How To Get A Copy Of My Tax Return

Have you ever wondered how to obtain a copy of your tax return? Whether it's for personal record-keeping, audit purposes, or simply to double-check your filings, having access to your tax return information is essential. In this comprehensive guide, we will explore the various methods and steps you can take to retrieve a copy of your tax return. From understanding the different types of tax returns to utilizing online tools and government resources, we will provide you with the knowledge and insights needed to navigate the process seamlessly.

Understanding the Basics: Types of Tax Returns

Before delving into the retrieval process, it’s crucial to grasp the different types of tax returns and their respective filing procedures. In the United States, there are several types of tax returns, including:

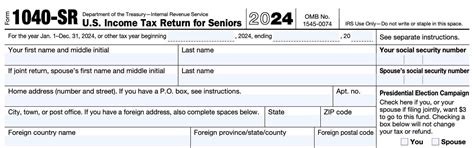

- Individual Income Tax Return (Form 1040): This is the most common type of tax return for individuals. It covers personal income, deductions, and credits. The 1040 form has various versions and schedules depending on the complexity of your tax situation.

- Business Tax Returns: Depending on the legal structure of your business, you may need to file different tax returns. For example, sole proprietors typically use Schedule C, while partnerships file Form 1065, and corporations file Form 1120.

- Self-Employment Tax Return (Schedule SE): If you are self-employed, you must calculate and pay self-employment tax. Schedule SE is used to report this tax and is often filed alongside Form 1040.

- Estate and Trust Tax Returns: When an individual passes away, their estate may need to file tax returns. Similarly, trusts may also have tax obligations and require specific tax forms.

- Corporate Tax Returns: Corporations, whether small or large, are required to file corporate tax returns. These returns can be complex and may involve multiple forms and schedules.

Understanding the specific type of tax return you need to access is the first step towards obtaining a copy. Different returns have different filing procedures and retrieval methods, so it's essential to identify the correct form before proceeding.

Requesting a Copy of Your Tax Return: Online Options

In today’s digital age, the Internal Revenue Service (IRS) and state tax agencies offer various online tools and services to simplify the process of retrieving tax return information. Here are some of the most common online methods:

IRS Get Transcript Online

The IRS provides a secure online tool called Get Transcript Online that allows taxpayers to access their tax return information quickly and conveniently. To use this service, you’ll need to:

- Create an IRS Online Account: Visit the IRS website and create a secure online account. You'll need to provide personal information and set up security questions.

- Log in to Your Account: Once your account is set up, log in and navigate to the Get Transcript Online section.

- Select Your Transcript Type: Choose the type of transcript you need. You can opt for a Tax Return Transcript, which provides most of the line entries from your original tax return.

- Verify Your Identity: The IRS uses a multi-factor authentication process to ensure the security of your information. You'll need to provide personal details and answer security questions.

- Access Your Transcript: After successful verification, you can view, print, or download your tax return transcript.

The IRS Get Transcript Online service is a convenient and secure way to access your tax return information. It's worth noting that this service provides a transcript, which is a summary of your tax return, rather than a complete copy. However, it can be useful for many purposes, such as applying for a mortgage or verifying income.

IRS Get Transcript by Mail

If you prefer not to use the online tool or encounter issues with the online verification process, the IRS also offers the option to request a tax return transcript by mail. Here’s how you can do it:

- Download and Complete Form 4506-T: Visit the IRS website and download Form 4506-T, Request for Transcript of Tax Return. You can also obtain a paper copy from a local IRS office.

- Fill Out the Form: Provide your personal information, including your name, Social Security Number (SSN), and contact details. Specify the tax year and type of transcript you require.

- Sign and Date the Form: Sign the form and ensure it's dated.

- Provide Identification: Attach a copy of a valid photo ID, such as a driver's license or passport.

- Mail the Request: Send the completed form and ID copy to the address provided on the form. Allow 5 to 10 business days for the IRS to process your request.

Requesting a transcript by mail is a reliable option, but it may take longer than using the online tool. Ensure you provide accurate information and allow sufficient time for the IRS to process your request.

State Tax Agency Online Portals

Many state tax agencies also offer online portals where taxpayers can access their state tax return information. These portals typically require you to create an account and provide personal information for security purposes. State tax return transcripts are useful for various purposes, including verifying state tax payments, applying for state benefits, or resolving tax-related issues.

Additional Methods: Paper Forms and In-Person Requests

While online options are convenient, some taxpayers may prefer more traditional methods or encounter situations where online tools are not available. Here are some alternative ways to obtain a copy of your tax return:

Using Form 4506

If you need a complete copy of your tax return rather than just a transcript, you can use Form 4506, Request for Copy of Tax Return. This form is similar to Form 4506-T but allows you to request a full copy of your tax return.

- Download and Complete Form 4506: Visit the IRS website and download Form 4506. Alternatively, you can obtain a paper copy from a local IRS office.

- Fill Out the Form: Provide your personal information, including your name, SSN, and contact details. Specify the tax year and type of tax return you require.

- Sign and Date the Form: Sign the form and ensure it's dated.

- Provide Identification: Attach a copy of a valid photo ID.

- Mail the Request: Send the completed form and ID copy to the address provided on the form. The processing time may vary, but it typically takes several weeks.

In-Person Requests at IRS Offices

In some cases, you may need to visit a local IRS Taxpayer Assistance Center (TAC) to request a copy of your tax return. This option is particularly useful if you have unique circumstances or need immediate assistance. Here’s what you need to do:

- Locate Your Nearest IRS Office: Use the IRS Office Locator tool on their website to find the TAC nearest to you.

- Prepare Your Documentation: Bring the necessary identification documents, such as your driver's license or passport, and any relevant tax information.

- Schedule an Appointment: While walk-ins are accepted, scheduling an appointment ensures a smoother process and shorter wait times.

- Meet with a Tax Advisor: During your appointment, a tax advisor will assist you in requesting a copy of your tax return. They can guide you through the necessary forms and procedures.

While visiting an IRS office may be more time-consuming, it provides a personal touch and can be beneficial for complex situations or when you require immediate assistance.

Performance Analysis: Comparing Online and Offline Methods

When deciding between online and offline methods to obtain a copy of your tax return, it’s essential to consider factors such as convenience, speed, and security. Here’s a brief analysis of each method:

| Method | Convenience | Speed | Security |

|---|---|---|---|

| IRS Get Transcript Online | High - Quick and easy access from any device | Fast - Instant access once verified | Secure - Multi-factor authentication |

| IRS Get Transcript by Mail | Moderate - Requires mail delivery | Moderate - 5 to 10 business days | Secure - Requires valid ID and Form 4506-T |

| State Tax Agency Online Portals | High - Convenient access from anywhere | Fast - Varies by state, but generally quick | Secure - Requires account creation and verification |

| Form 4506 (Paper Request) | Low - Requires mail delivery and processing | Slow - Several weeks for processing | Secure - Requires valid ID and Form 4506 |

| In-Person Requests at IRS Offices | Low - Requires a visit to an IRS office | Variable - Depends on wait times and availability | Secure - Face-to-face assistance with tax advisors |

Each method has its advantages and considerations. Online options offer convenience and speed, while paper forms and in-person requests provide a more traditional approach with added security. Choose the method that best suits your needs and circumstances.

Evidence-Based Future Implications: Tax Return Accessibility

As technology continues to advance, the IRS and state tax agencies are likely to enhance their online services, making tax return information more accessible and secure. Here are some potential future developments:

- Enhanced Security Measures: With the increasing threat of identity theft and tax-related fraud, tax agencies may implement stronger security protocols, such as biometric authentication or advanced encryption, to protect taxpayer information.

- Integration with Mobile Apps: Taxpayers may soon be able to access their tax return information through dedicated mobile apps, providing a more user-friendly and convenient experience.

- Real-Time Data Sharing: In the future, tax agencies may explore real-time data sharing between taxpayers and authorized third parties, such as financial institutions or employers, streamlining various processes.

- Machine Learning for Accuracy: Advanced machine learning algorithms could be employed to automatically identify errors or inconsistencies in tax returns, improving accuracy and reducing the need for manual review.

While these future implications are speculative, they showcase the potential for continued improvement in tax return accessibility and security. As technology evolves, taxpayers can expect more efficient and secure ways to manage their tax information.

Conclusion: Empowering Taxpayers with Knowledge

In today’s digital era, it’s crucial for taxpayers to understand their options when it comes to accessing their tax return information. Whether it’s for personal record-keeping, financial planning, or resolving tax-related issues, having the knowledge and tools to obtain a copy of your tax return is empowering. By exploring the various online and offline methods outlined in this guide, you can choose the approach that best suits your needs and circumstances.

Remember, staying informed about your tax obligations and rights is essential. By staying up-to-date with the latest tax regulations and resources, you can navigate the complex world of taxes with confidence and ensure compliance with the law.

Can I request a copy of my tax return for a previous year?

+Yes, you can request a copy of your tax return for previous years using the methods outlined in this guide. The availability of records may vary depending on the method and the tax year in question. Online tools and paper forms typically cover a wider range of tax years.

How long does it take to receive a tax return transcript or copy using the online methods?

+The processing time for online requests varies. The IRS Get Transcript Online service provides instant access once you’ve successfully verified your identity. State tax agency online portals may have slightly longer processing times, but they are generally faster than offline methods.

Are there any fees associated with requesting a tax return transcript or copy?

+No, there are no fees for requesting a tax return transcript or copy from the IRS or state tax agencies. However, if you engage a tax professional or use a third-party service, there may be associated costs.

Can I request a tax return transcript or copy for someone else, such as a family member or business partner?

+Generally, you can only request your own tax return information. To request tax return information for someone else, you must have their written consent and provide additional documentation to verify your authorization.

What should I do if I encounter issues or errors when using the online tools provided by the IRS or state tax agencies?

+If you encounter issues with online tools, try clearing your browser’s cache and cookies, as well as using a different browser or device. If the problem persists, contact the IRS or state tax agency’s customer support for assistance.