What Is The Sales Tax In Virginia

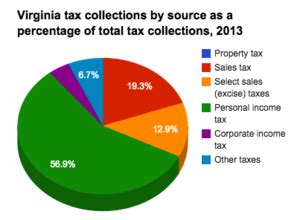

In the state of Virginia, sales tax is an important component of the revenue system, contributing significantly to the state's budget. It is a consumption tax that is levied on the sale of goods and services within the state. The sales tax rate in Virginia is subject to various factors, including the type of transaction and the location where the purchase is made. Understanding the sales tax structure in Virginia is crucial for both businesses and consumers to ensure compliance and manage financial obligations effectively.

Sales Tax Rate in Virginia

The general sales tax rate in Virginia is currently set at 4.3%, which is applied to most tangible personal property and certain services. However, it’s important to note that the state allows local jurisdictions, such as counties and cities, to impose additional sales tax rates. These local tax rates can vary, resulting in a combined sales tax rate that differs across the state.

Local Sales Tax Rates

In addition to the state sales tax, local governments in Virginia have the authority to levy their own sales taxes. These local rates can range from 0% to 4%, depending on the jurisdiction. For instance, cities like Norfolk and Richmond have a local sales tax rate of 1%, while other areas like Fairfax County and the City of Fairfax have a combined local rate of 1.5%. It’s crucial for businesses and consumers to be aware of these local variations to ensure accurate tax calculations.

| Jurisdiction | Local Sales Tax Rate |

|---|---|

| Fairfax County | 1.5% |

| Norfolk | 1% |

| Richmond | 1% |

| Virginia Beach | 1.5% |

| Arlington | 1% |

The table above provides a glimpse of some of the local sales tax rates in Virginia. It's important to note that these rates are subject to change, and it is always advisable to check the official sources or consult with tax professionals for the most up-to-date information.

Sales Tax Exemptions in Virginia

While the general sales tax rate applies to most transactions, Virginia offers certain exemptions and special tax rates for specific items and situations. These exemptions are designed to provide relief to certain sectors and promote specific economic or social goals.

Food and Grocery Sales Tax

One notable exemption in Virginia is the sales tax treatment of food and groceries. The state has a reduced sales tax rate of 1.5% for qualifying food items. This reduced rate applies to staple foods, including bread, milk, eggs, fruits, vegetables, and certain other grocery items. The reduced rate aims to ease the tax burden on essential food purchases, making them more affordable for Virginia residents.

Exemptions for Specific Industries

Virginia also provides sales tax exemptions for specific industries and transactions. For instance, sales tax is not applicable to sales made to government entities, certain non-profit organizations, and educational institutions. Additionally, there are exemptions for sales of specific types of machinery and equipment used in manufacturing and research and development activities.

Online Sales Tax

With the growth of e-commerce, Virginia has implemented laws to ensure the collection of sales tax on online purchases. This is particularly important as it levels the playing field for brick-and-mortar stores and online retailers. Virginia requires online retailers to collect and remit sales tax based on the buyer’s location, ensuring that the appropriate state and local sales tax rates are applied.

Sales Tax Collection and Remittance

Businesses operating in Virginia have the responsibility of collecting and remitting sales tax to the Virginia Department of Taxation. This process involves registering with the department, calculating the applicable tax rates, and filing regular tax returns. Failure to comply with sales tax obligations can result in penalties and interest charges.

Sales Tax Registration

To collect and remit sales tax, businesses must obtain a Virginia Sales and Use Tax Certificate of Registration. This registration process involves providing relevant business information and selecting a tax filing frequency, typically quarterly or annually. Once registered, businesses must display their sales tax permit number on all sales receipts and invoices.

Sales Tax Filing and Payment

Registered businesses are required to file sales tax returns and make payments to the Virginia Department of Taxation on a regular basis. The due dates for filing and payment depend on the business’s filing frequency. Late filing or payment can result in penalties, so it’s crucial for businesses to stay organized and comply with the tax deadlines.

Sales Tax Audits and Compliance

The Virginia Department of Taxation conducts sales tax audits to ensure compliance and to identify any underreporting or non-compliance issues. These audits can be triggered by various factors, including random selection, changes in business operations, or discrepancies in tax returns. During an audit, the department may request detailed sales records, invoices, and other supporting documentation to verify the accuracy of tax filings.

Sales Tax Audit Process

The sales tax audit process typically involves the following steps:

- Notification: The business receives a notification from the Virginia Department of Taxation informing them of the audit and providing details about the scope and timeframe.

- Document Collection: The business gathers and submits the requested documents, which may include sales records, purchase orders, invoices, and tax returns.

- Audit Review: The tax department reviews the submitted documents and may request additional information or conduct on-site visits to verify the accuracy of the records.

- Audit Results: Once the audit is complete, the department issues a report detailing any adjustments, penalties, or additional taxes owed.

- Appeal Process: If the business disagrees with the audit findings, they have the right to appeal and present their case to the department's appeals division.

Future Outlook and Potential Changes

The sales tax landscape in Virginia is subject to ongoing changes and potential reforms. As the state’s economy evolves and new technologies emerge, there may be proposals to modify the sales tax structure to address emerging challenges and opportunities. For instance, with the increasing popularity of online sales, there may be discussions around expanding the sales tax base to include certain digital services or products.

Potential Sales Tax Reforms

Some potential reforms that could impact the sales tax system in Virginia include:

- Streamlining the sales tax collection process for businesses, especially those operating in multiple jurisdictions, to reduce administrative burdens.

- Exploring the possibility of a uniform sales tax rate across the state to simplify tax calculations and reduce compliance challenges.

- Implementing measures to enhance the accuracy of sales tax reporting, such as improved tax software and data analytics.

- Addressing the challenges posed by the gig economy and the rise of independent contractors, ensuring that the sales tax system remains effective in capturing these transactions.

As the state's economy continues to evolve, the sales tax system in Virginia will likely undergo further adjustments to remain responsive to changing market dynamics and technological advancements.

What happens if I don’t collect and remit sales tax in Virginia as a business owner?

+Failing to collect and remit sales tax in Virginia can result in severe consequences for business owners. The Virginia Department of Taxation has the authority to impose penalties, interest charges, and even criminal charges for non-compliance. It is crucial for businesses to understand their sales tax obligations and seek professional advice if needed.

Are there any sales tax holidays in Virginia?

+Yes, Virginia occasionally offers sales tax holidays to promote specific types of purchases. These holidays typically waive the sales tax on certain items, such as back-to-school supplies or energy-efficient appliances. The dates and eligible items for these holidays vary, so it’s important to stay informed about any upcoming sales tax holidays.

How can I stay updated on sales tax changes and requirements in Virginia?

+To stay informed about sales tax changes and requirements in Virginia, it is recommended to regularly visit the official website of the Virginia Department of Taxation. They provide comprehensive resources, including tax guides, updates on tax laws, and information on tax rates and exemptions. Additionally, subscribing to their email updates or following their social media accounts can ensure you receive timely notifications about any changes.