San Bernardino Tax Rate

Understanding the tax landscape is crucial for individuals and businesses alike, especially when considering the various rates and regulations across different regions. In this comprehensive guide, we delve into the tax rates applicable in San Bernardino, offering a detailed analysis to help you navigate this complex but essential aspect of financial planning.

Unraveling the San Bernardino Tax Structure

San Bernardino, situated in California, presents a unique tax scenario due to its diverse economic landscape and its position as a hub for various industries. The tax rates here are influenced by a combination of federal, state, and local regulations, creating a multifaceted system that requires careful examination.

Federal and State Income Taxes

The federal income tax is a standard across the United States, and San Bernardino residents are subject to this national tax bracket system. Currently, the federal tax rates range from 10% to 37%, with seven brackets determining the applicable rate based on taxable income. This progressive system ensures that higher incomes are taxed at a higher rate.

California, the state in which San Bernardino is located, has its own state income tax system. California operates on a nine-bracket progressive tax structure, with rates starting at 1% and climbing to 12.3% for the highest earners. This means that, depending on your income level, you could be paying taxes at different rates for federal and state purposes.

| Federal Tax Brackets (2023) | Tax Rate |

|---|---|

| 10% | $0 - $10,275 (Single) / $0 - $20,550 (Married Filing Jointly) |

| 12% | $10,276 - $41,775 (Single) / $20,551 - $83,550 (Married Filing Jointly) |

| 22% | $41,776 - $89,075 (Single) / $83,551 - $178,150 (Married Filing Jointly) |

| 24% | $89,076 - $170,050 (Single) / $178,151 - $340,100 (Married Filing Jointly) |

| 32% | $170,051 - $215,950 (Single) / $340,101 - $431,900 (Married Filing Jointly) |

| 35% | $215,951 - $539,900 (Single) / $431,901 - $647,850 (Married Filing Jointly) |

| 37% | Over $539,900 (Single) / Over $647,850 (Married Filing Jointly) |

For a more localized perspective, let's focus on the San Bernardino County tax rate. The county levies an additional 1% tax on top of the state income tax, bringing the total countywide income tax to 10% for the lowest bracket and 13.3% for the highest earners. This additional county tax is a crucial consideration for those residing in San Bernardino.

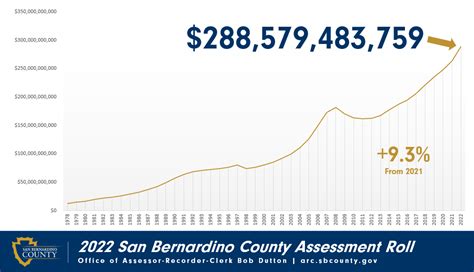

Property Taxes in San Bernardino

Property owners in San Bernardino face a unique set of regulations when it comes to property taxes. The state of California operates on a 1% base property tax rate, but this can be modified by local governments, leading to variations across counties and cities.

In San Bernardino, the effective property tax rate is approximately 0.78%, which is slightly lower than the state average. This rate is applied to the assessed value of the property, which is typically 100% of the fair market value. However, there are provisions for reassessment, especially when there are changes in ownership or new construction.

For instance, if you purchase a property in San Bernardino, the assessed value for tax purposes will be the purchase price or the current market value, whichever is lower. This assessed value is then subject to an annual increase of no more than 2%, unless there are improvements or other factors that justify a higher reassessment.

| San Bernardino Property Tax Rates | Tax Rate |

|---|---|

| Base Property Tax Rate | 1% |

| Effective Property Tax Rate | 0.78% |

Sales and Use Taxes

Sales and use taxes are another significant component of the tax landscape in San Bernardino. These taxes are applied to the sale of goods and services and are often a source of revenue for local governments.

In San Bernardino, the combined sales tax rate is approximately 7.75%, which includes both state and local taxes. This rate can vary slightly depending on the specific city or district within the county, as local governments are authorized to add their own sales tax on top of the state rate.

| San Bernardino Sales Tax Rates | Tax Rate |

|---|---|

| State Sales Tax | 6% |

| Local Sales Tax | 1.75% |

| Total Combined Sales Tax | 7.75% |

It's important to note that certain items, such as groceries, may be exempt from sales tax, and there are also specific rules for online purchases and out-of-state purchases, known as use taxes. These rules ensure that all purchases, regardless of origin, are subject to the appropriate tax rate.

Navigating Tax Strategies and Resources

Understanding the tax rates is just the first step in a complex process. To effectively manage your tax obligations, it’s essential to have a strategic approach and access to the right resources.

Seeking Professional Guidance

The tax landscape is intricate, and staying compliant with all the regulations can be challenging. Engaging the services of a qualified tax professional, such as a certified public accountant (CPA) or an enrolled agent, can provide invaluable guidance. These professionals are well-versed in the latest tax laws and can offer personalized advice based on your unique financial situation.

A tax professional can help you navigate the complexities of tax preparation, ensuring you claim all the deductions and credits you're entitled to. They can also provide strategic planning advice, helping you structure your finances to minimize tax liabilities and maximize savings.

Utilizing Tax Preparation Software

For those comfortable with technology and basic tax concepts, tax preparation software can be a cost-effective and efficient solution. These software platforms guide you through the tax preparation process, ensuring you don’t miss any crucial deductions or credits. They also provide a secure platform for storing your tax information and can often be linked to your bank accounts for seamless data entry.

Some popular tax preparation software options include TurboTax, H&R Block, and TaxAct. These platforms offer varying levels of support and guidance, catering to different levels of tax complexity. It's important to choose a platform that matches your comfort level and tax situation.

Staying Informed with Tax Updates

The tax landscape is dynamic, with frequent updates and changes. Staying informed about these changes is crucial to ensure you’re compliant and taking advantage of any new tax benefits. The Internal Revenue Service (IRS) website is a valuable resource, providing the latest news and updates on federal tax laws.

Additionally, subscribing to tax-focused newsletters or following reputable tax blogs can keep you up-to-date with the latest developments. Staying informed allows you to make timely decisions and adjust your financial strategies accordingly.

Understanding Tax Deductions and Credits

Tax deductions and credits can significantly reduce your tax liability. It’s important to understand the various deductions and credits you may be eligible for, such as the standard deduction, itemized deductions, and tax credits for things like education, child care, or energy-efficient improvements.

A thorough understanding of these deductions and credits can help you optimize your tax strategy and potentially reduce the amount of tax you owe. Consulting a tax professional or using a reliable tax preparation software can help you identify and maximize these benefits.

Conclusion: A Comprehensive Tax Strategy

Navigating the tax landscape in San Bernardino requires a comprehensive understanding of the various tax rates and regulations. From federal and state income taxes to property, sales, and use taxes, each component has its own set of rules and rates. By understanding these rates and seeking professional guidance, you can develop a strategic approach to tax management.

Whether you're an individual taxpayer or a business owner, a well-planned tax strategy can help you minimize your tax liabilities, maximize deductions and credits, and ensure compliance with all applicable tax laws. Remember, staying informed and seeking expert advice are crucial steps in achieving financial success and peace of mind.

What are the income tax rates for San Bernardino residents in 2023?

+San Bernardino residents are subject to both federal and state income tax rates. For federal taxes, the rates range from 10% to 37%, with seven brackets. California, the state where San Bernardino is located, has a nine-bracket progressive tax structure, with rates starting at 1% and climbing to 12.3% for the highest earners. Additionally, San Bernardino County levies an extra 1% tax, bringing the total countywide income tax to 10% for the lowest bracket and 13.3% for the highest earners.

How do property taxes work in San Bernardino?

+Property taxes in San Bernardino are based on the assessed value of the property, which is typically 100% of the fair market value. The effective property tax rate in San Bernardino is approximately 0.78%. However, there are provisions for reassessment, especially when there are changes in ownership or new construction. The Homeowners’ Exemption provides a reduction in the assessed value of a primary residence, offering a significant savings on annual property taxes.

What is the combined sales tax rate in San Bernardino?

+The combined sales tax rate in San Bernardino is approximately 7.75%, which includes both state and local taxes. This rate can vary slightly depending on the specific city or district within the county, as local governments are authorized to add their own sales tax on top of the state rate. Certain items, such as groceries, may be exempt from sales tax, and there are also specific rules for online purchases and out-of-state purchases, known as use taxes.

How can I stay updated on tax laws and changes?

+Staying informed about tax laws and changes is crucial for effective tax management. The Internal Revenue Service (IRS) website is a valuable resource, providing the latest news and updates on federal tax laws. Additionally, subscribing to tax-focused newsletters or following reputable tax blogs can keep you up-to-date with the latest developments. Staying informed allows you to make timely decisions and adjust your financial strategies accordingly.