Richland County Property Tax

Richland County, located in the heart of South Carolina, is a vibrant community known for its diverse neighborhoods, thriving businesses, and rich cultural heritage. One aspect that often sparks curiosity and interest among residents and prospective property owners is the topic of property taxes. Understanding how property taxes work, their implications, and how they are calculated is essential for making informed decisions about owning property in Richland County.

Understanding Richland County Property Taxes

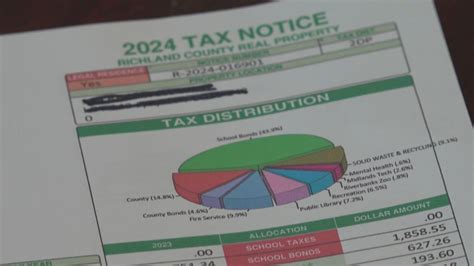

Property taxes are a crucial component of local government funding in Richland County, as they contribute significantly to the overall revenue stream. These taxes are primarily used to support essential services such as public education, law enforcement, infrastructure development, and various community programs. The revenue generated through property taxes helps maintain the quality of life that residents enjoy and ensures the continuous growth and development of the county.

The property tax system in Richland County operates based on a millage rate, which is a rate per $1,000 of assessed property value. This rate is determined annually by the Richland County Council, taking into consideration the budget requirements and the need to provide adequate funding for county services. The millage rate is then applied to the assessed value of each property, resulting in the calculated property tax amount that property owners are responsible for paying.

Property Assessment Process

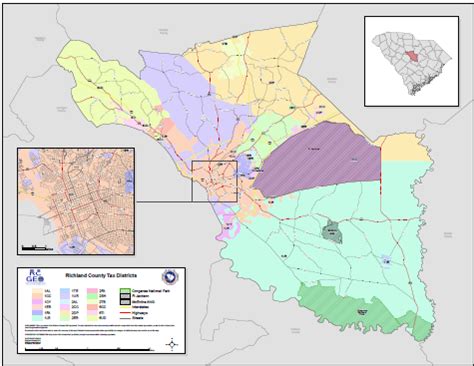

Property assessment is a critical step in determining the tax liability for each property owner in Richland County. The Richland County Assessor’s Office is responsible for assessing the value of all taxable properties within the county. This process involves evaluating various factors such as the property’s location, size, age, condition, and recent sales data of comparable properties in the area.

Once the assessor determines the fair market value of a property, a tax assessment is calculated. The assessed value may differ from the market value, as it is based on a formula that considers the property's potential for generating revenue through taxation. The assessed value is then used to calculate the property taxes owed by the owner.

It's important to note that property assessments are conducted regularly, often on a cyclical basis, to ensure that property values are accurately reflected and that tax assessments remain fair and equitable. Property owners have the right to appeal their assessment if they believe it is incorrect or unfair. The appeal process provides an opportunity for property owners to present evidence and have their assessment reviewed by the county's assessment review board.

| Assessment Year | Assessed Value | Tax Rate (Mills) | Estimated Taxes |

|---|---|---|---|

| 2023 | $300,000 | 200 | $6,000 |

| 2024 | $315,000 | 210 | $6,585 |

| 2025 | $330,000 | 220 | $7,260 |

Tax Payment Options and Due Dates

Richland County offers property owners several convenient payment options to fulfill their tax obligations. Taxpayers can choose to pay their property taxes online through the Richland County Treasurer’s Office website, by mail, or in person at the Treasurer’s Office. The county also provides the option to pay through a third-party payment processor, offering flexibility and ease of payment.

Property tax payments in Richland County are due annually. The specific due dates may vary depending on the tax year and the type of property. Generally, the first installment of property taxes is due in the fall, while the second installment is due in the spring. It is essential for property owners to stay informed about the due dates to avoid any late fees or penalties.

Richland County also offers various payment plans and options for property owners facing financial difficulties. These plans may include installment agreements or deferred payment options for eligible taxpayers. By working closely with the Richland County Treasurer's Office, property owners can explore these alternatives and ensure timely payment of their property taxes.

Property Tax Exemptions and Discounts

Richland County recognizes the diverse needs and circumstances of its residents and, as such, offers various property tax exemptions and discounts to eligible property owners. These incentives aim to support specific groups and encourage certain types of development within the county.

Homestead Exemption

The Homestead Exemption is a widely utilized property tax relief program in Richland County. This exemption reduces the assessed value of a primary residence, resulting in lower property taxes for homeowners. To qualify for the Homestead Exemption, property owners must meet certain criteria, such as owning and occupying the property as their primary residence and having South Carolina as their primary state of residence.

The Homestead Exemption provides a substantial benefit to homeowners, as it can significantly reduce their tax liability. The exemption amount is determined annually and is subject to change based on legislative decisions. Property owners who qualify for the Homestead Exemption must renew their application annually to continue receiving the benefit.

Veterans and Senior Citizen Discounts

Richland County extends its appreciation to veterans and senior citizens by offering property tax discounts specifically tailored to these groups. Veterans who meet certain criteria, such as having an honorable discharge and residing in Richland County, may be eligible for a discount on their property taxes. The discount amount is determined based on the veteran’s level of disability and can provide substantial savings on their tax bill.

Similarly, senior citizens aged 65 and above who meet specific income and residency requirements may also qualify for a property tax discount. This discount aims to support senior citizens in maintaining their independence and remaining in their homes as they age. The discount amount is based on the individual's income level and can provide significant relief from the financial burden of property taxes.

Other Tax Exemptions and Incentives

In addition to the Homestead Exemption and discounts for veterans and senior citizens, Richland County offers various other tax exemptions and incentives to promote specific types of development and support community initiatives.

For example, the county may provide tax exemptions for historic properties that are preserved and maintained according to certain guidelines. This incentive encourages the preservation of Richland County's rich historical heritage and promotes the development of historic districts.

Furthermore, Richland County may offer tax incentives for renewable energy projects, green building initiatives, or affordable housing developments. These incentives aim to promote sustainable practices, encourage energy efficiency, and address the need for affordable housing within the community.

Appealing Property Tax Assessments

Property owners in Richland County have the right to appeal their property tax assessments if they believe the assessed value is incorrect or unfair. The appeal process provides an opportunity for property owners to present evidence and argue their case before the Richland County Assessment Appeals Board.

Steps to Appeal

To initiate an appeal, property owners must first obtain the necessary forms and instructions from the Richland County Assessor’s Office. These forms typically include an appeal application and instructions on gathering the required documentation and evidence to support the appeal.

Once the appeal application is completed and the required documentation is gathered, property owners must submit their appeal to the Assessment Appeals Board within the designated timeframe. It is crucial to ensure that all required information is provided accurately and thoroughly to increase the chances of a successful appeal.

The Assessment Appeals Board consists of impartial individuals who carefully review each appeal on its merits. The board considers various factors, including the property's assessed value, recent sales data, and any other relevant evidence presented by the property owner. They aim to ensure that property assessments are fair, accurate, and consistent across the county.

Outcomes and Next Steps

After the Assessment Appeals Board reviews the appeal, they make a decision regarding the assessed value of the property. The board may uphold the original assessment, adjust the assessed value upwards or downwards, or dismiss the appeal if it lacks sufficient evidence or merit.

If the appeal is successful, the property owner will receive a revised tax assessment, reflecting the changes made by the board. This revised assessment will then be used to calculate the property taxes owed, potentially resulting in a reduced tax bill for the owner.

In cases where the appeal is unsuccessful, property owners have the option to pursue further legal action or seek alternative resolutions. It is important for property owners to carefully consider their options and seek professional advice if necessary.

Property Tax Rates and Revaluations

The property tax rates in Richland County are subject to periodic revaluations to ensure fairness and accuracy. These revaluations take into account various economic factors, market trends, and the need to maintain a balanced tax burden across the county.

Revaluation Process

Revaluations are conducted by the Richland County Assessor’s Office at regular intervals, typically every few years. During a revaluation, the assessor’s office thoroughly reviews and updates the assessed values of all taxable properties within the county. This process involves analyzing recent sales data, market trends, and other relevant factors to ensure that property values are accurately reflected in the assessment process.

Property owners are notified of any changes in their assessed value as a result of the revaluation process. This notification provides an opportunity for property owners to review the new assessment and understand the factors that influenced the change in value.

Impact on Property Taxes

The revaluation process can have a significant impact on property taxes. If the assessed value of a property increases, the property owner may see a corresponding increase in their tax liability. Conversely, if the assessed value decreases, the property owner may benefit from a reduction in their tax burden.

It is important for property owners to understand that revaluations are conducted to ensure fairness and equity across the county. While individual property values may fluctuate, the overall tax burden is intended to remain stable and balanced. The Richland County Council carefully considers the impact of revaluations on taxpayers and aims to minimize any sudden or drastic changes in property tax rates.

Online Resources and Support

Richland County provides various online resources and support to assist property owners in understanding their property taxes, accessing important information, and staying informed about tax-related matters.

Richland County Property Tax Website

The Richland County Property Tax website serves as a valuable resource for property owners. This comprehensive website offers a wealth of information, including tax rates, assessment details, payment options, and important deadlines. Property owners can easily access their property tax records, view their tax bills, and make online payments through the secure portal provided by the county.

The website also provides helpful guides and tutorials, explaining the property tax process in Richland County. These resources cover topics such as understanding tax assessments, applying for exemptions, and appealing property tax decisions. Property owners can find answers to frequently asked questions and access relevant forms and applications directly from the website.

Online Property Tax Lookup Tools

Richland County offers online property tax lookup tools that allow property owners and prospective buyers to access detailed information about a property’s tax history, assessment details, and current tax obligations. These tools provide transparency and enable users to make informed decisions regarding property ownership and investment.

By utilizing these online tools, property owners can quickly retrieve information about their own properties or research properties they are interested in purchasing. The data available includes the property's assessed value, tax rate, and estimated taxes, providing a clear picture of the property's tax liability.

Community Engagement and Outreach

Richland County recognizes the importance of community engagement and outreach when it comes to property taxes. The county actively communicates with residents and property owners to ensure that they are well-informed about tax-related matters and have access to the necessary resources and support.

Community Meetings and Workshops

Richland County organizes community meetings and workshops to provide residents with opportunities to learn more about property taxes, assessment processes, and available exemptions and incentives. These events are led by county officials, including representatives from the Assessor’s Office and the Treasurer’s Office, who share their expertise and answer questions from attendees.

Community meetings and workshops create a platform for open dialogue and allow residents to voice their concerns, ask questions, and receive personalized assistance. These events foster a sense of community engagement and empower residents to actively participate in the property tax process.

Outreach Programs for Seniors and Veterans

Recognizing the unique needs of seniors and veterans, Richland County implements targeted outreach programs to ensure that these groups have access to the support and resources they require. These programs aim to provide tailored information and assistance regarding property tax exemptions, discounts, and other relevant benefits.

Through collaboration with veteran organizations, senior centers, and community groups, Richland County reaches out to these populations, offering guidance and support. The county ensures that seniors and veterans are aware of their eligibility for tax relief and provides assistance in completing the necessary paperwork to obtain these benefits.

Conclusion: A Comprehensive Understanding

Understanding Richland County’s property tax system is essential for property owners, prospective buyers, and community members alike. By delving into the various aspects of property taxes, including assessments, exemptions, appeal processes, and online resources, individuals can navigate the property tax landscape with confidence and make informed decisions.

Richland County's commitment to fairness, transparency, and community engagement ensures that property taxes are an integral part of supporting the county's growth and development while providing residents with the necessary resources and support. By staying informed and actively participating in the property tax process, residents can contribute to the vibrant and thriving community that Richland County strives to be.

What is the current millage rate in Richland County for property taxes?

+The millage rate in Richland County is set annually by the Richland County Council. As of the 2023 tax year, the millage rate is 200 mills. This rate may be subject to change in subsequent years based on budgetary requirements and the need to provide adequate funding for county services.

How often are property assessments conducted in Richland County?

+Property assessments in Richland County are conducted on a cyclical basis, typically every few years. The exact frequency of assessments may vary, but they are performed regularly to ensure that property values are accurately reflected and that tax assessments remain fair and equitable.

What are the payment options for Richland County property taxes?

+Richland County offers various payment options for property taxes. Taxpayers can pay online through the Richland County Treasurer’s Office website, by mail, or in person at the Treasurer’s Office. Additionally, a third-party payment processor is available for added convenience. Payment plans and deferred payment options may also be available for eligible taxpayers.

Are there any property tax exemptions or discounts available in Richland County?

+Yes, Richland County offers several property tax exemptions and discounts. These include the Homestead Exemption, which reduces the assessed value of a primary residence, and discounts for veterans and senior citizens. Other exemptions and incentives may be available for historic properties, renewable energy projects, and affordable housing developments.

How can I appeal my property tax assessment in Richland County?

+To appeal your property tax assessment in Richland County, you must obtain the necessary forms and instructions from the Richland County Assessor’s Office. After completing the appeal application and gathering the required documentation, you must submit your appeal to the Assessment Appeals Board within the designated timeframe. The board will carefully review your appeal and make a decision regarding the assessed value of your property.