please note that the response time for mail inquiries may be longer compared to online or phone methods.

Arkansas Tax Refund Timeline

Understanding the typical timeline for Arkansas tax refunds can help manage expectations. On average, it takes approximately 6 to 8 weeks for the DFA to process tax returns and issue refunds. However, this timeline can vary based on several factors, including the complexity of the tax return, the volume of returns being processed, and any potential errors or discrepancies identified during the review process.

Factors Affecting Refund Timing

Several factors can influence the time it takes for your Arkansas tax refund to be processed and issued. These include:

- Filing Method: Tax returns filed electronically, particularly through the DFA's online filing system, are generally processed faster than paper returns.

- Payment Method: If you chose direct deposit as your refund payment method, you can expect a quicker turnaround compared to receiving a check in the mail.

- Errors or Discrepancies: If the DFA identifies any errors or discrepancies in your tax return, it may require additional time to resolve these issues, potentially delaying the refund process.

- Tax Season Volume: The DFA processes a high volume of tax returns during the peak tax season. As a result, refunds may take longer to be issued during this period.

Tips for a Smooth Arkansas Tax Refund Process

To ensure a smooth and timely tax refund process, consider the following tips:

- File Electronically: Filing your tax return electronically is not only faster but also reduces the risk of errors. It also allows you to track your refund status more easily.

- Choose Direct Deposit: Opting for direct deposit as your refund payment method ensures a quicker and more secure refund process compared to receiving a check.

- Review Your Return: Before submitting your tax return, carefully review it for accuracy. This includes verifying your personal information, income details, and deductions. Double-checking your return can help prevent errors that might delay your refund.

- Stay Informed: Keep yourself updated on the latest tax information and guidelines from the DFA. This includes understanding the tax filing deadlines, any changes to tax laws, and the availability of new refund status tracking tools.

Conclusion: Navigating Arkansas Tax Refunds

The Arkansas tax refund process, while straightforward, can sometimes present challenges and delays. By understanding the various methods to check your refund status and being aware of the factors that influence refund timing, you can navigate the process with confidence. Remember to stay informed, file accurately, and utilize the resources provided by the DFA to ensure a smooth and timely tax refund experience.

FAQ

How long does it typically take to receive my Arkansas tax refund after filing my return?

+

On average, it takes approximately 6 to 8 weeks for the DFA to process tax returns and issue refunds. However, the timeline can vary based on factors such as filing method, payment method, and the presence of errors or discrepancies.

Can I check my Arkansas tax refund status online, and what information do I need for this process?

+

Yes, you can check your Arkansas tax refund status online through the DFA’s Refund Status Lookup tool. You will need your Social Security Number (SSN), tax year, and the expected refund amount.

Is there a dedicated phone line for Arkansas tax refund inquiries, and what are the operating hours for this service?

+

Yes, the Arkansas Tax Refund Hotline is available at 1-800-829-8833. This service operates Monday through Friday, excluding state holidays, from 8:00 a.m. to 4:30 p.m. Central Time.

What should I do if I haven’t received my Arkansas tax refund within the expected timeframe, and how can I escalate the issue if needed?

+

If you haven’t received your refund within the expected timeframe, you should first verify your refund status through the online lookup tool or by calling the Tax Refund Hotline. If your refund status indicates a delay, you can contact the DFA’s Income Tax Section at 501-682-7117 for further assistance.