Estate Tax Vs Inheritance Tax

Navigating the complexities of wealth transfer and estate planning often leads to questions about the differences between estate tax and inheritance tax. While these terms are sometimes used interchangeably, they represent distinct concepts with unique implications for individuals and their beneficiaries. This article aims to clarify the nuances between estate tax and inheritance tax, offering a comprehensive guide to help individuals make informed decisions about their financial and estate planning strategies.

Understanding Estate Tax

Estate tax, also known as death tax, is a levy imposed on the transfer of an individual’s assets upon their death. It is a federal tax that applies to the total value of an estate, which includes all property, real estate, investments, and other assets owned by the deceased. The primary purpose of estate tax is to ensure a fair and equitable distribution of wealth and to generate revenue for the government.

Key Features of Estate Tax

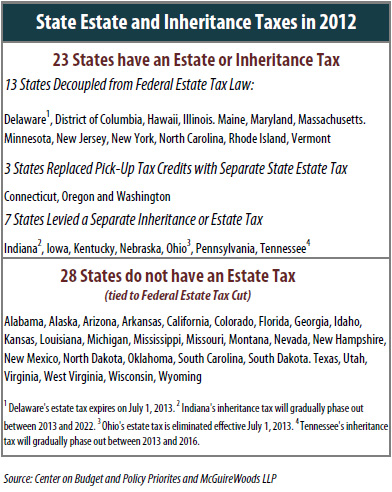

- Estate tax is a federal tax, although some states may also impose their own estate or inheritance taxes.

- The tax is calculated based on the net value of the estate, after accounting for deductions, exemptions, and expenses.

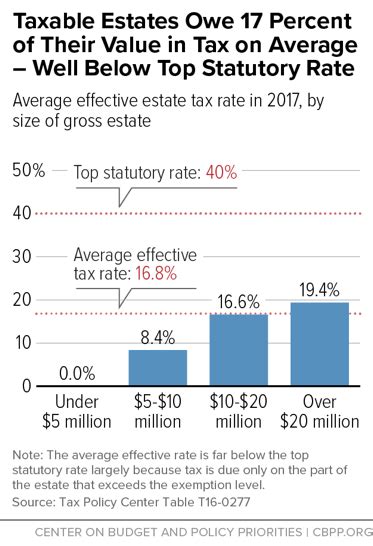

- The tax rate increases with the size of the estate, following a progressive structure similar to income tax.

- Estate tax is typically paid by the executor of the estate, who is responsible for administering the estate and ensuring compliance with tax regulations.

- The tax liability may be reduced through various strategies, such as gifting, charitable contributions, and utilizing estate planning tools like trusts.

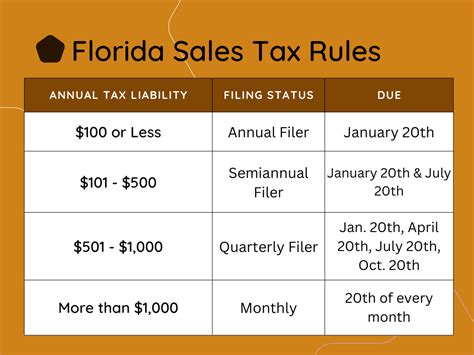

| Estate Value | Federal Estate Tax Rate |

|---|---|

| $0 - $12,060,000 | 0% |

| $12,060,001 - $23,185,000 | 24% |

| $23,185,001 - $55,200,000 | 31% |

| $55,200,001 - $1,000,000,000 | 37% |

| Over $1,000,000,000 | 40% |

Note: The above rates are for the 2024 tax year and may be subject to change in future years.

Inheritance Tax: A State-Level Levy

Inheritance tax, on the other hand, is a state-level tax that is levied on the recipients of an estate, often referred to as beneficiaries. This tax is applied to the value of the assets received by each individual beneficiary, and the rate may vary depending on the beneficiary’s relationship to the deceased and the size of their inheritance.

Key Characteristics of Inheritance Tax

- Inheritance tax is imposed by a limited number of states, including Iowa, Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania.

- The tax rates and exemptions vary widely between states, with some states offering exemptions for spouses and close family members.

- Inheritance tax is typically paid by the beneficiary, who may be required to file a state inheritance tax return.

- The tax is calculated based on the value of the assets received, with rates that can range from a few percent to upwards of 20%.

- Certain strategies, such as gifting during the decedent’s lifetime or utilizing trust structures, can help reduce or avoid inheritance tax liabilities.

For example, in Pennsylvania, the inheritance tax rates for 2024 are as follows:

| Relationship to Decedent | Inheritance Tax Rate |

|---|---|

| Spouse | 0% |

| Direct Descendants (Children, Grandchildren) | 4.5% |

| Other Relatives | 12% |

| Non-Relatives | 15% |

Key Differences and Considerations

Understanding the differences between estate tax and inheritance tax is crucial for effective financial planning. Here are some key distinctions to consider:

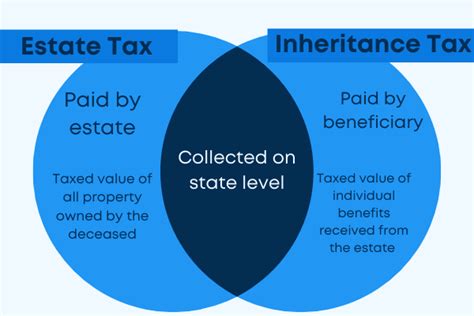

- Taxpayer: Estate tax is paid by the estate itself, while inheritance tax is paid by the beneficiaries.

- Tax Base: Estate tax is calculated based on the total value of the estate, whereas inheritance tax is assessed on the value of assets received by each beneficiary.

- Tax Rates: Estate tax rates are progressive and determined at the federal level, while inheritance tax rates vary widely between states and may depend on the beneficiary's relationship to the deceased.

- Exemptions: Both estate and inheritance taxes offer exemptions, but the amounts and conditions vary. Federal estate tax exemptions are substantial, while state inheritance tax exemptions can be more limited.

- Strategy: Effective estate planning strategies can help reduce or eliminate estate tax liabilities. Similarly, understanding inheritance tax laws and employing strategic gifting or trust structures can minimize the impact on beneficiaries.

Conclusion

Estate tax and inheritance tax are two distinct components of the U.S. tax system that impact the transfer of wealth. While estate tax is a federal levy applied to the estate itself, inheritance tax is a state-level tax assessed on beneficiaries. Understanding these differences is crucial for individuals seeking to optimize their estate planning and ensure a smooth transition of assets to their heirs.

By navigating the complexities of estate and inheritance taxes, individuals can make informed decisions to minimize tax liabilities and maximize the value transferred to their loved ones. Whether through strategic gifting, utilizing trusts, or seeking professional advice, a well-planned approach to wealth transfer can help individuals achieve their estate planning goals and protect their legacy.

Frequently Asked Questions

What is the current federal estate tax exemption amount for 2024?

+

The federal estate tax exemption for 2024 is set at 12,060,000. This means that estates valued at 12 million or less are generally exempt from federal estate tax.

Are there any states that do not impose an inheritance tax?

+

Yes, the majority of states do not impose an inheritance tax. Only a few states, including Iowa, Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania, have inheritance tax laws in place.

Can estate planning strategies help reduce both estate and inheritance taxes?

+

Absolutely! Effective estate planning strategies, such as gifting, utilizing trusts, and making charitable contributions, can help reduce or eliminate both estate and inheritance tax liabilities. Working with a qualified estate planning professional can help individuals tailor their strategies to their specific needs and goals.

Are there any exemptions or deductions available for estate tax?

+

Yes, the federal estate tax offers a variety of exemptions and deductions. The most notable exemption is the unified credit, which is applied to the estate’s total value to reduce the taxable amount. Additionally, certain expenses and deductions, such as funeral costs and administrative expenses, can further reduce the taxable estate.

How can I ensure my estate plan is optimized to minimize tax liabilities?

+

To optimize your estate plan and minimize tax liabilities, it’s crucial to work with experienced professionals, such as estate planning attorneys and tax advisors. They can help you navigate the complex tax laws, identify opportunities for tax savings, and create a customized plan that aligns with your financial goals and objectives.