When Is Tax Free Week In Maryland

In the state of Maryland, tax-free shopping is a highly anticipated event for residents and businesses alike. This annual tradition offers a unique opportunity to save on certain items, making it a popular time for back-to-school shopping and other purchases. Let's delve into the specifics of Tax-Free Week in Maryland, exploring its history, benefits, and how it impacts the state's economy.

The History and Significance of Tax-Free Week

Tax-Free Week in Maryland is a relatively recent addition to the state’s calendar, but it has quickly become a notable event. First introduced in 2011, this initiative was a strategic move by the Maryland government to provide economic relief to residents and stimulate spending during a critical time of the year. The concept is simple: for a designated week, certain items are exempt from state sales tax, making them more affordable for consumers.

The timing of Tax-Free Week is carefully chosen to coincide with the back-to-school season. As students and their families prepare for the new academic year, the tax exemption on essential school supplies and clothing provides a significant financial advantage. This not only helps families save money but also encourages early shopping, benefiting local businesses and the overall economy.

Over the years, Tax-Free Week has evolved to include a wider range of items, making it an attractive proposition for a broader audience. While the focus remains on school-related items, the exemption has expanded to cover clothing, footwear, and even certain electronics, making it a popular time for back-to-school and back-to-work shopping.

The Benefits of Tax-Free Week for Consumers and Businesses

The advantages of Tax-Free Week are twofold, benefiting both consumers and businesses in Maryland. For consumers, the most obvious advantage is the financial savings. By eliminating the sales tax on eligible items, shoppers can make significant savings, especially when purchasing multiple items. This is particularly advantageous for families with multiple children, as the cost of school supplies and uniforms can quickly add up.

Moreover, Tax-Free Week encourages early shopping, allowing consumers to avoid the last-minute rush and potentially missed opportunities. This advance planning can lead to better deals and a wider selection of products, ensuring that shoppers can find exactly what they need. Additionally, the tax exemption on clothing and footwear provides an opportunity for consumers to update their wardrobes without the added financial burden.

For businesses, Tax-Free Week presents a unique opportunity to boost sales and engage with customers. By offering tax-free shopping, retailers can attract a larger customer base and encourage spending. This initiative can help businesses move inventory, especially seasonal items, and create a positive shopping experience for customers. Furthermore, the increased foot traffic during Tax-Free Week can lead to additional sales of non-exempt items, providing a boost to the bottom line.

Impact on Maryland’s Economy

The economic impact of Tax-Free Week in Maryland is significant and far-reaching. By encouraging consumer spending, the initiative contributes to the state’s overall economic growth. The increased sales during this week generate additional revenue for businesses, which can then be reinvested into the local economy. This cycle of spending and reinvestment strengthens the economic fabric of the state, creating a positive feedback loop.

Furthermore, Tax-Free Week has a positive effect on employment in the retail sector. The increased sales and foot traffic during this period often require additional staff, creating temporary job opportunities. This not only provides income for individuals but also contributes to the overall employment rate in the state. Additionally, the success of Tax-Free Week can lead to a lasting impact, with businesses potentially expanding their operations or hiring more permanent staff to meet the increased demand.

From a broader perspective, Tax-Free Week also fosters a sense of community and solidarity. The initiative brings people together, whether it's families shopping for school supplies or individuals looking to refresh their wardrobe. This shared experience strengthens social bonds and creates a positive association with the state of Maryland, contributing to a sense of pride and belonging.

Eligibility and Exclusions

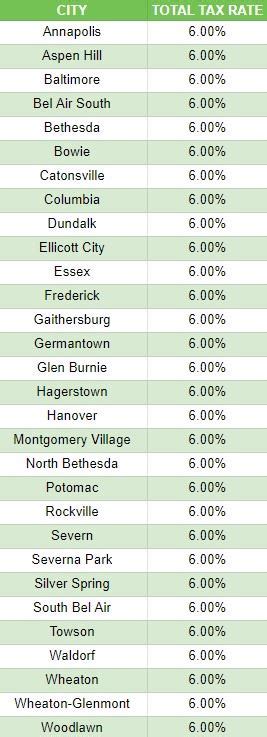

While Tax-Free Week offers significant savings, it’s important to understand the eligibility criteria and exclusions. In Maryland, the tax exemption applies to clothing and footwear items priced under $100, as well as certain school supplies. The exemption also extends to certain electronic items, including computers and related accessories. However, it’s essential to check the official guidelines provided by the Maryland Comptroller’s Office for a comprehensive list of eligible items.

| Category | Tax-Free Status |

|---|---|

| Clothing & Footwear | Eligible (under $100) |

| School Supplies | Eligible (specific items) |

| Electronics | Eligible (computers & accessories) |

Maximizing Your Savings

To make the most of Tax-Free Week, it’s advisable to plan your shopping in advance. Create a list of the items you need and research the best deals and offers available. Many retailers offer special promotions and discounts during this period, so take advantage of these opportunities. Additionally, consider shopping online, as many e-commerce platforms also participate in Tax-Free Week, offering convenient and often more affordable options.

Remember, while Tax-Free Week provides an excellent opportunity to save, it's essential to maintain a balanced perspective. Avoid overspending and only purchase items you genuinely need or will use. This ensures you maximize your savings while also being financially responsible.

Community Engagement and Awareness

Tax-Free Week isn’t just about individual savings; it’s also an opportunity for community engagement and education. Many schools and local organizations use this time to raise awareness about the importance of budgeting and financial literacy. By involving students and families in the planning and shopping process, they can learn valuable lessons about managing finances and making informed purchasing decisions.

Furthermore, Tax-Free Week can be a time for businesses to engage with their communities. Retailers can organize special events, workshops, or promotions to attract customers and give back to the community. This fosters a positive relationship between businesses and their customers, strengthening the local economy and creating a sense of mutual support.

Future Outlook and Potential Changes

As with any initiative, Tax-Free Week is subject to potential changes and evolutions. The success and impact of this event have led to discussions about expanding the eligible items or extending the duration of the week. These proposals aim to further stimulate the economy and provide even greater savings for consumers.

However, it's important to note that any changes to Tax-Free Week would require careful consideration and analysis. The current structure and timing of the event have been successful in achieving their intended goals, and any modifications should be made with a thorough understanding of their potential impact on the economy and consumers.

Furthermore, the ongoing COVID-19 pandemic has introduced new challenges and opportunities. With the rise of online shopping and the need for social distancing, Tax-Free Week may see an increased focus on digital platforms and contactless transactions. This could open up new avenues for consumer engagement and provide a unique shopping experience during these challenging times.

Conclusion

Tax-Free Week in Maryland is a unique and beneficial initiative that offers financial savings and economic stimulation. By understanding the eligibility criteria and planning your shopping effectively, you can make the most of this annual event. Whether you’re a consumer looking to save on back-to-school essentials or a business aiming to boost sales, Tax-Free Week presents a valuable opportunity to contribute to the state’s economy and create a positive impact.

Stay informed, plan ahead, and make the most of Tax-Free Week in Maryland! Keep an eye on the official guidelines and announcements to ensure you don't miss out on any updates or changes to this exciting event.

When is Tax-Free Week in Maryland for 2023?

+Tax-Free Week in Maryland typically occurs in late July or early August. The exact dates can vary each year, so it’s best to check the official announcement by the Maryland Comptroller’s Office for the specific dates.

What items are exempt from tax during Tax-Free Week in Maryland?

+During Tax-Free Week, clothing and footwear priced under $100 are exempt from sales tax. Certain school supplies and electronics (computers and related accessories) are also eligible for the tax exemption.

Can I shop online and still benefit from Tax-Free Week in Maryland?

+Yes, many online retailers participate in Tax-Free Week. When shopping online, ensure that the retailer is based in Maryland or has a physical presence in the state to qualify for the tax exemption.

Are there any restrictions on the quantity of items I can purchase during Tax-Free Week?

+There are no restrictions on the quantity of items you can purchase during Tax-Free Week. However, it’s important to note that the tax exemption applies to each individual item, so if you purchase multiple items, each item must qualify for the exemption individually.