Vat Tax Number

The VAT (Value Added Tax) Tax Number is a crucial identification system for businesses and organizations operating within the European Union (EU). It serves as a unique identifier, enabling efficient tax administration and facilitating cross-border trade. This article aims to delve into the intricacies of the VAT Tax Number, its importance, and its impact on businesses.

Understanding the VAT Tax Number

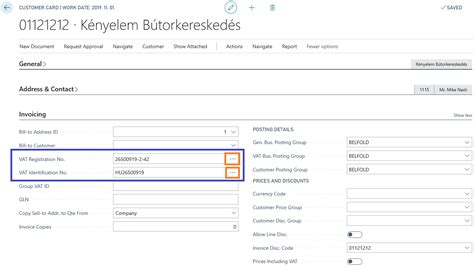

The VAT Tax Number, also known as the VAT Identification Number (VATIN) or simply the VAT Number, is a numeric or alphanumeric code assigned to businesses and legal entities registered for VAT purposes in an EU member state. It is a fundamental tool for tax authorities to track and manage the VAT obligations of businesses, ensuring compliance and transparency.

Each EU member state has its own unique VAT registration system, and consequently, the format and length of the VAT Tax Number can vary. However, the primary purpose remains consistent across the bloc: to identify businesses for VAT-related activities and transactions.

Format and Structure

The VAT Tax Number typically consists of a combination of letters and digits, with the specific arrangement depending on the issuing country. For instance, in the United Kingdom, the VAT Number starts with the country code “GB,” followed by a unique identifier, such as “123456789.” In contrast, in France, the VATIN begins with “FR,” and is followed by a sequence of 11 digits.

While the format may differ, the core purpose of the VAT Tax Number remains the same: to ensure that businesses are properly registered for VAT and to simplify the process of collecting and remitting VAT to the appropriate tax authorities.

| Country | VAT Tax Number Format |

|---|---|

| United Kingdom | GB987654321 |

| France | FR12345678901 |

| Germany | DE123456789 |

Importance of the VAT Tax Number

The significance of the VAT Tax Number extends beyond mere identification. It plays a pivotal role in various aspects of business operations and cross-border trade within the EU.

Compliance and Tax Administration

For tax authorities, the VAT Tax Number is a powerful tool for monitoring and regulating VAT obligations. It allows them to track the VAT liabilities of businesses, ensuring that the correct amount of VAT is charged, accounted for, and remitted to the government. This helps prevent tax evasion and promotes fair competition among businesses.

Businesses, on the other hand, benefit from the VAT Tax Number by gaining access to simplified tax procedures. They can use their VATIN to register for VAT in multiple EU countries, file VAT returns, and claim VAT refunds on eligible purchases. This streamlines the tax compliance process and reduces administrative burdens.

Cross-Border Trade

In the context of international trade within the EU, the VAT Tax Number is essential for facilitating smooth transactions. It enables businesses to trade goods and services across borders without the complexities of individual country-specific tax systems. Instead, a single VAT number serves as a universal identifier, making it easier to navigate the diverse tax landscapes of the EU.

Moreover, the VAT Tax Number is a prerequisite for participating in the EU's VAT refund scheme, which allows non-resident businesses to reclaim the VAT paid on purchases made within the EU. This scheme encourages international trade by reducing the financial burden of VAT for foreign businesses operating within the bloc.

Business Identification and Trust

For businesses, the VAT Tax Number serves as a badge of legitimacy and trust. It demonstrates that the business is registered and compliant with the tax regulations of its respective country. This can be particularly beneficial when dealing with international clients or suppliers, as it provides assurance that the business is operating within the legal framework.

Additionally, the VAT Tax Number can be a valuable asset when seeking financing or investment. Financial institutions often view businesses with VAT registration as more stable and compliant, making it easier to secure loans or attract investors.

Obtaining a VAT Tax Number

The process of obtaining a VAT Tax Number varies depending on the country of registration. Generally, businesses must meet certain criteria, such as exceeding a specified turnover threshold or engaging in specific economic activities that require VAT registration.

The application process typically involves submitting relevant documentation, such as business registration certificates, proof of address, and financial records, to the tax authorities. The exact requirements and procedures can be obtained from the tax office of the respective EU member state.

Registration Procedures

Each EU member state has its own VAT registration system, and businesses must navigate these processes to obtain their unique VAT Tax Number. While the general steps are similar, the specific requirements and timelines can vary. Some countries offer online registration, while others require physical presence or postal submissions.

For instance, in the United Kingdom, businesses can register for VAT online through the HM Revenue and Customs (HMRC) website. The process typically involves filling out an online form, providing business details, and waiting for the HMRC to issue the VAT number. In contrast, in Germany, businesses may need to submit physical documents to the Finanzamt (tax office) to obtain their VATIN.

Turnover Thresholds

EU member states set different turnover thresholds for mandatory VAT registration. For example, in the UK, businesses must register for VAT if their taxable turnover exceeds £85,000. In France, the threshold is €35,000 for goods and €17,000 for services. These thresholds are subject to change, and businesses should consult the relevant tax authorities for the most up-to-date information.

Voluntary Registration

In some cases, businesses may opt for voluntary VAT registration even if they have not yet reached the mandatory threshold. This can be advantageous for businesses that wish to reclaim VAT on purchases or establish their tax compliance credentials. However, it is essential to carefully consider the costs and benefits of voluntary registration, as it may involve additional administrative burdens.

Utilizing the VAT Tax Number

Once a business has obtained its VAT Tax Number, it becomes a powerful tool for various business operations and transactions.

Invoicing and Accounting

The VAT Tax Number is a mandatory inclusion on all VAT-related invoices issued by the business. It helps identify the business and its VAT obligations to customers, suppliers, and tax authorities. Proper invoicing is crucial for accurate tax reporting and compliance.

Additionally, the VAT Tax Number facilitates the accurate accounting of VAT transactions. It allows businesses to track their VAT liabilities and claims, ensuring that the correct amounts are recorded and reported in their financial records.

Cross-Border Transactions

For businesses engaged in cross-border trade within the EU, the VAT Tax Number is a critical identifier. It enables seamless transactions with foreign partners, as it provides assurance that the business is properly registered and compliant with VAT regulations.

When selling goods or services to businesses in other EU countries, the VAT Tax Number is essential for determining the correct VAT treatment. It helps calculate the applicable VAT rate, whether it be the standard rate, reduced rate, or zero-rated supply. This ensures that transactions are conducted in compliance with the relevant tax laws.

VAT Refunds and Reclaims

The VAT Tax Number is a prerequisite for businesses to claim VAT refunds on eligible purchases made within the EU. By using their VATIN, businesses can apply for refunds on the VAT paid on business-related expenses, such as equipment, travel, or raw materials. This can be a significant financial benefit for businesses operating across borders.

The process of claiming VAT refunds varies by country, but generally involves submitting a refund application to the tax authorities, providing supporting documentation, and waiting for the refund to be processed. The timeframes and specific requirements can differ, so businesses should familiarize themselves with the procedures in each EU country they operate in.

Challenges and Considerations

While the VAT Tax Number is a valuable tool for businesses, it also comes with certain challenges and considerations that must be addressed.

VAT Compliance and Penalties

The VAT Tax Number places businesses under a certain level of scrutiny, as tax authorities closely monitor VAT obligations. Failure to comply with VAT regulations, including accurate invoicing, timely filing of returns, and proper payment of VAT liabilities, can result in penalties and fines. These penalties can be significant, impacting a business’s financial health and reputation.

Businesses must ensure they have robust systems in place to manage their VAT obligations effectively. This includes staying updated on the latest VAT regulations, accurately calculating and remitting VAT, and maintaining proper records to support their VAT filings.

Complexities of Cross-Border Trade

While the VAT Tax Number simplifies cross-border trade within the EU, it does not eliminate all complexities. Businesses must navigate the diverse tax landscapes of different EU countries, including varying VAT rates, thresholds, and refund procedures. Additionally, they must stay informed about any changes in VAT regulations, as these can impact their operations and financial planning.

Staying compliant with the ever-changing VAT landscape requires ongoing vigilance and expertise. Businesses may benefit from engaging tax professionals or consultants who specialize in VAT to ensure they remain up-to-date and compliant with the latest regulations.

Administrative Burdens

Obtaining and utilizing a VAT Tax Number comes with certain administrative burdens. Businesses must allocate resources to manage their VAT obligations, including the time and effort required for registration, invoicing, filing returns, and claiming refunds. These administrative tasks can be time-consuming and may divert focus from core business operations.

To mitigate these burdens, businesses can explore VAT automation tools and software that streamline the VAT compliance process. These solutions can help reduce manual errors, improve efficiency, and free up time for strategic decision-making.

Future Outlook and Implications

The VAT Tax Number system within the EU is continually evolving, and its future implications are worth exploring.

Digitalization and Automation

The EU is actively pursuing initiatives to digitize and automate VAT processes, aiming to enhance efficiency and reduce administrative burdens. Projects such as the EU VAT e-Invoicing initiative seek to standardize electronic invoicing across the bloc, making it easier for businesses to comply with VAT regulations and improve data exchange.

Additionally, the VAT Mini One Stop Shop (VAT MOSS) system, which simplifies the reporting of VAT for digital services, is being expanded to cover other types of supplies. This initiative aims to streamline VAT compliance for businesses offering cross-border services, reducing the administrative hurdles associated with multiple VAT registrations.

Brexit and UK VAT

The departure of the United Kingdom from the EU has introduced new complexities to the VAT landscape. UK businesses now face additional considerations when trading with the EU, including the need for UK VAT registration and the potential for reverse charge VAT mechanisms.

The UK government has implemented measures to facilitate trade with the EU, such as the UK VAT registration threshold of £85,000 for non-UK businesses supplying goods to UK consumers. However, businesses must remain vigilant about the changing VAT regulations post-Brexit and ensure they are compliant with the new requirements.

Potential Reforms and Harmonization

The EU is exploring various reforms to its VAT system, aiming to simplify and harmonize regulations across member states. These reforms could include the introduction of a common EU VAT threshold, reducing the administrative burden for businesses operating in multiple EU countries. Additionally, there are discussions about the potential for a VAT union, which would further streamline cross-border trade and simplify VAT compliance.

While these reforms are still in the planning stages, they could have significant implications for businesses operating within the EU. Staying informed about potential changes and engaging with industry associations or tax professionals can help businesses prepare for and adapt to any future reforms.

Impact on International Trade

The VAT Tax Number system, along with potential reforms, will continue to shape international trade within the EU. The EU’s commitment to streamlining VAT processes and enhancing cross-border trade will likely benefit businesses operating across borders, making it easier to navigate the diverse tax landscapes of the member states.

Furthermore, the EU's efforts to simplify VAT compliance and reduce administrative burdens can attract more international businesses to the bloc, fostering economic growth and collaboration.

How can I obtain a VAT Tax Number for my business in the EU?

+

To obtain a VAT Tax Number in the EU, you must register your business for VAT with the tax authorities in the relevant EU member state. The specific process and requirements can vary, so it’s essential to consult the tax office of the country where your business operates. Generally, you’ll need to provide business registration documents, proof of address, and financial information. Once approved, you’ll receive your unique VAT Tax Number.

What is the purpose of the VAT Tax Number in cross-border trade within the EU?

+

The VAT Tax Number is crucial for cross-border trade within the EU as it identifies businesses and their VAT obligations. It simplifies transactions by providing a universal identifier, ensuring proper tax treatment and compliance. This facilitates seamless trade across borders, reducing complexities and promoting international business within the EU.

Are there any penalties for non-compliance with VAT regulations in the EU?

+

Yes, non-compliance with VAT regulations in the EU can result in penalties and fines. Tax authorities closely monitor VAT obligations, and businesses must ensure accurate invoicing, timely filing of returns, and proper payment of VAT liabilities. Failure to comply can lead to significant financial penalties, impacting a business’s financial health and reputation.

How can I stay updated on changes to VAT regulations in the EU?

+

Staying updated on VAT regulations in the EU is crucial for businesses. You can subscribe to official government websites, such as the European Commission’s VAT website, to receive updates on any changes or reforms. Additionally, engaging with tax professionals or industry associations can provide valuable insights and guidance on navigating the evolving VAT landscape.

What are the potential benefits of the EU’s VAT reform initiatives for businesses?

+

The EU’s VAT reform initiatives aim to simplify and harmonize VAT regulations, which can benefit businesses in several ways. Potential reforms, such as a common EU VAT threshold and a VAT union, could reduce administrative burdens, enhance cross-border trade, and make it easier for businesses to operate across the bloc. These initiatives aim to foster economic growth and collaboration within the EU.