Kansas Tax Refund Status

Are you a resident of Kansas and eagerly awaiting your tax refund? If so, you're probably wondering how to check the status of your refund and when you can expect to receive it. The Kansas Department of Revenue has a streamlined process in place to help taxpayers track their refund journey. In this comprehensive guide, we'll delve into the steps you need to take to check your Kansas tax refund status and offer some insights into the factors that can influence the timing of your refund.

Understanding the Kansas Tax Refund Process

Before we dive into the specifics of checking your refund status, it's essential to have a clear understanding of the Kansas tax refund process. This will help set expectations and provide a framework for interpreting the information you receive.

When you file your Kansas income tax return, the Department of Revenue receives your submission and begins processing it. The processing time can vary depending on various factors, including the complexity of your return, any errors or discrepancies, and the volume of returns being handled at the time.

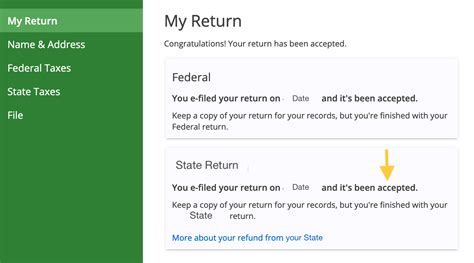

Once your return is successfully processed, the department will approve your refund request. The approval signifies that your tax return has been accepted, and the refund amount has been calculated accurately based on the information provided. At this stage, the clock starts ticking for the refund disbursement process.

Factors Influencing Refund Timing

The time it takes for your Kansas tax refund to reach your account can be influenced by several factors. Understanding these factors can help you estimate when you might receive your refund and manage your expectations accordingly.

- Filing Method: The way you file your tax return can impact the processing time. Electronic filing tends to be faster than traditional paper filing, as it eliminates manual data entry and reduces the potential for errors.

- Return Complexity: More complex tax returns, such as those involving business income, investments, or multiple sources of income, may take longer to process. The Department of Revenue needs to thoroughly review these returns to ensure accuracy.

- Error Corrections: If there are errors or discrepancies in your tax return, the department will reach out to you to resolve them. This process can delay the refund until the issues are addressed.

- Refund Method: The method you choose to receive your refund can also affect the timing. Opting for direct deposit is typically faster than receiving a paper check.

- Refund Amount: Larger refund amounts may undergo additional scrutiny to ensure accuracy and prevent fraud. This extra review can add a few extra days to the processing time.

Checking Your Kansas Tax Refund Status

Now that we've explored the factors influencing refund timing, let's delve into the steps you can take to check the status of your Kansas tax refund.

Option 1: Online Refund Lookup

The most convenient and efficient way to check your refund status is by using the Kansas Department of Revenue's online refund lookup tool. This tool provides real-time updates on the progress of your refund and is available 24/7, allowing you to access the information whenever it's convenient for you.

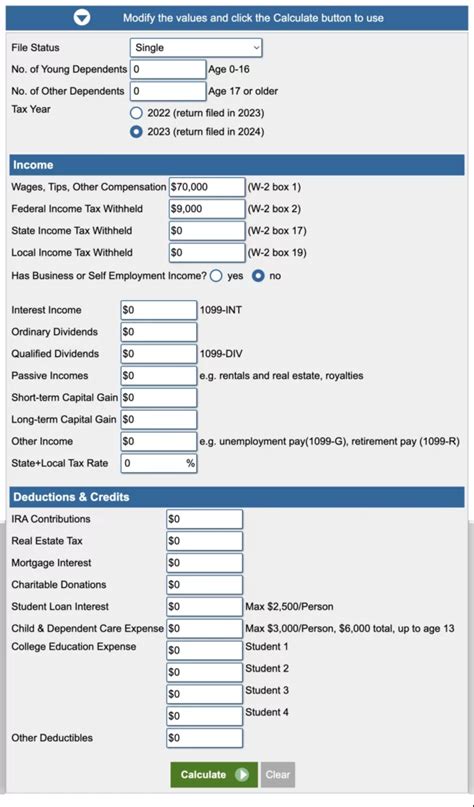

To use the online refund lookup, you'll need the following information:

- Social Security Number: Your Social Security Number (SSN) is a unique identifier used to track your tax returns and refunds. Ensure you enter it correctly to avoid delays.

- Refund Amount: The refund amount you're expecting is another key piece of information. This helps the system verify your identity and ensure you receive the correct refund.

- Refund Type: Specify whether you're expecting a state or local refund. This distinction is essential as it determines which agency processes your refund.

Once you have this information ready, follow these steps to check your refund status online:

- Visit the Kansas Department of Revenue's online refund lookup page.

- Enter your Social Security Number, refund amount, and refund type into the designated fields.

- Click the "Submit" button to retrieve your refund status.

- The system will display the current status of your refund, including whether it has been approved, is in processing, or has been issued.

Option 2: Telephone Inquiry

If you prefer a more personal approach or encounter issues with the online lookup tool, you can contact the Kansas Department of Revenue's refund inquiry line. A dedicated team is available to assist you with your refund status inquiries.

To reach the refund inquiry line, you can call 1-800-322-4657 during regular business hours. When you connect with a representative, have your Social Security Number and refund amount ready to provide them with the necessary details to assist you promptly.

The representative will verify your information and provide you with an update on the status of your refund. They can also address any specific concerns or questions you may have regarding your refund.

Estimated Kansas Tax Refund Timeline

While the exact timing of your Kansas tax refund can vary based on the factors we discussed earlier, the Kansas Department of Revenue provides some general guidelines to help taxpayers estimate when they can expect their refunds.

For tax returns filed electronically with direct deposit as the chosen refund method, the typical processing time is 7–10 business days from the date of filing. This timeline assumes that there are no errors or discrepancies in your return and that the refund amount is not subject to additional review.

If you opt for a paper check, the processing time can be slightly longer, with an estimated timeline of 10–14 business days from the date of filing. Again, this estimate assumes a smooth processing journey without any complications.

It's important to note that these timelines are just estimates, and actual processing times may vary. Factors such as the complexity of your return, the volume of returns being processed, and any necessary corrections can all impact the actual timing of your refund.

| Filing Method | Estimated Processing Time |

|---|---|

| Electronic Filing with Direct Deposit | 7–10 business days |

| Paper Filing with Paper Check | 10–14 business days |

Frequently Asked Questions (FAQs)

What if I encounter an error when using the online refund lookup tool?

+If you encounter an error when using the online refund lookup tool, ensure you’ve entered all the required information correctly. Double-check your Social Security Number, refund amount, and refund type. If the error persists, it’s best to contact the Kansas Department of Revenue’s refund inquiry line for assistance.

Can I track my refund if I filed a joint return with my spouse?

+Yes, you can track your refund even if you filed a joint return. When using the online lookup tool or contacting the refund inquiry line, provide the Social Security Number and refund amount associated with your return. The refund status will be specific to the tax return and refund amount you provide.

How can I update my direct deposit information if it changes after filing my return?

+If your direct deposit information changes after filing your return, you’ll need to contact the Kansas Department of Revenue directly to update your refund disbursement details. They can guide you through the process and ensure your refund is sent to the correct account.

What should I do if my refund is significantly different from what I expected?

+If your refund amount is significantly different from what you expected, it’s essential to review your tax return carefully. Ensure all the income, deductions, and credits you claimed are accurate. If you identify any discrepancies, you may need to amend your return to correct the errors. Contact the Department of Revenue for guidance if needed.